WTI crude oil has been in a sustained rally for the past 9 weeks. Its most recent low was on January 20th at $27.70 a barrel, while last Friday saw price reach its most recent high at $42.52. That rally makes for an increase in price of 53.50%. It is has also recovered the ground lost from the beginning of the year where it opened at $38.34, for a YTD gain of 10.9%, making it one of the best performing commodities this year.

The oil rig count has been falling steadily over the past year as crude oil prices continued their one way decline to levels not seen since 2008. Over the past week, according to data from BakerHughes.com, another 4 rigs were shut down in the US and 27 internationally. The total rig count in the US compared to last year is down by 593 for a total of 476 operating rigs.

Concern therefore comes in light of the fact that the most recent sharp increase in WTI prices may not have reached extraction operators yet, but if should if price remains at these levels or rises further. Adding more rigs as higher crude prices since more operations become profitable again, will increase supply and possibly diminish the current bull trend. If supply increased sufficiently without a concurrent increase in demand then we could see this bull trend reverse again or at least correct to the downside.

Investment banks like Goldman Sachs had predicted crude oil prices below $20 a barrel for 2016, and although we are only in the first months, current market movements make that forecast look less likely without new factors coming into play.

Today at 2:30 pm the Energy Information Administration will release weekly Crude oil stocks for the US. The expected number is 1.317 million barrels of new stock, any large variation in this data release can cause considerable volatility.

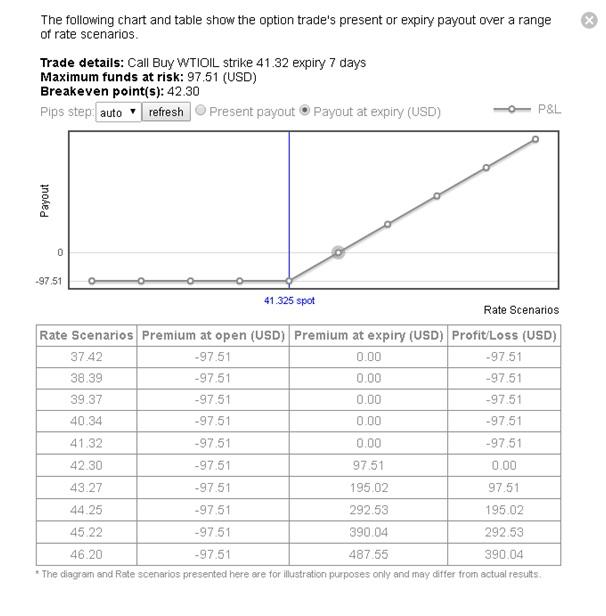

If you think the data release for today will be smaller than expected and that the bull trend will remain intact over the next week then you may buy a Call option, which gives you the right to buy WTI oil at a set price (strike) for a set date (expiry) and a specific amount.

The screenshot below shows that a WTI oil Call option with $41.39, expiry 7 days and for 100 barrels would cost $97.15, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Call option, which you can get by clicking the Scenarios button.

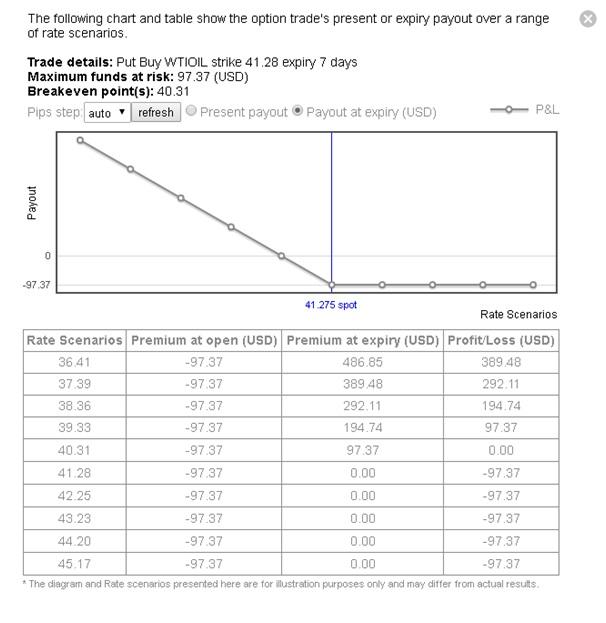

On the other hand, if you think the bear trend has come to an end and price will correct to the downside over the next week, then you may buy a Put option. The screenshot below shows that a WTI oil Put option with $41.26 strike, 7 day expiry and for 100 barrels would cost $97.33, which would also be the maximum possible loss.

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700 on Powell’s presser

The selling bias in the Greenback gathers extra pace as Powell’s press conference is under way, lifting EUR/USD to daily tops past the 1.0700 hurdle.

GBP/USD rises above 1.2500 on weaker Dollar

The resumption of the upward pressure sends GBP/USD back above 1.2500 the figure in response to increasing selling pressure hurting the Greenback.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.