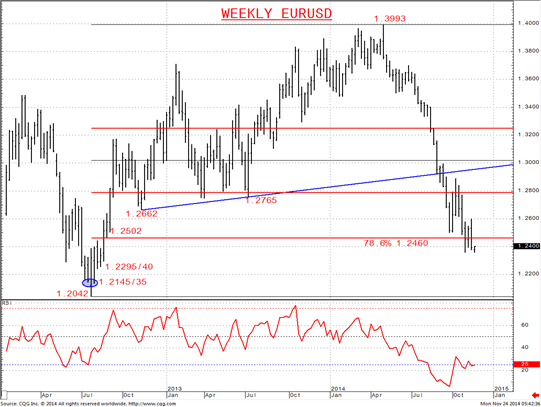

A far more aggressive sell off than we had anticipated Friday for a bearish outside weekly pattern to signal a bearish breakout from our 1.2631 and 1.2433 range.

The inability to reverse above the down trend line from October has re-energized the bearish theme and rejected the basing effort above 1.2573/78 previous resistance peaks.

The plunge through 1.2433 and 1.2399/94 lows aims for more notable bear targets.

Short-term Outlook - Downside Risks:

Initial risk early this week is through the cycle low at 1.2358 this week

We now see a more negative tone with the bearish threat to 1.2295/ 1.2240 weekly targets from 2012.

Potentially through month-end and for December, the threat is lower, for 1.2145/35 and even the 2012 cycle low at 1.2042.

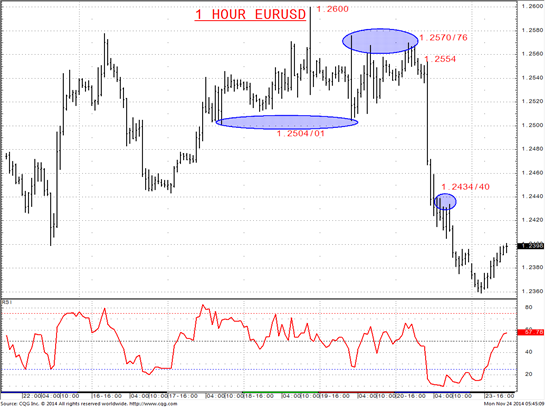

Momentum: The 8-day RSI, short-term momentum is falling and has scope to go still lower this week.

What Changes This? Above 1.2440 eases bear risks; through 1.2560 signals a neutral tone, only shifting positive above 1.2600.

For Today: We see a downside bias for 1.2358; break here aims for 1.2336 and 1.2312, maybe key 1.2295. But above 1.2440 opens risk up to 1.2501/04.

1 Hour EURUSD Chart

Weekly EURUSD Chart

THERE IS SUBSTANTIAL RISK OF LOSS IN TRADING FUTURES, OPTIONS AND FX PRODUCTS. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.