USD/NOK

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against GBP and JPY, in that order, while it remained lower against NOK, SEK, AUD, CHF and EUR. The greenback was stable vs NZD and CAD.

EUR/USD moved higher as the bloc’s preliminary PMIs for October managed to remain above the neutral level for the 16th consecutive time. Eurozone’s preliminary composite PMI - covering both the manufacturing and service sectors – beat expectations of a drop below the 50 level and rose from the previous reading. Even more of a surprise was the rise in the German manufacturing PMI into expansionary territory. EUR/USD gained on relief that German manufacturing is expanding despite the recent weak batch of data. However, since EUR/USD failed to reach the 1.2700 level, I would maintain my view that the recovery from 1.2500 has probably ended and a test of 1.2600 as a first step is on the horizon.

The Swedish krona also gained vs the dollar after the country’s unemployment rate declined in September strengthening SEK at the release.

The British pound was the main loser during the European morning following the unexpected drop in retail sales excluding gasoline in September. The poor data only reinforce my opinion that we still have further room to the downside.

Norges Bank left its key policy rate unchanged at 1.5%, as expected. In the statement accompanying the decision, Bank Governor Oystein Olsen noted that the outlook for inflation and output are broadly in line with September projections. NOK gained on the news, most likely due to relief that the Bank left rates on hold despite the fall in oil prices. If oil prices continue to fall, they could weigh on the Norwegian economy and put the NOK under selling pressure.

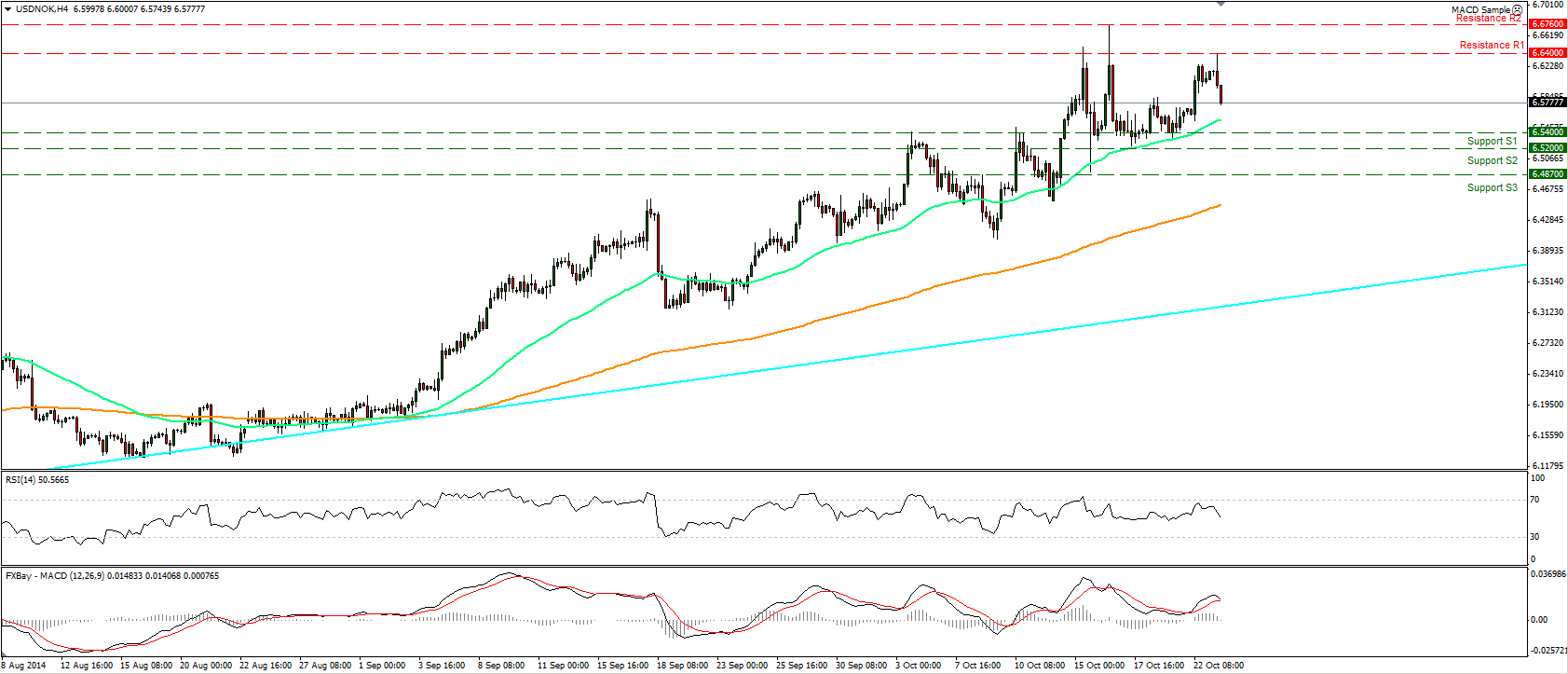

USD/NOK moved lower following Norway’s central bank decision to keep its benchmark interest rate unchanged. The decline of the pair may set the stage for another test near its 50-period moving average, which has provided fairly reliable support for the lows in the recent past. Looking at our short-term momentum studies, the RSI declined after finding resistance near its 70 line while the MACD, shows signs of topping and seems ready to cross its trigger line. Both stochastics are moving down and support the notion that the initial test of the 50-period moving average and then the 6.5400 (S1) support level are possible. A break below could trigger further bearish extensions towards the 6.5200 (S2) zone. As for the bigger picture, as long as the rate is forming higher highs and higher lows above the light blue longer-term uptrend line (taken from back at the low of the 8th of May), I see a positive overall picture.

Support: 6.5400 (S1), 6.5200 (S2), 6.4870 (S3) .

Resistance: 6.6400 (R1), 6.6760 (R2), 6.7300 (R3) .

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.