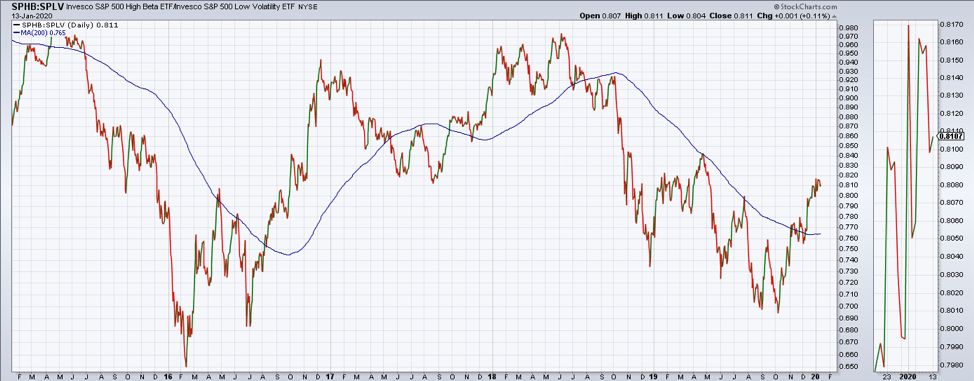

Highlights:

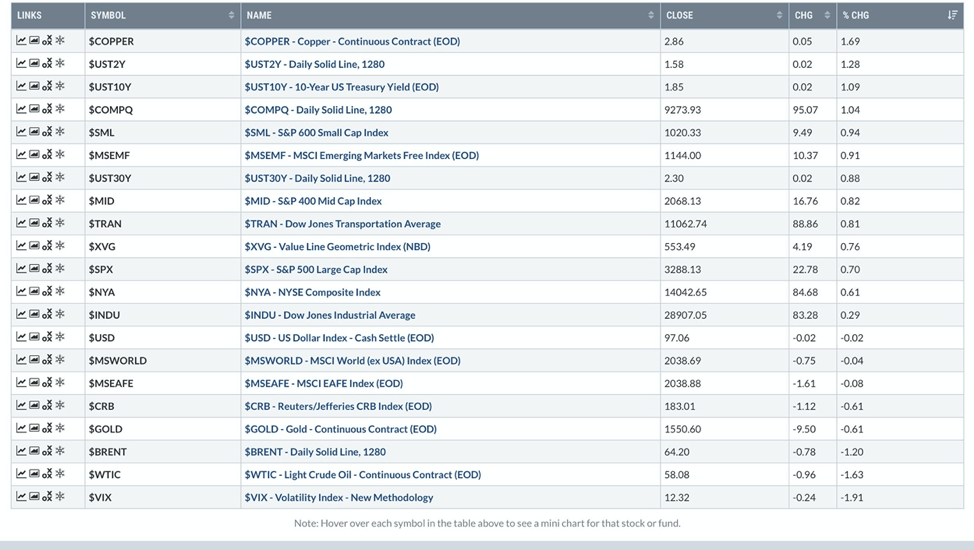

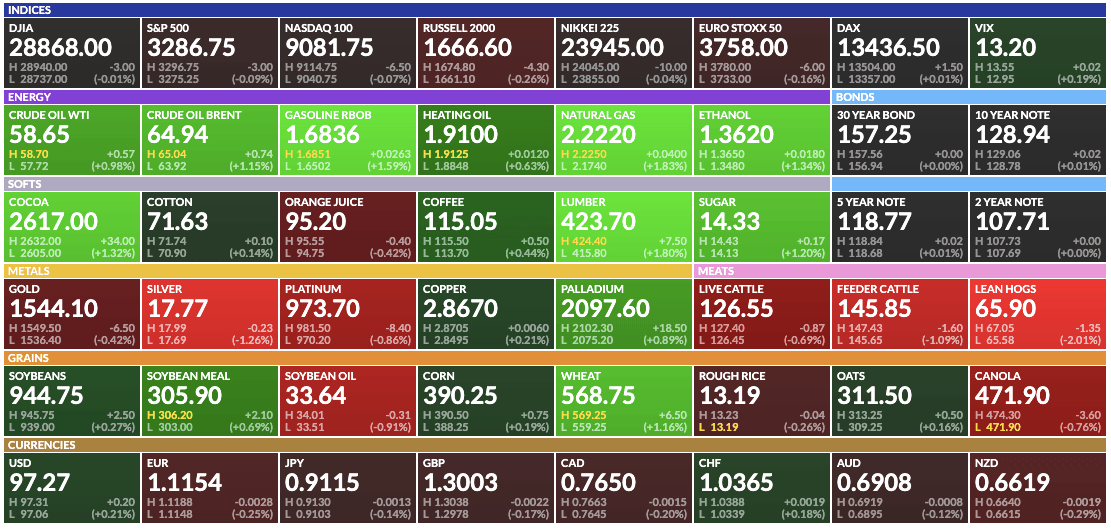

Market Summary: Stocks finished the day up again yesterday, with the S&P 500 higher by 0.70%. Copper was the top performing asset, up 1.69%. Brent Crude was down -1.20% as oil continued to correct. The U.S. dollar was down slightly, and interest rates were up 2 basis points on the U.S. 10-year Treasury note.

Copper: Dr. Copper is indicating that we are in the midst of a global growth upturn. Copper is back in a positive trend and is above its 200-day moving average. A breakout above the 2019 highs would be a good sign that the global economy has possibly bottomed.

