It was another day of market mayhem in China, where the benchmark Shanghai Composite fell by more than 6%. Unlike some of the other panic episodes we’ve seen so far in 2016 though, the volatility was contained to China, with major European indices seeing only minimal moves and oil, everyone’s favorite indicator of investor sentiment, hovering around the key 30.00 level.

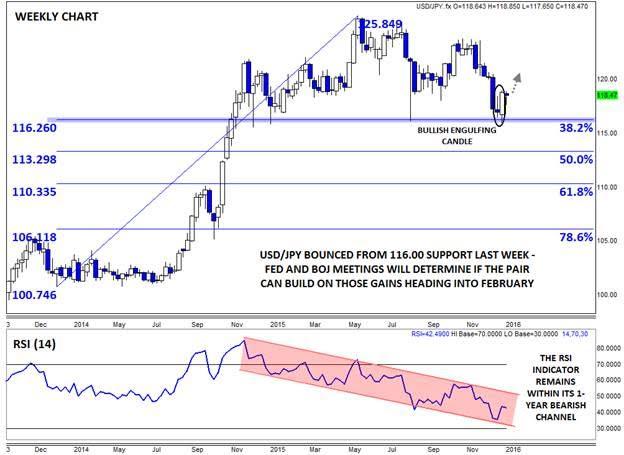

Lost amidst the intense focus on the day-to-day fluctuations in oil however, is analysis of the traditional gauge of investor risk appetite: USD/JPY. Much like the major US indices, USD/JPY has found a floor at key previous support, in its case in the 116.00 zone. Last week, the pair carved out a big Bullish Engulfing Candle* from that support level, signaling an intraweek shift from selling to buying pressure and hinting at the potential for more strength this week.

So far, bulls haven’t been able to create much upside momentum, but even the roughly-unchanged performance since the beginning of the week is impressive given the steep drop in US and Asian equities. Before we would feel confident saying any sort of medium-term bottom has formed, we would need to see the weekly RSI indicator break out of its established bearish channel, which would signal an end to the full year of increasing bearish momentum.

In case you hadn’t had a chance to look ahead on the economic calendar, USD/JPY will be buffeted by two big central bank announcements later this week. The US Federal Reserve will issue its latest monetary policy statement tomorrow at 14:00 ET (19:00 GMT), though no major changes are likely (stay tuned for our full FOMC preview later this afternoon).

Then on Friday, the Bank of Japan will meet to decide whether to further increase its QQE program or to hold off for another month. Overnight, a number of Japanese officials including Economy Minister Amari, Finance Minister Aso, and Prime Minister Abe all issued comments essentially implying that the BOJ should not increase its stimulus yet, but it remains to be seen whether this veiled “advice†is followed or merely misdirection for traders. Either way, volatility is likely to pick up in USD/JPY over the rest of the week, and a surprise easing from the BOJ could cause USD/JPY to spike quickly toward 120.00.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.