![]()

Precious metals have turned quite volatile over the past week or so. Both gold and silver rallied strongly last week, mainly due to a falling dollar, before dropping back sharply yesterday as the greenback surged higher on the back of some surprisingly good housing market data. The USD also received some indirect support from a falling GBP and EUR following news that the UK fell into deflation for the first time since 1960 and after an ECB member said the central bank’s QE programme could be temporarily boosted. The dollar will be in focus again when the FOMC’s last meeting minutes are released at 19:00 BST (14:00 ET) today. If this conveys a dovish message then the US currency could be hit hard, while a hawkish message could send it sharply higher. This in turn may cause the buck-denominated commodities like silver to move sharply.

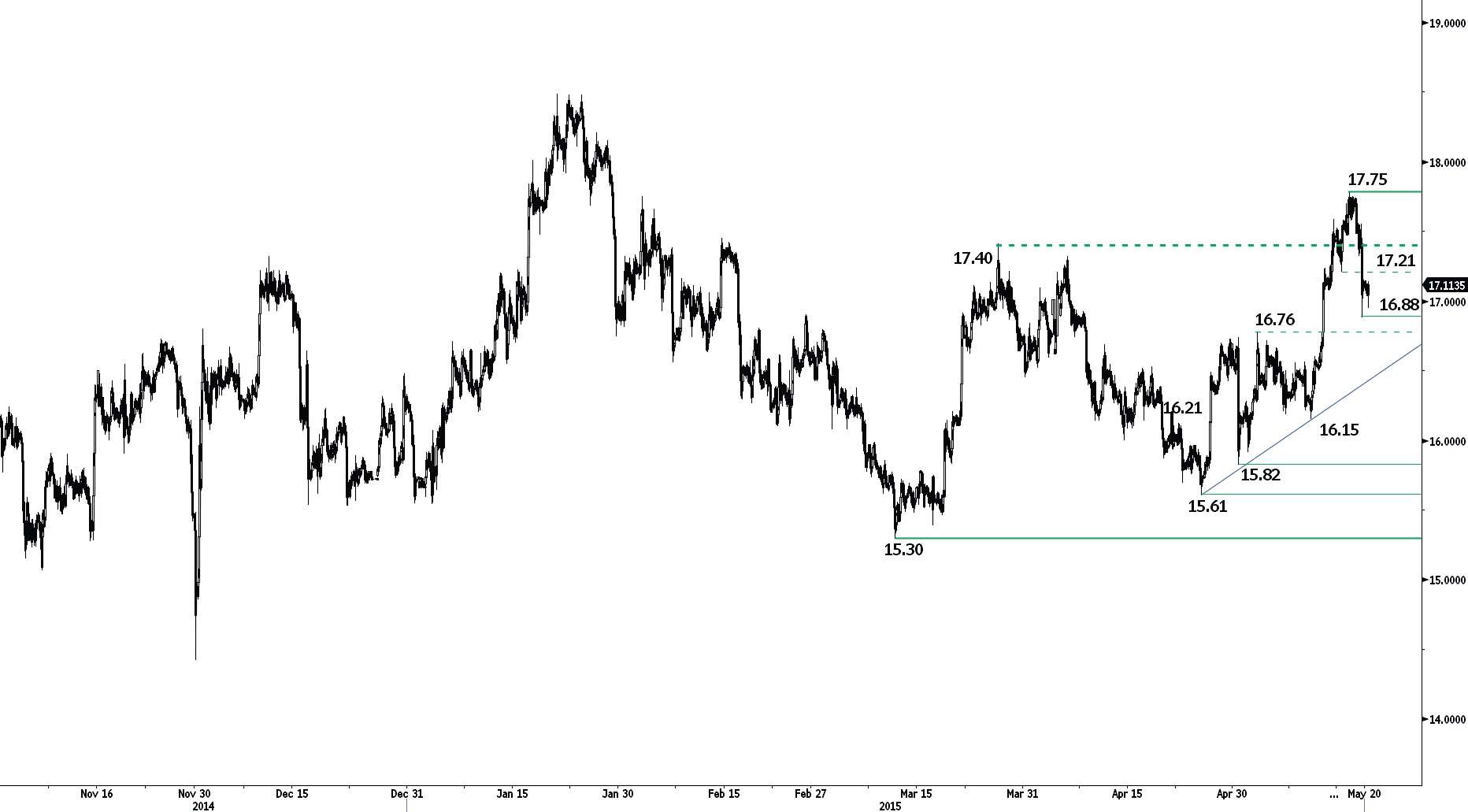

Yesterday’s sharp pullback caused silver to break below some important short-term support levels. But it has still managed to hold its own above the technically-important area of $16.90/$17.00. This is where the 200-day moving average meets the 38.2% Fibonacci retracement level of the last upward move. If this 38.2% Fibonacci level – which represents a shallow pullback, compared to say the 61.8% level – holds firm, it would suggest that the buyers may still have the overall control. Thus if silver were to rally now and eventually climb above Monday’s high then the next leg higher could be significant. What’s more, silver has already broken above a long-term downward-sloping trend line which may discourage the bears from establishing further bold positions. However if silver falls back from here then it may make a move towards $16.70 (the point of origin of last week’s breakout) or $16.40 (61.8% Fibonacci level) before deciding on its next decision.

So, in summary, the price of silver has the potential to bounce back strongly today if the dollar falls back, say as a result of a dovish FOMC minutes, or otherwise if the bulls defend the abovementioned $16.90/$17.00 area successfully. However if the bulls do not show up here then the near term outlook would become more murky and possibly bearish once again.

Figure 1:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.