![]()

As we noted earlier today, there’s not much hitting the wires in terms of actionable economic news (beyond the slight negative, but still better-than-expected revision to Q3 US GDP data), so we wanted to revisit one of the forex market’s strongest correlations: the relationship between EUR/USD and USD/CHF.

One of the most common problems I see from newer FX traders is that many of them analyze the Swiss franc in isolation. Even though the Swiss National Bank officially ended the EUR/CHF floor back in January, trade in the franc is still driven predominantly by flows in the euro. That’s because the Swiss economy is still heavily dependent on its neighbors to the east (and west and north and south)… in other words, the Eurozone. It’s worth noting here that the Eurozone’s economy (~ $13T USD) is nearly 20 times larger than that of Switzerland ($685B USD), and traders tend to lump these two currencies together under the umbrella of “European currencies.”

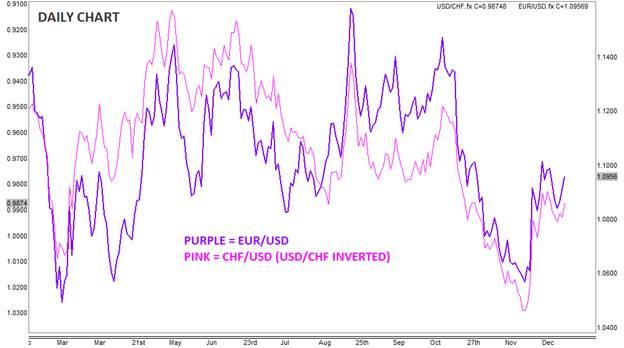

To add some meat to the discussion, the current 50-day correlation between EUR/USD and USD/CHF is -0.97, amazingly close to the 1.0 figure that would signal that the two instruments move in lockstep. For more visual traders, I’ve plotted chart of the EUR/USD vs. CHF/USD (inverted version of the USD/CHF):

Why does it matter?

Beyond the obvious implication that USD/CHF traders should be extremely plugged in to Eurozone economic news, we can also use the two pairs to confirm moves in one another. In other words, if EUR/USD sees a bullish breakout above a resistance level, traders could look to see if there’s a corresponding bearish breakout below a support level in USD/CHF to give them more confidence in the move (and visa-versa).

Though 2015 brought the officially brought the end of the central bank enforced relationship between USD/CHF and EUR/USD, traders have created a correlation that is nearly as strong. With the Swiss National Bank’s monetary policy moves now more in-line with the European Central Bank, EUR/USD traders could use moves in USD/CHF to gain an edge in 2016.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.