Stepping into the first full week of November, the economic calendar is a little more on the quieter side this week.

RBA to increase the official cash rate?

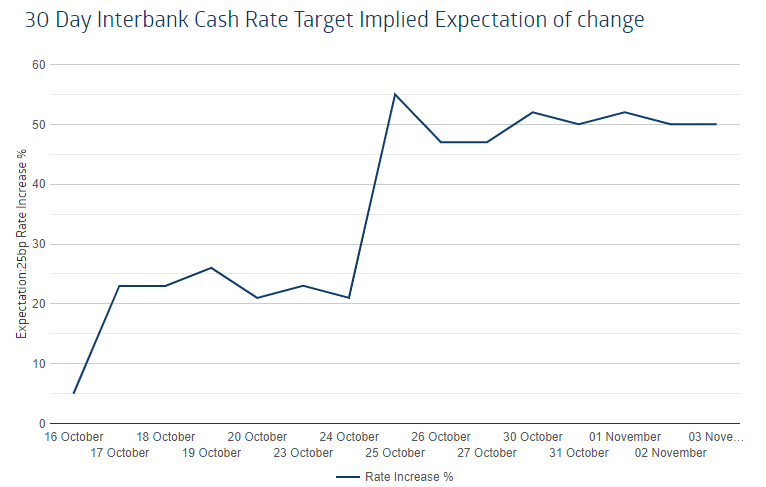

The Reserve Bank of Australia (RBA) is the highlight event on Tuesday at 3:30 am GMT. Amid stronger-than-expected CPI inflation and rising house prices, the ASX 30-Day Interbank Cash Rate Futures for the November contract imply that the market is about even ahead of this week’s rate decision. Ultimately, the recent upside surprise in Q3 inflation data is likely sufficient to tip the scales more in favour of a rate increase. The Official Cash Rate stands at 4.10% and has been on hold for four consecutive meetings.

What does this mean for the AUD/USD this week?

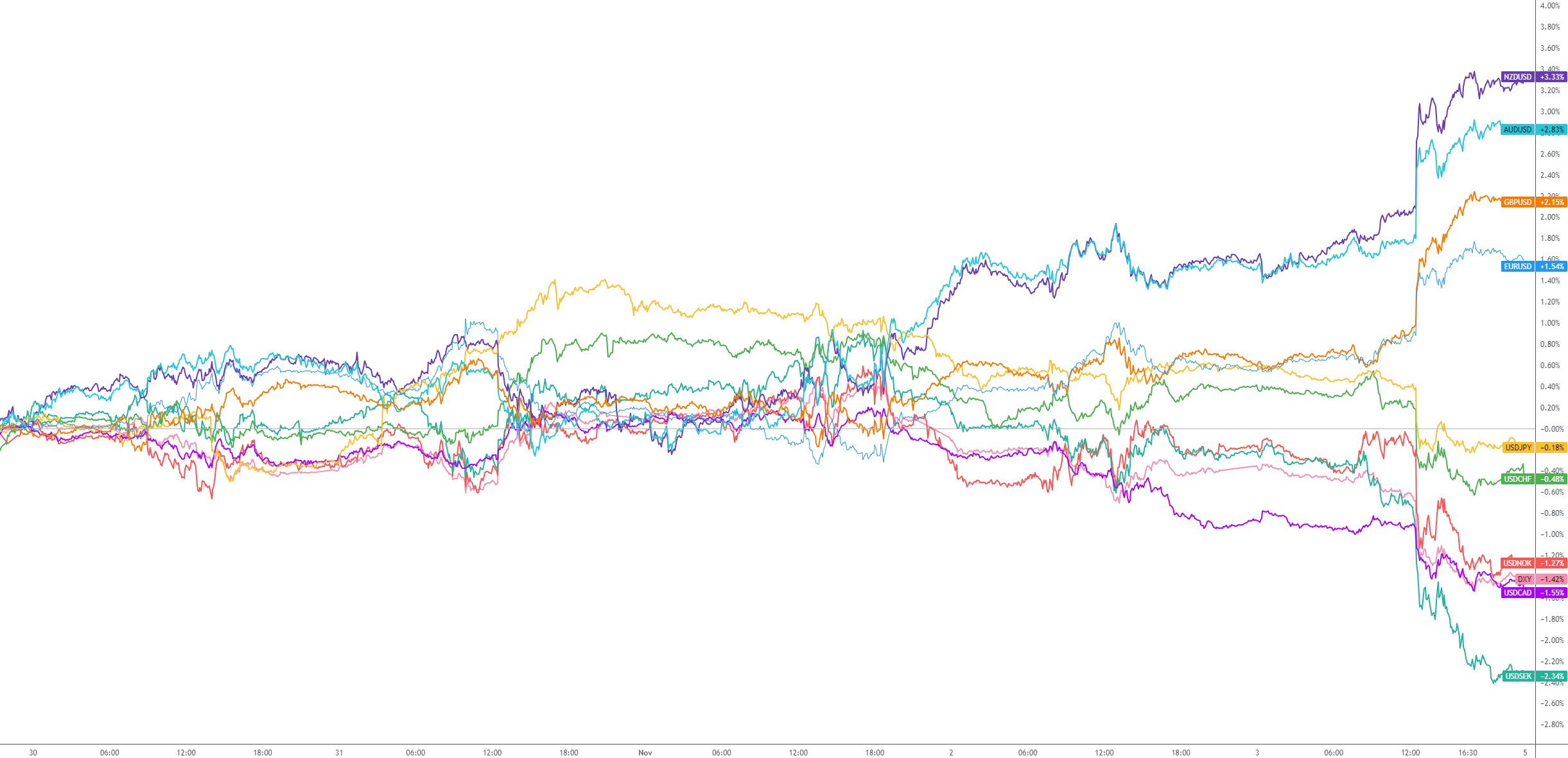

The AUD/USD found some legs last week, climbing +2.8% and recording its most significant one-week gain since November 2022. Should a rate increase come to fruition, further outperformance in the currency pair is possible.

Fed Chair Powell scheduled to speak

Several Fed officials are scheduled to speak on Thursday, including Fed Chair Jerome Powell at 7:00 pm GMT. Powell is expected to participate in a panel discussion titled Monetary Challenges in a Global Economy at the Jacques Polak Annual Research Conference in Washington DC. Fed officials speaking at the event could shed light on the recent FOMC decision/guidance and, consequently, elevate volatility across the financial markets.

Additional economic data this week

Preliminary Q3 UK growth numbers are a key release on Friday at 7:00 am GMT, followed by preliminary US UoM consumer sentiment data at 3:00 pm GMT.

UK growth numbers are expected to be soft for Q3. Growth declined -0.6% in July on a month-on-month basis, though rebounded to 0.2% in August. Therefore, aside from a significant recovery in economic activity (doubtful) in September, Q3 GDP might drop into negative territory and weigh on sterling (GBP).

US preliminary UoM consumer sentiment data is expected to fall slightly to 63.6 in November, down from 63.8 in October.

G10 FX (5-day change)

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.