USD/NOK

The dollar traded unchanged or higher against its G10 counterparts during the European morning Wednesday, ahead of today’s FOMC minutes. It was higher against NZD, SEK, AUD and EUR, in that order, while it was stable vs GBP, CAD, JPY, CHF and NOK.

The Norwegian krone reversed losses against the dollar after the mainland GDP, which excludes oil and gas extraction, expanded 0.5% qoq in Q1 from +0.4% qoq in Q4, exceeding expectations of +0.3% qoq. The total GDP grew 0.2% qoq in Q1, at a slower pace from +0.9% qoq in Q4. The better-than-expected mainland growth rate pushed USD/NOK down approximately 0.80% on the news, reversing earlier gains caused mainly by a firmer dollar and lower oil prices. The solid growth figures could take off some pressure from the Norges Bank to cut rates at its June meeting, thus NOK could strengthen somewhat going into the meeting. Nevertheless, positive data surprises will be required to keep NOK supported and if the upcoming data are as disappointing as the inflation rate last week, USD/NOK could strengthen.

The minutes of the May Bank of England meeting showed that the MPC voted unanimously to keep rates unchanged, and again the decision for two members was “finely balanced”. While there was a range of views over the most likely future path for the rate, all members agreed that it was more likely than not that it would rise over the 3-year forecast period. GBP strengthened on views that the slack in the economy could be fully absorbed within a year, which could put upward pressure on the CPI and increase the possibility of a rate hike early next year.

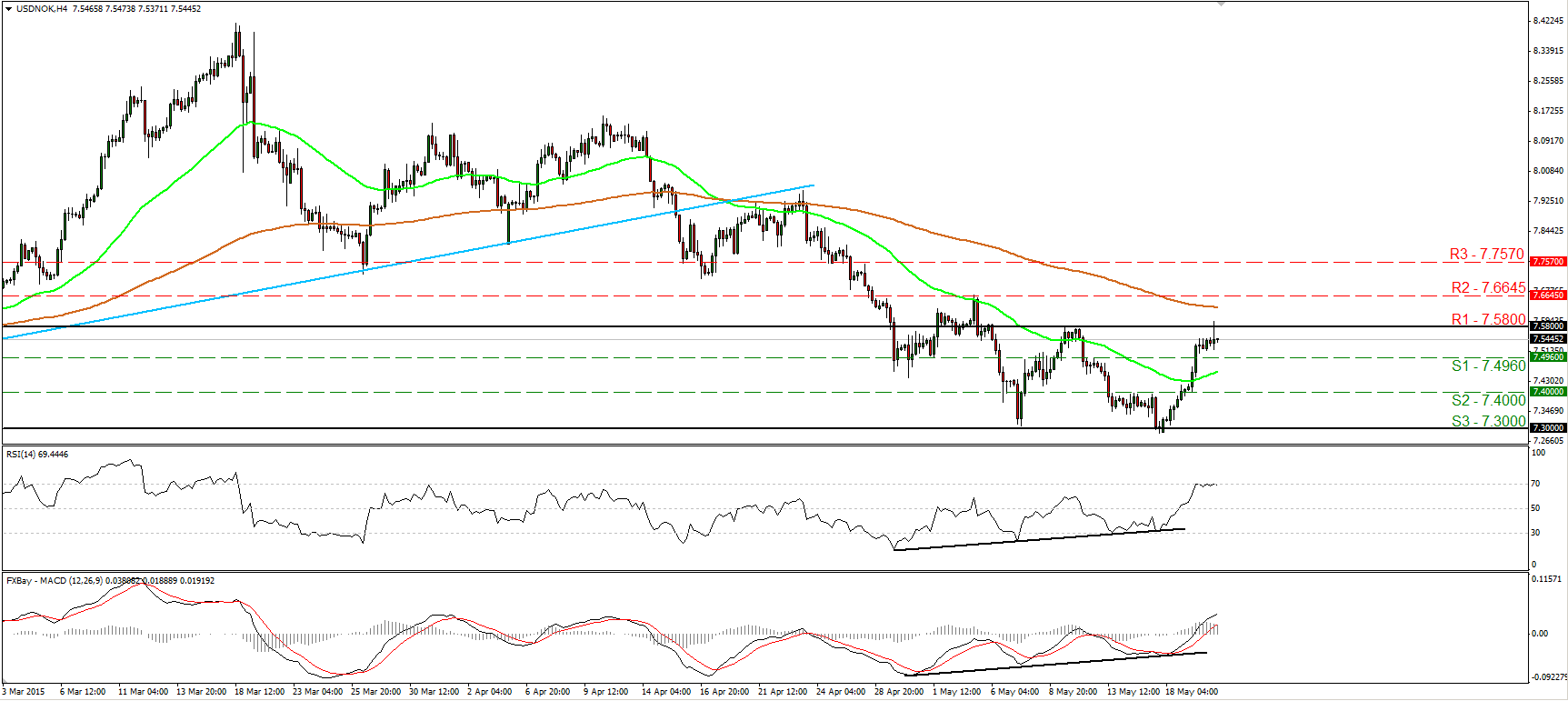

USD/NOK moved higher during the European morning Wednesday, but hit resistance fractionally above the key hurdle of 7.5800 (R1) after the better-than-expected mainland GDP from Norway and retreated to give back a large portion of its gains. The rate has been oscillating between that resistance and the strong support zone of 7.3000 (S3) since the 6th of May. Therefore, I would consider the short-term trend to be sideways. Given our proximity to the upper bound of the range, I would expect the forthcoming wave to be negative. A clear move below 7.4960 (S1) is likely to confirm that and perhaps challenge initially the next support at 7.4000 (S2). Our momentum studies support the occurrence of that scenario as well. The RSI found solid resistance at its 70 line, while the MACD shows signs that it could start topping. In the bigger picture, the rate is still trading below the prior longer-term uptrend line (light blue line), something that keeps the overall outlook somewhat negative. However, the latest rebound from the 7.3000 (S3) area came when that zone coincided with the 200-day moving average. As a result, I would prefer to see a clear and decisive close below 7.3000 (S3) before I trust the medium-term downtrend again.

Support: 7.4960 (S1), 7.4000 (S2), 7.3000 (S3)

Resistance: 7.5800 (R1), 7.6645 (R2), 7.7570 (R3)

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.