![]()

As we end May in a rather rainy and blustery fashion here in London, the dollar is having a bad end to the trading month. The latest economic data hasn’t helped things; the US economy shrank 0.7% in the first quarter. Although this was less than the -0.9% decline expected, it suggests that the US economy is still under the first-quarter weather-related curse that we saw last year.

The immediate rush to safe havens saw Treasury yields fall and the dollar to back away from recent highs, however, not even this data is enough to dislodge the dollar’s pole position in the G10 FX space for this month.

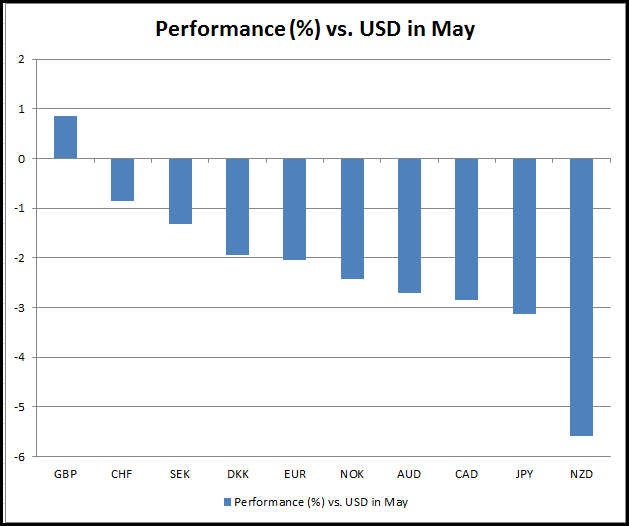

As you can see below, the dollar managed to outpace all of its G10 peers, with NZD suffering the most, dropping some 5.56% to a five-year low vs. the USD, while the JPY fell more than 3%, sending USDJPY to its highest level for 12 years. The pound managed to eke out a gain vs. the USD this month, highlighting how powerful a win for the Conservatives was for sterling.

But, after such a strong performance it is natural to see a bit of dollar short-covering as we move into June, this has been exacerbated by the US GDP data. However, we continue to think that the USD may continue to strengthen for a few reasons:

The Fed seems willing to look through a period of weather-related GDP weakness, and may still raise rates in 2H 2015.

US 2-year Treasury yields are still only 60 basis points, surely this will have to move higher if we get more “hawkish” Fed rhetoric, which could add to the dollar’s attractiveness?

The rest of the G10 are unlikely to hike ahead of the Fed, which should give the USD the yield advantage for some time to come.

How to trade the USD:

We think that EURUSD could prove tricky in the next few days/ weeks, as a “kicking the can down the road” solution to the Greek problem, thus averting imminent bankruptcy, could trigger a relief rally in the single currency.

As you should be able to see in figure 1, dollar strength seems fairly well entrenched and may continue into June. We believe the buck has the potential for further gains vs. the NZD (where the 2010 low at 0.6560 is now key support), and the JPY (where the next key level of resistance for USDJPY is 136.50 – the high from 2002). The pound also looks fragile, especially in light of a potential austerity-led slowdown in growth for the next few years, 1.5155 – a cluster of daily smas could act as key support next week.

Takeaway:

The dollar has triumphed vs. its G10 peers in May.

Although the pound managed to eke out a gain vs. the buck, it has lost steam in recent weeks.

The dollar starts June in a strong position; however, it may struggle vs. the EUR if we get a last minute Greece deal.

We believe the dollar may have further to go vs. the JPY and NZD after breaking through multi-year barriers that could open the way to further strength in the coming days.

The dollar is King for May, and we believe that it can last into June, although gains may not be as broad-based as this month.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.