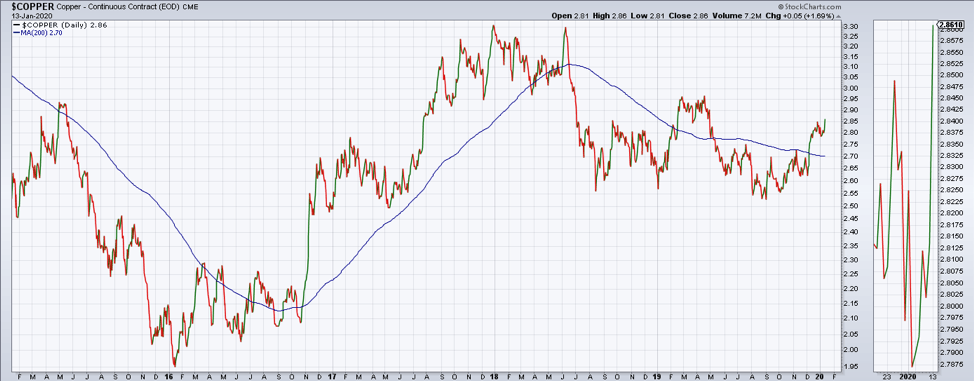

Advance/Decline: The cumulative advance/decline line for the S&P 500 remains in a strong positive trend. This indicator has a history of diverging from equity prices at major tops. No divergence here.

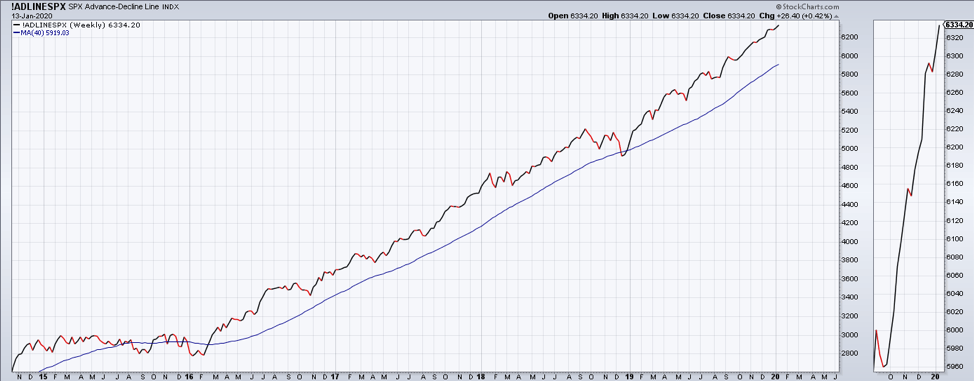

High Beta: In another sign of a risk-on posture for market participants, the High Beta ETF (SPHB) is in a positive trend relative to the Low Volatility ETF (SPLV). The ratio is above its 200-day moving average after remaining in a negative trend from mid-2018 through the third quarter of 2019. The rally since the fourth quarter is implying expectations for a growth upturn.

