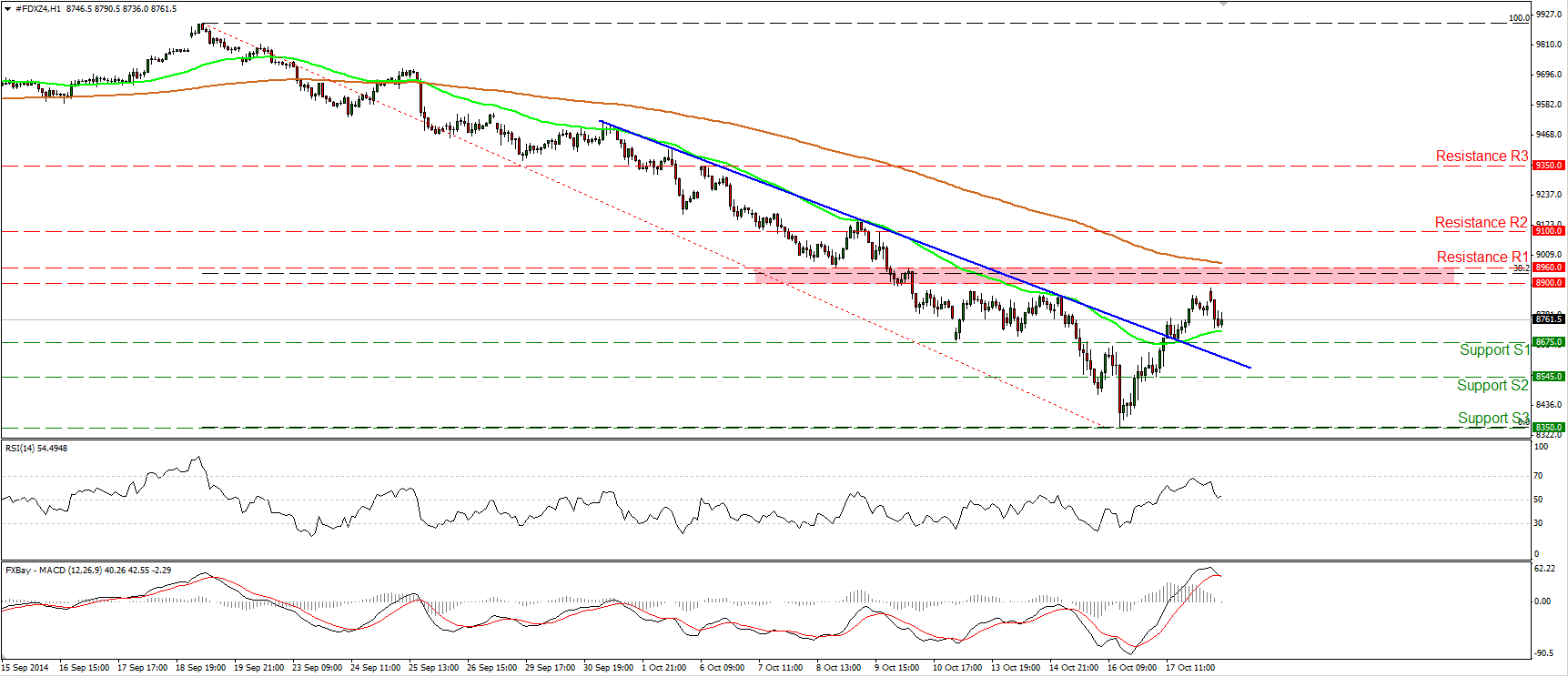

DAX futures

The dollar traded mixed against its G10 peers during the European morning Monday. It was higher against NOK, SEK and AUD, in that order, while it was lower against JPY and CHF. The greenback was stable vs CAD, EUR, NZD and GBP.

The Swiss franc traded 65 pips above its 1.2000 floor against the euro at midday in Europe. The decline in the rate could be viewed as a renewed buying opportunity given the strong support from Swiss National Bank to limit the downside. SNB still retains the negative interest rate tool and could intervene in the market directly by buying EUR in order to weaken CHF. Since November 2012 the pair attempted a few times to break the 1.2050/60 support area but none of them proved successful.

German PPI fell 1.0% yoy in September, an acceleration from -0.8% yoy in the previous month. The reading was in line with market consensus and suggests that the risk of deflation in the Eurozone continues. The latest weak German data seem to have entrenched the negative sentiment toward the country’s economy. The PMIs to be released on Thursday should shed more light on the recent economic activity. Other data showed that the Eurozone’s current account surplus fell in August from an upwardly revised surplus in July. Despite the weakening fundamentals, EUR/USD remained resilient during its European morning, reflecting the restrained mood of investors. While the gyrations around 1.2750 may continue, the weaker economic data out of the bloc support my bearish view on euro.

DAX futures tumbled on Monday after finding resistance marginally below the key zone of 8900/60. Within that zone I see the 38.2% retracement level of the 19th September – 16th of October down move. Moreover, back on the 10th of October, the dip below that zone signaled the completion of a possible complex Head and Shoulders top formation on the daily chart. As long as the rate remains below that zone, the pattern is still in play. However, on Friday, the rate moved above the blue short-term blue downtrend line (seen on the 1-hour chart) and above the 50-hour moving average, which provided reliable resistance to the highs of the recent short-term downtrend. But I will treat this short-term advance as a corrective move of the 19th September – 16th of October tumble. A move below the support hurdle of 8350 (S3) is the move that would confirm a forthcoming lower low on the daily chart and provide evidence that the recent advance was just the “return move” towards the neckline (in our case the 8900/60 zone) before the next leg down. On the weekly chart, the MACD turned negative in the end of September for the first time since July 2012. I also see negative divergence between the indicator and the price action. These momentum signs add to the negative picture of the DAX in my view.

Support: 8675 (S1), 8545 (S2), 8350 (S3) .

Resistance: 8960 (R1), 9100 (R2), 9350 (R3) .

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.