As we could witness it, Canada is currently undergoing a recession as the economy is suffering due to low oil prices. Oil prices have been falling sharply also through the summer and fall of 2014. As with GDP, oil prices do have a significant impact on employment and overall economy. Canada's dependance on oil and gas is threatening its overall economy and it is reflected on the charts.

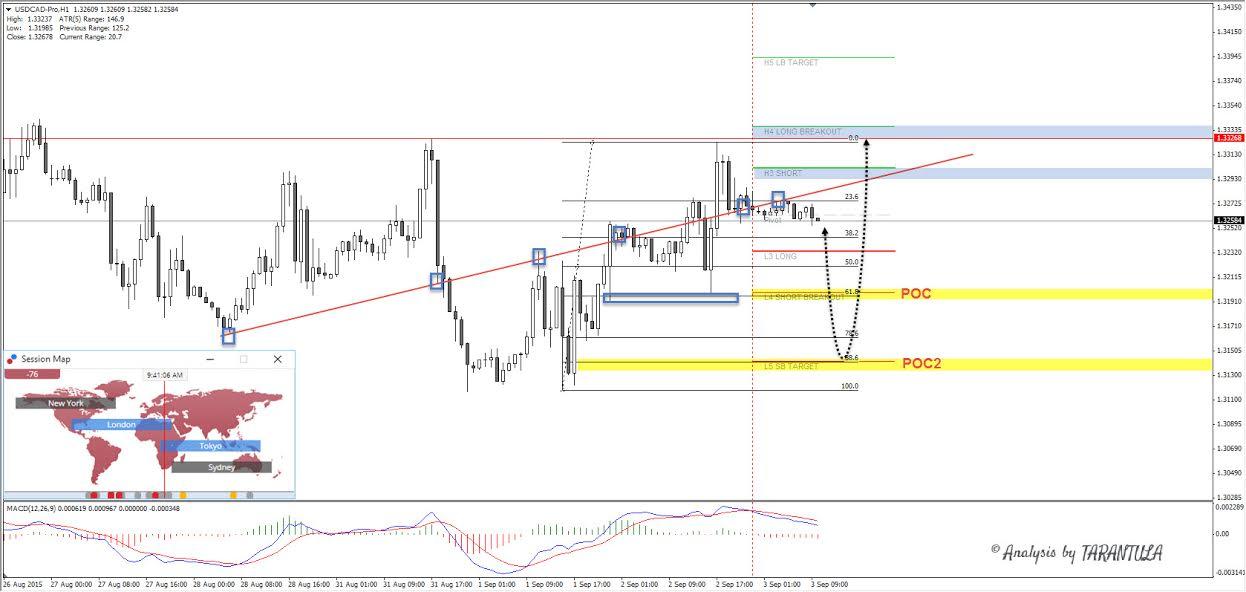

USDCAD is showing an inner trend line and a possile retracement. We see a perfect confluence at 1.3195 zone (L4, 61.8 , double bottom) and deeper 1.3140 (88.6, L5). Targets are 1.3310 and 1.3340. On the chart we can see important touches of trend line and if the retracement happens ideally it would reach POCs and bounce. If the price closes above inner trendline there could be a short term breakout towards previously mentioned targets. Watch US/LO market overlap as USDCAD best movement happens during that session.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.