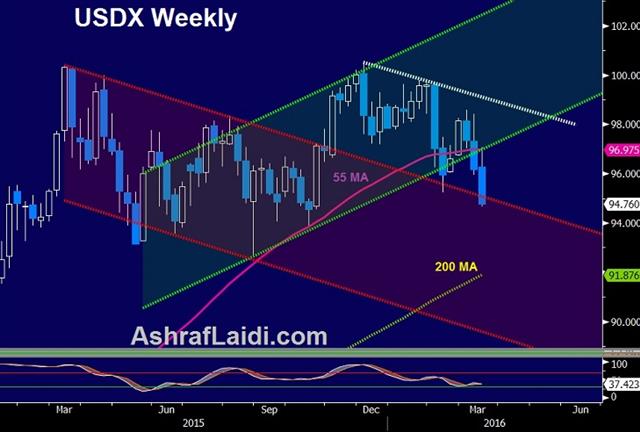

The Fed squandered much of its hawkish rhetoric Wednesday and market participants continue to ask 'why?' (as they sell the US dollar). If you look at the recent turns in markets many of them can be traced back to late February. It's no coincidence that's when G20 leaders met in China. GBPUSD was stopped out and EURUSD was closed at a profit, leaving us with 4 Premium trades in progress.

Click To Enlarge

We take a closer look at the events since the G20 ahead of a relatively quiet end-of-week session in Asia-Pacific trading.

The day after the G20 meetings China lowered the RRR by 50 basis points in a surprise move. The government followed that up by loosening property lending and creating a TARP-like program to buy bad loans. Shortly afterwards the ECB unveiled a larger stimulus package than almost anyone expected. The RBNZ surprised with a rate cut and now the Fed has abandoned any pretense of hawkishness. Next week the Canadian government will announce a major stimulative budget

The idea that G20 leaders sat down and decided to do more isn't a conspiracy. Ideas like that are what meetings like the G20 are for.

Alone, each central bank decision can be justified but a pattern is forming and it's one we will continue to monitor.

In the shorter-term, the market continues to reel from the Fed decision. The US dollar slumped across the board and only stabilized after USD/JPY fell to a 15-month low of 110.75 and then abruptly jumped to 112.00. There was talk of intervention but a newswire source said Japanese officials had only called around to try and figure out what happened.

US economic data modestly positive. Jobless claims and JOLTS posted a slight beat while the Philly Fed was strong at +12.4 vs -1.7 expected.

Looking ahead, data on Chinese property prices are due at 0130 GMT. It's followed at 0530 GMT by Japanese department store sales. A speech from the RBA's Luci Ellis stuck to regulatory policy and did not touch on monetary policy or the Aussie.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.