![]()

With less than 24 hours to go before the 2015 UK election gets under way, the UK markets are fairly sanguine. The FTSE 100 has stabilised around the 50-day sma and GBPUSD looks comfortable above 1.5000, after the stunning service sector PMI for April surged to its highest level since August 2014.

While the good economic news is reflected in the UK’s asset prices - Gilt yields have also risen to their highest level so far this year – the outcome of tomorrow’s election in the UK could change the current trends in asset prices.

As we already mentioned in our UK election preview HERE, if one party fails to win an outright majority, as is expected, experiences elsewhere suggest that this need not be a disaster for domestic financial markets. However, it would be disingenuous to think that the election and its outcome won’t affect financial markets in some way. To try and gauge what magnitude it could have, we decided to look back to the last election in 2010.

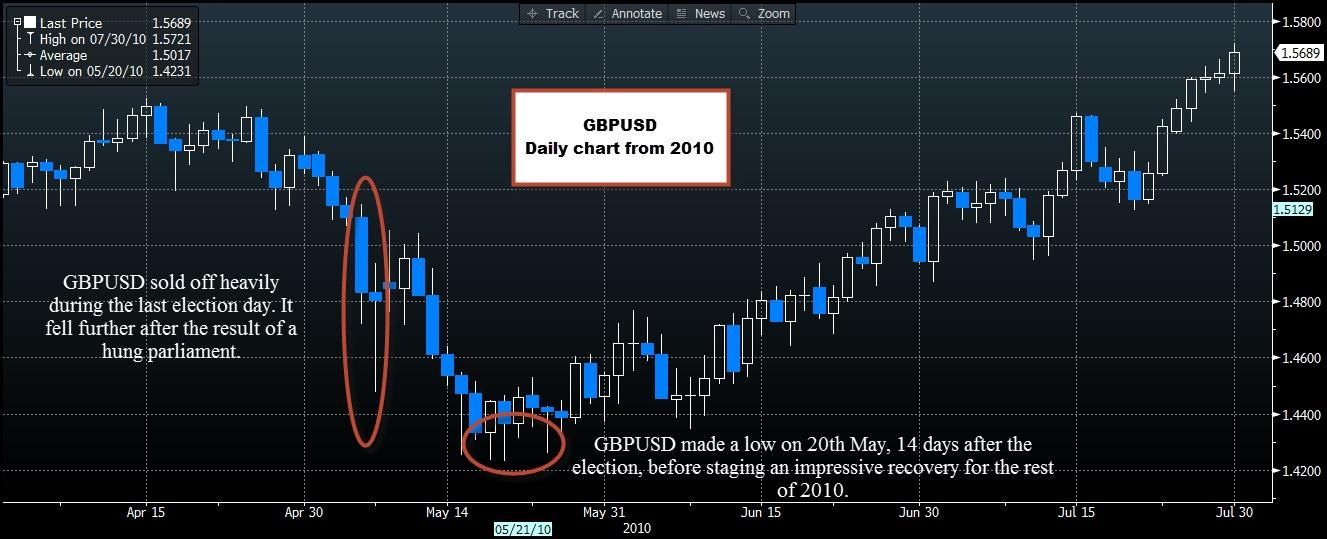

This is what happened to GBPUSD in the days before, during and after the election:

Leading up to May 6th: the pound dropped more than 600 pips in a month from 1.5335 to a low of 1.47 on Election Day itself. This pushed GBPUSD below its 50-day sma.

The 5 days it took to form a Conservative/ Lib Dem coalition: Initially the pound dropped to a low below 1.45 the day after the election after the reality of a hung parliament hit home. However, once the coalition was formed on 12th May, the pound had staged a mini-recovery, and briefly touched 1.50.

The weeks after the coalition was formed: the pound fell to a low of 1.4231 on May 20th, before staging an impressive recovery, rising to 1.5600 on 31st Dec 2010.

The past is not always a good reflection of what will happen in the future, especially considering the contrasting states of the UK economy back then: in 2010 the UK was in the middle of a recession, today the UK economy is riding high. Interestingly, in the month leading up to the last election, GBPUSD was trading in roughly the same range as today: between 1.4700 and 1.5500, this time around GBPUSD has been trading between 1.4550 – 1.5500.

Even though it is an imperfect comparison, there are some conclusions worth noting about how the pound reacted after the last election:

Conclusions:

A hung parliament could cause a knee jerk reaction lower in the pound.

A sell off in the pound could be sharper this time around, as GBPUSD has rallied more than 5% in the weeks leading up to this election.

Key support in the lead up to this election is the low from 13th April at 1.4566. In 2010 the post-election low was 1.4230.

If the pound does sell-off on the back of a hung parliament this time round, just because a coalition is formed does not mean that the pound will recover.

It could take even longer this time round for a recovery in the pound to take hold due to some idiosyncrasies with this election including: an EU referendum if the Tories get into power, and a potential Labour coalition with the Scottish National Party.

We have to wait for 2200 BST on Thursday evening for the initial results of the poll, until then if you are a UK citizen then make time to vote tomorrow. If you are also a GBP trader then we would recommend using a Stop Loss to protect your positions, as things could get volatile over the next 48 hours.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.