![]()

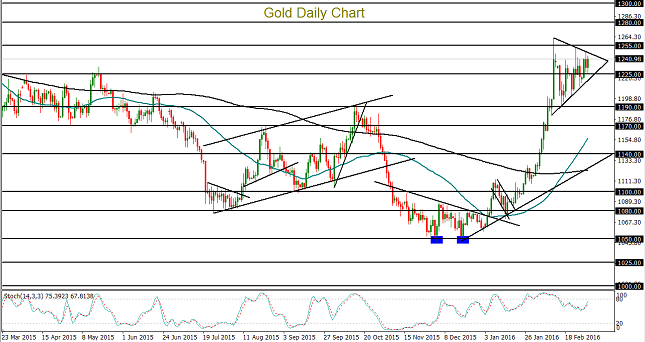

Gold has been trading within a large triangle consolidation pattern for the past three weeks since it hit a one-year high at $1263 in mid-February. Price action within this consolidation has fluctuated widely between that $1263 high and a low at $1190 support. As characteristic of triangle patterns, the price range within has progressively tightened and converged to the point where a directional breakout has become increasingly likely.

With respect to the global financial markets, some of the key characteristics of gold are that: it is denominated in US dollars, it is a non-interest-paying asset, and it is a key “safe haven” asset. Generally-speaking, these characteristics have resulted in an inverse correlation between the precious metal and both the US dollar as well as global equity markets. Though these inverse relationships are far from precise, gold generally rises when the dollar falls, and vice versa. Likewise, the metal often rises when stocks fall, and vice versa.

As a case in point, when the dollar was plunging during the first half of February, gold surged for the first two weeks of that month to hit its noted one-year high at $1263. During the same time span, global stock markets plummeted to new lows, stimulating safe haven flows back to gold. This combination of factors boosting the price of gold at that time prompted a swift and unexpected recovery for the precious metal.

Since that high was reached, a relative stabilization for both the dollar and equity markets resulted in the pullback and current consolidation in the price of gold. Consolidation patterns are all eventually broken, oftentimes by some fundamental catalyst that pushes the market in a particular direction.

One such catalyst may be this Friday’s US non-farm payrolls employment report for February. Any reading significantly above the consensus expectation of 195,000 jobs added could likely have a significant impact on boosting the dollar due to its potential role in helping to shape the Federal Reserve’s decision to implement future interest rate hikes. A positive employment reading could also help lift equity markets further. In this scenario, a rising stock market and appreciating dollar could have the correlative effect of prompting a breakdown in the price of gold below the current triangle consolidation. In this event, the next major downside target on a triangle breakdown is around the noted $1190 support level.

In the opposite event of a return to volatility in the global stock markets and/or another pullback for the dollar, any breakout to the upside for gold would confirm a continuation of the strong uptrend that has been in place since the beginning of the year. In this event, the next major upside target resides at the key $1300 resistance level.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.