Jobless claims spike, markets under pressure

Hedging against War. Jobless Claims climbing.

Good morning

New York made a big effort to rally at first, but this was quickly swamped by spiking higher New Jobless Claims, stories of National Guard being called in to teach in schools as teacher absenteeism sky-rockets, and generally a state of decline becomes all too apparent across the full national economy.

Add the blunder by President Biden in his remarks on Ukraine and the increasing likelihood Russia could re-take Ukraine at any moment, and it is a wonder the market has not fallen further.

But wait.... it still might.

I would suggest the risk for today is accelerating downside, rather than any significant recovery in prices at all. What is happening right now is encouraging our fundamental and price action analysis which has been warning us for months that the equity market is a high risk proposition at these levels.

It still has not sunk in with most banks and other economists that the world's major economies are slowing. That the recovery phase has come and gone. That we are entering a more entrenched economic slow-down period. The evidence is everywhere, but everyone wanted to ignore it and just keep looking across the valley? It is not a valley.

There is no half-measure way of saying it.

Should Russia press on into Ukraine, then stocks will collapse as well they should. As I said yesterday; Gold $2,000, Oil $100, AUDUSD 65 cents, and from quite some time ago; US500 4050, AUS200 6800.

The US dollar will resume its major up-trend process as a hedge against great global uncertainty over the pandemic, the nature of the true economy and now the risk of a significant war.

Hopefully, I am completely and utterly wrong. It is just that my "look out the window" commonsense economic view of the world has been screaming to me for some time that the great disconnect between stocks and reality cannot last much longer.

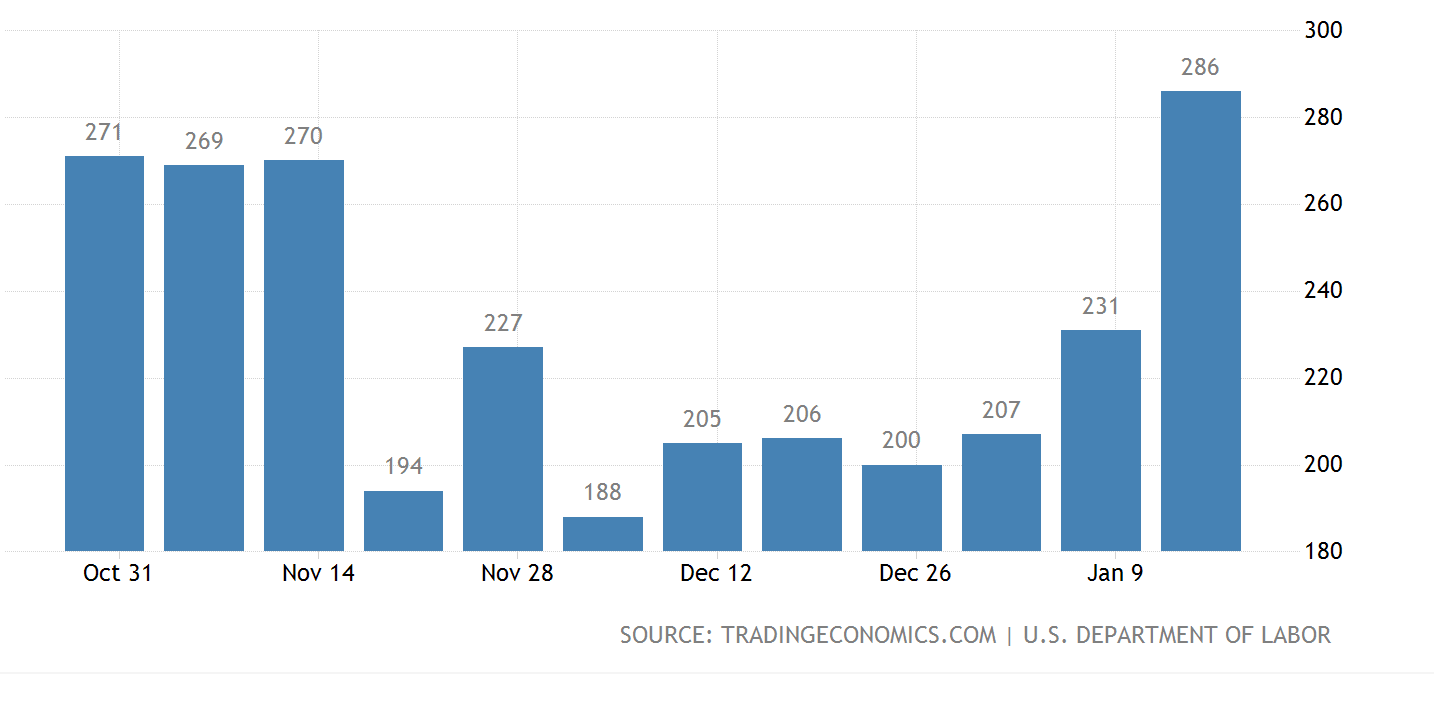

US New Jobless Claims

Begin to spike higher. The US is only in the very early stages of this Omicron and run-down of stimulus broad based economic slow-down. The duration will be over the horizon.

US Existing Home Sales

Begin to fall again. Think property bubble bursting.

Philadelphia Manufacturing

Problematic.

Eurozone Inflation

Confirmed out of control.

Gold 2 hourly

Will be pushed lower by a stronger US dollar at first, but again expect reassertion and eventually moving much higher.

EURUSD 2 hourly

Attempted rally failed. US dollar begins to ride global panic buying.

US500 2 hourly

One way street high risk potential.

AUS200 2 hourly

It is a collapsing trend.

Economics in the park.

Australian Un-employment.

Wednesday a reasonable recap,

Even has jokes.

The Quick Story.

Have the best of days.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a