![]()

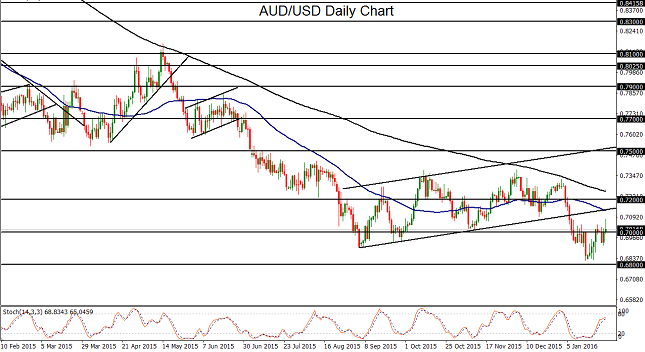

AUD/USD made a tentative breakout above a small, inverted head-and-shoulders pattern on Wednesday, but pared most of its gains by the afternoon. During the Asian session early Wednesday, Australia released its Consumer Price Index (CPI) inflation reading that showed a greater-than-expected increase in consumer prices, prompting AUD/USD to rise to a three-week high.

After the currency pair’s early Wednesday surge, however, it gave back much of its gains in the afternoon when the US FOMC statement was released.

The bullish head-and-shoulders pattern that has been forming since the beginning of the year had given AUD/USD bulls cause for some optimism that a bottom may have been forming for the embattled currency pair as it consolidated near recent multi-year lows. Less than two weeks ago in mid-January, AUD/USD dropped to more than a six-year low at 0.6825, just above its 0.6800 downside support target, forming the “head” of the chart pattern.

Despite the late retreat from its highs on Wednesday, AUD/USD could still potentially complete the bullish head-and-shoulders pattern, especially with the Reserve Bank of Australia’s (RBA) rate statement scheduled to be released on Tuesday of next week. With the slightly higher inflation readings in Australia that may reduce the chances of a near-future interest rate cut, the RBA may strike a more hawkish tone that could boost the Australian dollar further from its long-term lows.

In the event of a sustained breakout above the inverted head-and-shoulders pattern, the first major upside target is around the 0.7200 resistance level. Of course, the chart pattern would be invalidated on any return back down towards the key bearish trend target at the noted 0.6800 support level, in which case a continuation of the longstanding downtrend will have been confirmed.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.