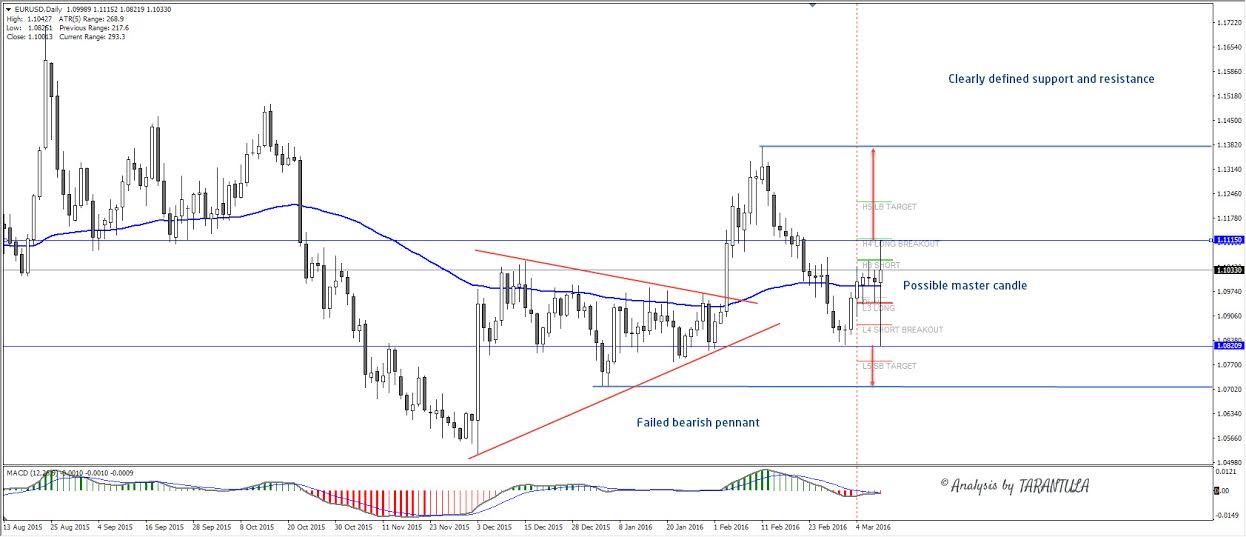

As presumed the ECB decision made a hectic movement on Forex and Equities. The ECB decided to cut main refinance rate to 0.0% while markets expected 0.05% + deposit rate was cut to -0.40% vs 0.40% expected. Four new Targeted longer-term refinancing operations (TLTROs) have been announced with QE shift to €80bn Initially EURUSD has been sold to 1.0820 but when Draghi stated there will be no rate cuts Algos stepped in, equities were sold and that created a huge move up in the EURUSD towards 1.1115. Equities have a strong correlation to Forex as explained in our webinars and it can cause massive whipsaws in price action.

Technically the EURUSD is possibly showing a MASTER candle on Daily time frame and it marks clear support and resistance levels. EURUSD is looking bullish now with 1.1115 as resistance and 1.0820 as support. The daily candle serve as the best indicator of interim support and resistance where levels are clearly defined by price action in now moment. Any spike and daily close above 1.1115 will aim for 1.1215 and 1.1376 while a daily close below 1.0820 would aim for 1.0770 and 1.0700. Adding to EURUSD bullishness we see a failed bearish pennant on daily but watch for daily close above or below the master candle for next direction. My current guess it will be bullish.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.