March’s ECB cheat sheet: Decoding rate cuts conditionality

We analyse different scenarios ahead of this week's ECB announcement, along with FX and rates implications. As the Bank publishes new staff projections, President Lagarde may start laying out the conditions for easing policy. That may be perceived as slightly dovish, meaning a softer EUR and a re-flattening of the money market curve are tangible risks.

Risks of a modest dovish surprise

Going into the March ECB meeting, the market has taken a more cautious stance towards expected easing from the central bank. In early February, the market had fully discounted two cuts by June. Now, it is not even fully discounting a first cut in June – although with 22bp priced, it still remains the base case. For the year as a whole, the market expects slightly more than 90bp of easing, while in early February, it was looking at closer to 150bp. In sum, it has come off its aggressive pricing and is now not too far from what our economists are expecting from the ECB – a first cut in June with 75bp of easing delivered in total this year.

The governing council also seems to coalesce around June as the date for a first cut, and if the ECB does indeed start to prepare the ground for such an outcome, that could be seen as mildly dovish against the backdrop of more cautious market pricing. A modest re-flattening of the money market curve could be in store as an impact reaction as conviction for the eventual start of the cutting cycle grows again. Longer rates could follow lower, though likely to a lesser degree.

At the same time, the ECB still has enough reasons to keep its guard up and not give away too much at this meeting – not least for the sake of reputational concerns surrounding its inflation-fighting credentials, stressed again by President Christine Lagarde more recently. Central banks will remain in a holding pattern for the coming months, and the slowing progress on bringing down inflation still exerts upward pressure more generally on rates for now to keep them in elevated ranges.

EUR/USD should remain a Dollar story

The possibility that the ECB discusses the conditions for starting to ease policy implies that the balance of risks is slightly titled to the downside for the euro this week. Markets may price in more or earlier rate cuts in the EUR curve, but Lagarde should probably reiterate that there is still missing evidence from the data side and refrain from offering clearer guidance on easing. This means that the impact in FX should not be particularly long-lasting.

In EUR/USD, we could see the dollar leg taking over again rapidly. Markets may be reluctant to take aggressive idiosyncratic EUR positions (in both directions) before seeing the eurozone’s wage and inflation data in March/April, leaving US figures the key catalyst of any material swing in the pair. US payrolls on Friday may well end up having a larger impact on EUR/USD than the ECB announcement.

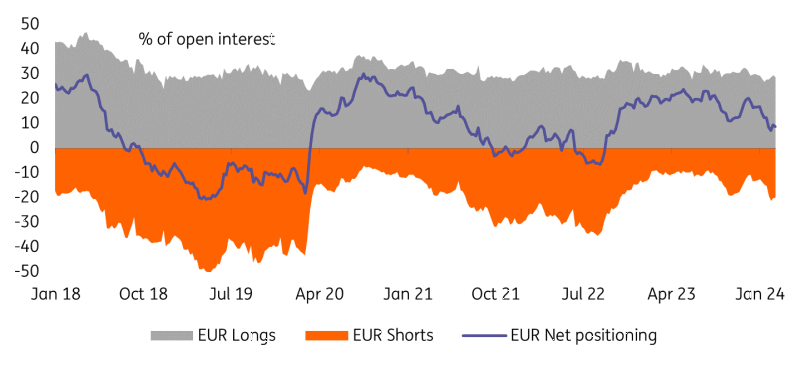

It is reasonable to expect that FX volatility has bottomed out. March may see some declines in US data sentiment and start to reignite directional trades, but action may be confined among higher-beta currencies, with EUR/USD potentially ending the quarter close to the current 1.08 mark. The euro has a net-long positioning vs the dollar (9% of open interest, according to CFTC data) and a lower sensitivity to risk than other European currencies, making it a more accurate mirror of broader dollar trends. The recent upside surprises in US data may have left a mark on investors, which could require more conclusive evidence on the US inflation and jobs story before structurally turning against the dollar.

EUR/USD net positioning still positive despite recent decline

Source: ING, CFTC, Macrobond

Read the original analysis: March’s ECB cheat sheet: Decoding rate cuts conditionality

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.