Since it hit a new five-month low below 1.2900 late last week on the last day of March, USD/CAD has rebounded to hit a high briefly above 1.3200 resistance as of Tuesday. This rebound has occurred as the price of crude oil has retreated in the past several trading days, dragging the oil-correlated Canadian dollar down with it. Renewed pressure on oil prices has been brought on after an apparent stumbling block recently surfaced surrounding proposed negotiations among major OPEC nations and Russia to coordinate a cap on crude oil production. Specifically, some OPEC nations including Saudi Arabia have found it difficult to accept a concerted output cap if Iran does not agree to participate. Of course, Iran is in the midst of ramping up its own oil production to make up for lost time and revenue after previous sanctions long imposed on the country were recently lifted.

The drawn-out speculation over these output negotiations have led to rather choppy price action in the past few months for both crude oil and the Canadian dollar as markets have reacted in knee-jerk fashion to periodic utterances, both optimistic and pessimistic, by ministers of major oil-producing countries.

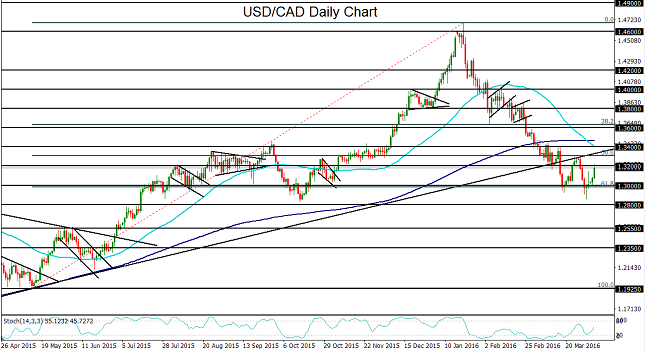

For more than two months, USD/CAD has slid sharply from its January long-term high above 1.4600 as crude oil has rebounded, boosting the Canadian dollar, and the US dollar has steadily weakened on lowered expectations for further US interest rate hikes by the Federal Reserve. After reaching down to the 1.3000 psychological support level by mid-March, however, the currency pair dipped below that level on several occasions but has had a hard time remaining below it. The 1.3000 area is also around the 61.8% Fibonacci retracement level of the bullish trend from the May 2015 lows up to the noted January long-term high above 1.4600.

Upcoming economic events to take note of when trading the currency pair this week include the release of meeting minutes on Wednesday for last month’s FOMC meeting, speeches by various Fed members including Fed Chair Janet Yellen on Wednesday and Thursday, and key government reports on employment change and the unemployment rate coming out of Canada on Friday.

Outside of these events, with any further slide in crude oil prices, USD/CAD could extend its current rebound, which would lend support to a tentative bottoming of the currency pair. With any breakout and recovery momentum above 1.3200, the next major upside targets on a continued rebound are at the key 1.3400 and 1.3600 resistance levels. To the downside, any sustained breakdown below the noted 1.3000 psychological support level should find major support around 1.2800.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.