Heading into the event, we can have a look at the major changes since last quarterly inflation report –

- Pound dropped – GBP/USD stood at 1.54 on Nov 5 and since then has been on a one way losing streak. The pair clocked a multi-year low of 1.0479 before recovering to 1.44 levels.

- BOE turns dovish, markets indicate rate cut ahead – Carney’s dovish turn from “rates could rise at the turn of the year†to “now is not the time to raise rates†began in November. The BOE is no more on track to raise rates. This is what markets believe. In fact, SONIA forwards indicate a minor chance of a rate cut in the next six months.

- Negative rates a new normal – ECB pushed deposit rate to -0.30% in December. Bank of Japan surprised markets last week by pushing interest rate to negative territory. The Swiss National Bank too has negative rates. This clearly is turning out to be a new normal for the central banks. BoE rates stand at 0.50%, hence it is worth noting that the bank has room to cut rates before it actually hits negative territory.

- Markets no longer cheer unconventional policy tools – If the latest reaction to the BoJ negative rates surprise is anything to go by, then the negative rates and other unconventional tools appear to have lost their efficiency. Investors are clearly worried and wonder where we go from here if the negative rates fail to prop up the economy.

| Scenario | Details | Expected impact on GBP |

| Dovish | 1. Minutes show a 9-0 vote count in favor of keeping interest rates at record lows or 8-1 (1 member in favor of a rate cut) | GBP/USD could began its journey back to latest cyclical low of 1.4079 in case point number 1 and 3 materialize |

| 2. Inflation and GDP forecasts are revised lower (more likely), slowdown in wage growth noted | By now, Point 2 is well known and priced-in | |

| 3. Carney Indicates readiness to cut rates if required and says committee discussed rate cut. | 8-1 vote count (1 member in favour of rate cut) would confirm the BoE has ditched its plans to raise rates | |

| Hawkish | 1. 8-1 vote count (slightly hawkish) or 7-2 vote count (more hawkish, but low probability) | 8-1 vote count (8 in favor of rates unchanged, while 1 favoring rate hike) would be slightly hawkish and could help Sterling secure a daily close above 1.45 |

| 2. Notes wage growth slowdown, but indicates drop in spare capacity slack and slack in the labor market | 7-2 vote count (2 in favor of rate hike) would be shocker and send Sterling higher to 1.4917 (monthly 5-MA) | |

| 3. Carney takes a U-turn again. Says next move likely to be a rate hike. Negative rates/rate cut not under consideration |

Note – BoJ has moved to negative territory, while ECB has expressed readiness to do more in March. Markets are pricing-in another deposit rate cut by the ECB in March. Hence, a hawkish outcome is unlikely.

Low inflation, weak GDP are well known facts. Most important is the vote split and Carney’s comments on next policy move. A comment like “the committee discussed rate cut†could spell disaster for Pound even if the vote count remains unchanged at January’s 8-1 split.

____________________________________________________________________

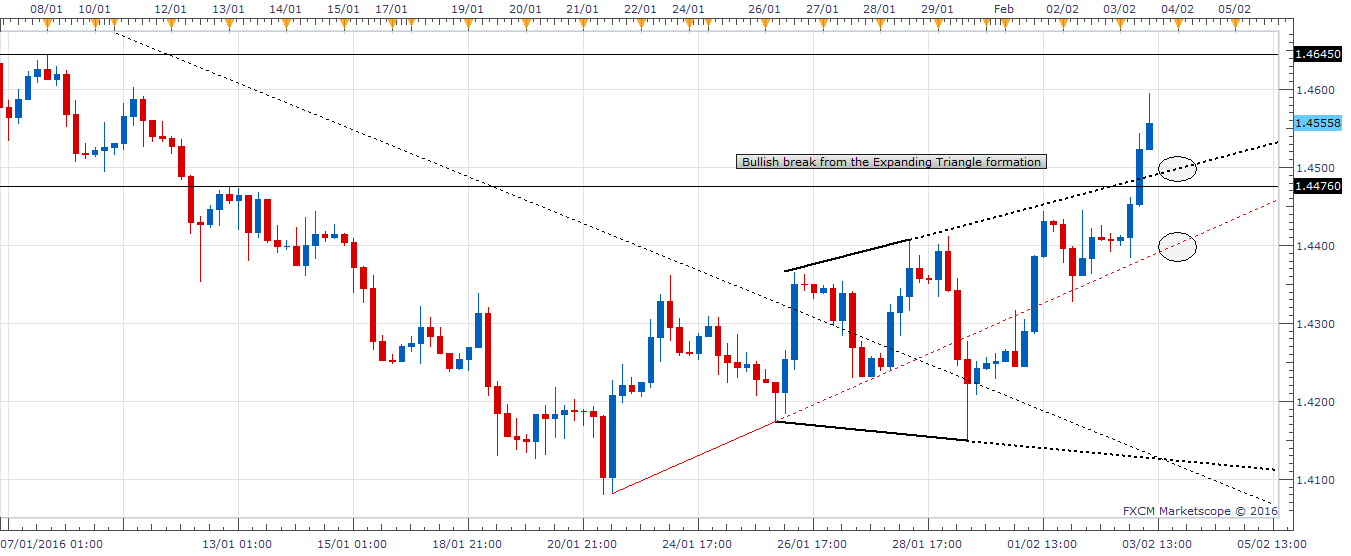

GBP/USD – 4 hour chart shows bullish break from expanding triangle formation

_20160203154609.png)

Levels to consider in case of hawkish BoE

Bullish break from the expanding triangle formation has opened doors for upside technical target of 1.4825 – 1.4917 (monthly 5-MA)However, there are couple of major hurdles on the way higher –

- 1.4587 (falling channel resistance on the daily chart)

- 1.4655 (50% of 1.5230-1.4079)

- And a major hurdle at 1.4786 (38.2% of 1.5930-1.4079)+1.4791 (61.8% of 1.5230-1.4079)

Levels to consider if BoE is dovish

A failure to sustain above the expanding triangle formation would open doors for a drop to rising trend line support (red).A dovish outcome could send the pair back to 1.4079 levels.

However, there are major support levels on the way lower–

- 1.44-1.4410 (rising trend line support

- 1.4351 (23.6% of 1.5230-1.4079)

- 1.4228 (Feb 1 low)

- 1.4149 (Jan 29 low)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.