USD/NOK

The dollar traded higher or unchanged against its G10 peers during the European morning Wednesday as investors stayed focused on the outcome of the Fed's two day policy meeting. It was higher against SEK, NZD, EUR, JPY and AUD, in that order, while it was virtually unchanged against CHF, CAD and GBP. The greenback was lower only against NOK.

The Norwegian krone gained after the country's AKU unemployment rate for May rose 10 bps to 4.3%, in line with expectations, easing concerns about further rate cuts by Norway's central bank. On top of that, a minor advance in oil prices also kept NOK supported. Tomorrow's release of retail sales for June and the official unemployment rate for July on Friday will shed more light on the country's fundamentals and perhaps help investors to adjust their expectations for further action by the Bank at its September meeting. If the data come in strong, NOK could gain further.

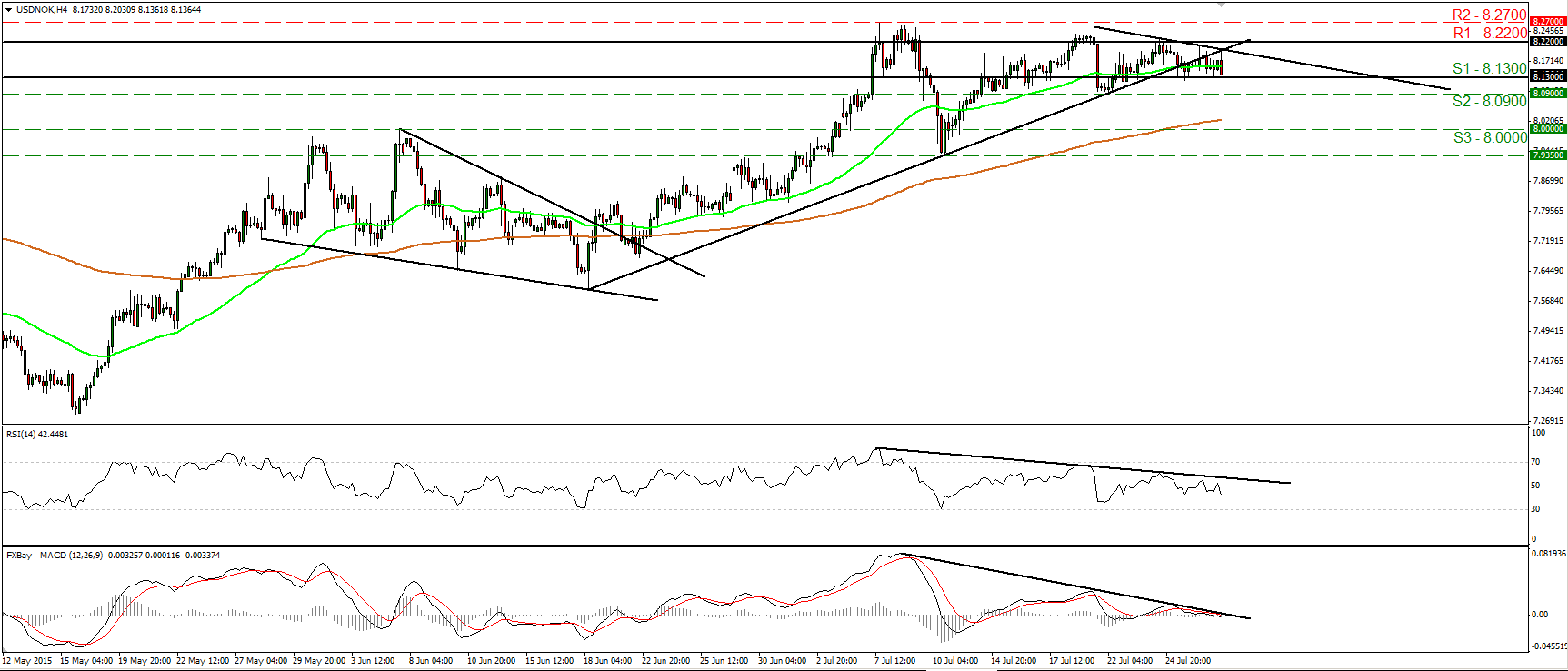

USD/NOK has been trading in a consolidative mode between 8.1300 (S1) and 8.2200 (R1) since the 23rd of the month. It is also trading below the uptrend line taken from the low of the 18th of June and below the short-term downtrend line drawn from the peak of the 21st of July. Having that in mind, and that our short-term oscillators detect negative momentum, I would expect the rate to trade lower. A clear break below 8.1300 (S1) could bring into the game the 8.0900 (S2) area. A break below the latter zone is the move that could carry larger bearish extensions, perhaps towards the psychological territory of 8.0000 (S3). Our daily oscillators also support my view that further downside is on the cards, at least in the short run. The 14-day RSI has turned down and could be headed towards its 50 line, while the daily MACD has topped and fallen below its trigger line. Nonetheless, I still see a major uptrend on the longer-term -- daily and weekly – charts, so I would treat the short-term downturn as a corrective phase in the longer-term uptrend.

Support: 8.1300 (S1), 8.0900 (S2), 8.0000 (S3)

Resistance: 8.2200 (R1), 8.2700 (R2), 8.4000 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.