Manufacturing cycle has turned – More to come

-

We point to five signs that the global manufacturing cycle has turned and expect to see further upside in global PMIs across regions over the next 3-6 months.

-

The covid pandemic created big swings in the manufacturing cycle with the pendulum swinging from a huge boost in goods demand to a subsequent bust. We now believe the pendulum is starting to swing back supported by a turn in the inventory cycle and a moderate improvement in goods demand.

-

The expected turn in manufacturing supports a soft landing scenario for the global economy and is one of the reasons we believe central banks will move with caution when they start cutting rates.

For a while we have seen some tentative signs that a turn in the global manufacturing cycle was in sight but broad based evidence was scarce. However, in January we got the most clear sign so far that the deep recession in the industrial sector in 2023 is coming to an end. Global PMI manufacturing for January jumped from 49.0 to 50.0, the biggest monthly increase in 3½ years, and it represented a synchronized increase across regions. We see five reasons that this will mark the inflection point for global manufacturing:

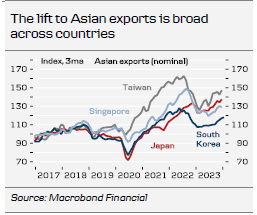

First, Asian manufacturing data has been improving for a while and they tend to lead the global cycle about 2-3 months as economies like China, South Korea, Taiwan and Singapore are manufacturing hubs of key components into final goods, not least semiconductors (one exception to this picture was a big drop in Taiwan export orders in December but we are inclined to believe it was one-off as Taiwan PMI has increased and no other Asian countries have seen a similar drop in orders).

Second, PMIs for the euro area and the US have finally turned. For some time they showed signs of stabilisation but moved sideways at low levels for more than a year reflecting continued recession. In January, however, we saw a quite strong increase in the US ISM manufacturing new orders index and the euro PMI order index increased for the third month in a row. At 44.7 the latter index is still clearly below 50, which signals production is still declining but just at a slower pace than before. However, historically once the index turns it continues higher over the coming year.

Third, financial conditions have eased, which normally is a leading indicator of a turn up in the manufacturing cycle (see chart page 2). For some time, equities have rallied, credit spreads are tighter and bond yields have moved lower. Oil prices are also lower from the peak levels in 2022 adding to the tailwind. This is the evident in both US and Europe.

Fourth, the order-inventory balances in PMI releases indicate that the global inventory cycle is turning. Changes in inventories work as accelerators on the business cycle. During the pandemic, very high goods demand and supply chain challenges drove down inventories and triggered a desire to build higher inventories to be more resilient. Hence, for a while businesses had to lift production above actual demand.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.