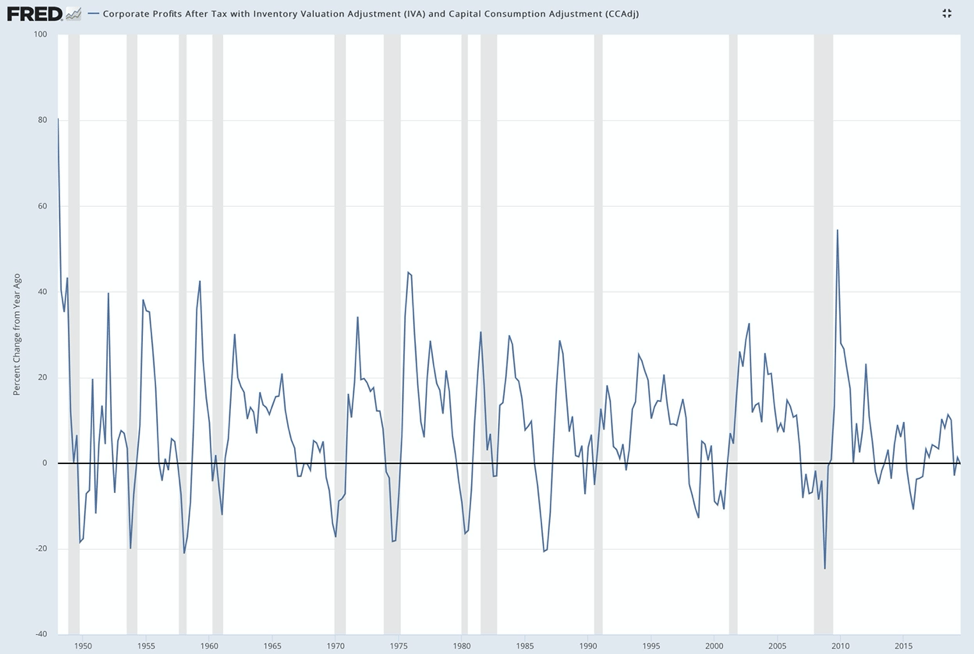

Chart of the Day: Corporate profits are negative on a year-over-year basis. Will profits rebound in 2020?

Futures Summary:

News from Bloomberg:

Boeing mocked Lion Air's call for 737 Max training before the deadly crash in 2018. The airline had mulled putting its pilots through simulator exercises, but Boeing convinced them it was unnecessary, people familiar said. Some internal messages have been un-redacted and show a Boeing employee calling "friggin" Lion Air "idiots" for requesting the training.

JPMorgan kicks off earnings season today, followed by Citi and Wells Fargo. Investors will be laser-focused on forecasts. Consumer health and loan-growth trends may support JPMorgan's outlook, Bloomberg Intelligence said. Citi may need to revisit its 2020 return on tangible equity target as revenue expectations have revised lower in recent quarters. Wells is reporting for the first time under CEO Charlie Scharf.

President Trump's Senate impeachment trial will probably start next week with opening arguments expected on Jan. 21, Senator John Cornyn said. The House is poised to vote tomorrow on impeachment managers named by Nancy Pelosi and then vote to authorize sending the impeachment articles to the Senate, a person familiar said.

BlackRock is putting climate concerns at the heart of its strategy, ditching investments with high sustainability-related risk. "Climate change has become a defining factor in companies' long-term prospects," CEO Larry Fink wrote in his annual letter to corporate executives. "Awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance."

U.S. stock-index futures struggled for direction with European equities, while China's shares and the offshore yuan erased gains after data showed its trade with the U.S. slumped last year. Treasuries and the dollar edged higher. Gold extended losses, while oil halted a five-day losing streak.

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.