![]()

Only a few weeks ago it looked like the spectre of deflation had finally lifted from the Eurozone. However, today’s German CPI figures throw that into doubt. EU harmonised data for June shows that CPI fell 0.2% on the month, which pushed the annual rate down to 0.1% from 0.7% in May. So, is this just a pause in the uptrend for CPI, or is the trend over before it even began?

To answer this we need to dig a bit deeper into the data. Brandenburg and North Rhine Westphalia both released the breakdown of prices today. For Brandenburg the largest downward impacts on the CPI were rent and housing costs, utilities – mostly heating oil, transportation, communication and package tour holidays, which all saw prices drop by more than 1% compared to this time last year. In North Rhine Westphalia the largest downward pressures on CPI included transportation and communication, rent and housing costs and clothing. This is worth noting as the price declines were not only concentrated in the energy sector, but were broad-based suggesting that some areas of Germany’s economy could be losing their pricing power.

In fairness, one month does not necessarily reverse a trend, but it could keep the ECB on high alert for the overall Eurozone figure, which is released on Tuesday morning. If we see more evidence that inflation is weak then we could see the ECB’s focus shift back to its QE programme.

Will the ECB boost its QE programme?

The ECB’s only mandate is to protect price stability, so if CPI data starts moving backwards then we could see the ECB renew efforts - and potentially even boost - its QE programme. While we don’t think that this is likely now, combined with the economic impact of the Greek crisis on the currency bloc, this summer could see pressure build on the ECB to boost its QE programme.

So, while the EUR’s performance has been notable for its resilience to the most dangerous stage of the Greek crisis yet, it may falter if we see the ECB talking (or even taking) further steps to shore up the Eurozone economy from the effects of these two dangers.

What does this mean for the market?

In the short-term the market focus is all on Greece as we wait to see if Athens will default on Tuesday and the outcome of the bailout referendum next Sunday. However, we note two things to watch in the financial markets in the coming days and weeks that could limit EUR upside and boost European stocks:

1, German bund yields:

The two year yield is back below -0.20 basis points. Likewise, the 10-year yield is also below 0.85%, nearly 10 basis points lower than it was on Friday. While we expect yields to try and recoup some recent losses as Greek fears calm down, if we see an escalation of Greek concerns later this week, or a weak Eurozone CPI figure on Tuesday then we could see further weakness in German yields, which could limit EUR upside.

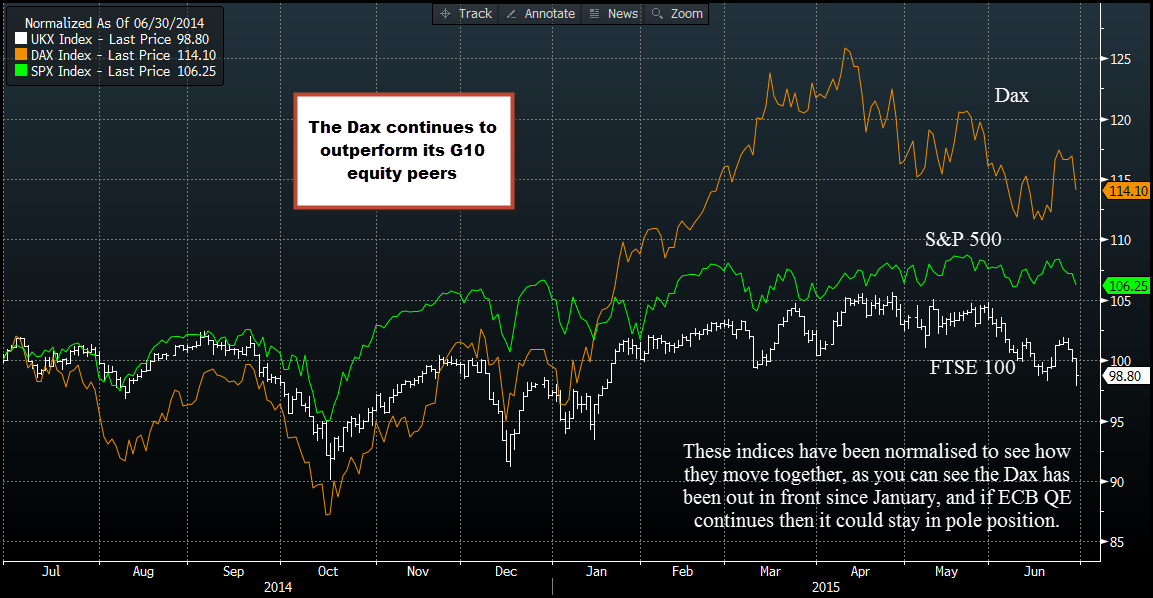

2, Dax: still king of the G10 equity space

The German index may have come under severe pressure earlier as news of Greek capital controls dominated the market, however, the Dax continues to outperform its US and UK counterpart, as you can see in the chart below. If we see weak Eurozone CPI this week then the prospect of a prolonged or enhanced QE package from the ECB in the coming months could keep the Dax at the top of the equity pile.

From a technical perspective, the Dax managed to stay above the 10,800 level on the back of the sell off at the start of this week – the low from earlier in June. Added to that, since the German CPI release, the Dax has had a moderate recovery, which could gain momentum on the back of weak Eurozone CPI on Tuesday.

Takeaway:

German CPI dipped in May, which could challenge the view that deflation is no longer a risk for the currency bloc.

While one month’s data does not reverse a trend, it is worth watching Eurozone CPI on Tuesday to see if the decline is broad-based across the currency bloc.

A mixture of Greek and deflation fears could keep the focus on the ECB’S QE programme, which may cap EUR gains and could boost the stock market in the coming weeks.

We continue to think that the Dax could outperform its G10 equity peers, especially if deflation fears return and pressure the ECB on QE.

The key products that could be impacted by a weaker reading of Eurozone CPI on Tuesday may include: a lower EUR and a higher Dax and European stock indices.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.