EUR/GBP

The dollar traded mixed against its G10 counterparts during the European morning Friday, in the absence of any major market moving events. It was higher against AUD and NZD, in that order, while it was lower vs SEK, NOK, EUR and CHF. The greenback was virtually unchanged against CAD, JPY and GBP.

EUR traded somewhat higher after a moderate improvement in the final service-sector PMIs for June from France and Italy, despite the decline in the German figure. Eurozone's final service-sector PMI confirmed the preliminary reading, while retail sales for May beat expectations and decelerated less than expected. Nevertheless, with the US markets closed today and all attention shifted onto the outcome of the Greek referendum on Sunday, there is unlikely to be fresh positioning and the markets could remain muted. The restrained mood of investors is also reflected in the equity markets, with DAX trading a touch lower from Thursday.

The British pound gained a bit after the country's service-sector PMI increased more than expected in June. Investors overlooked the disappointing manufacturing PMI figure released on Wednesday, as the service sector PMI corroborated the positive construction PMI and eased concerns over the rebound in Q2 growth. Even though GBP jumped on the news, the uncertainty over the Greek crisis and the thin market kept the pound from strengthening further.

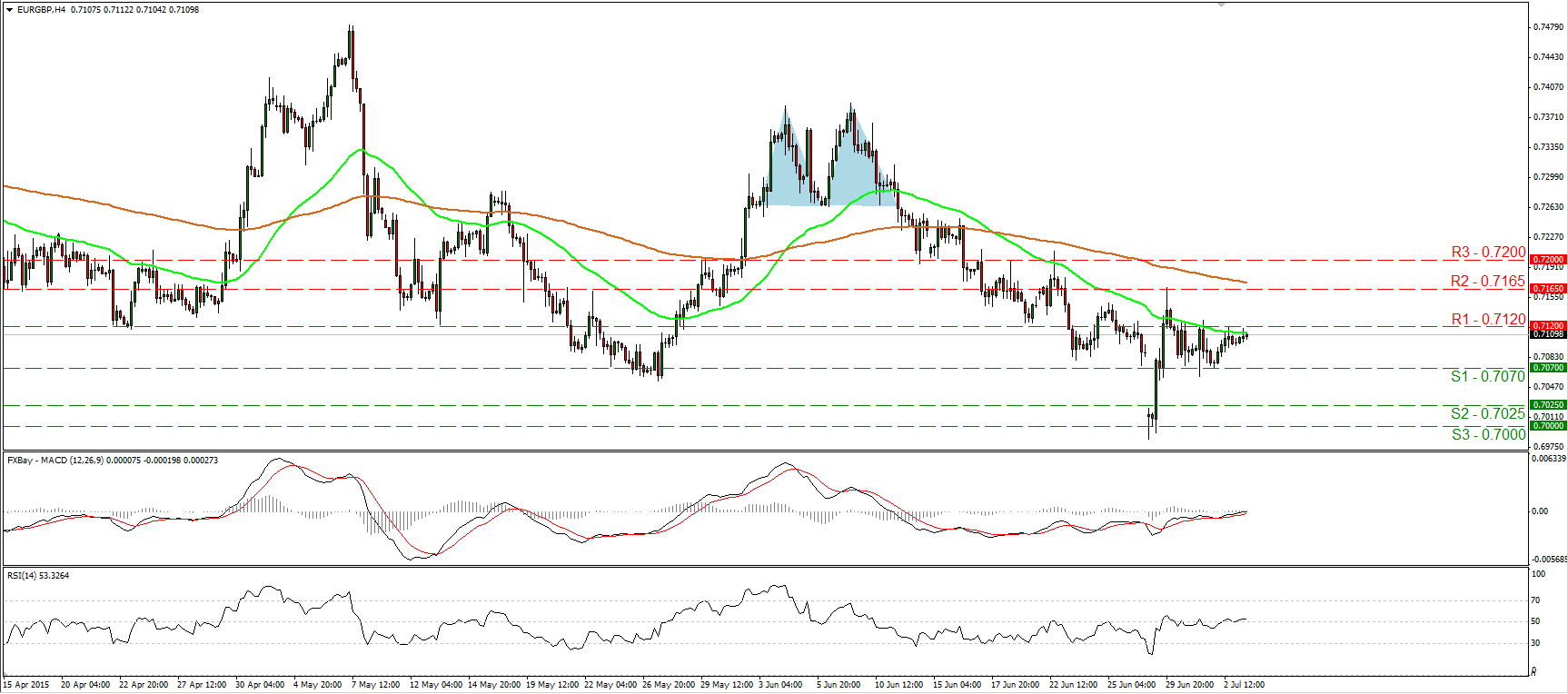

EUR/GBP traded in a consolidative manner during the European morning Friday, staying fractionally below the resistance barrier of 0.7120 (R1). I believe that a clear move above that obstacle is likely to encourage buyers to pull the trigger for the next resistance territory of 0.7165 (R2). Our short-term momentum studies lie near their equilibrium lines, confirming the recent sideways action, but they also stand in their bullish territories. This increases somewhat the likelihood that the forthcoming wave could be positive. The RSI stands fractionally above its 50 line, while the MACD has just poked its nose above its zero line. Our daily momentum studies give evidence that EUR/GBP could trade a bit higher as well. The 14-day RSI, although below its 50 line, has turned up, while the daily MACD shows signs of bottoming and could move above its trigger line soon. On the daily chart, the pair has been trading in a non-trending mode since mid-March. Therefore, I would consider the overall outlook to be neutral. I would like to see a clear close below the psychological figure of 0.7000 (S3) before I assume the continuation of the prevailing long-term downtrend.

Support: 0.7070 (S1), 0.7025 (S2), 0.7000 (S3)

Resistance: 0.7120 (R1), 0.7165 (R2), 0.7200 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.