![]()

It looks like a combination of weaker US economic data; tensions in the Middle East and a sharp decline in the dollar index have started to bite USDJPY, which has fallen below 118.50 on Thursday. It is also coming up to fiscal year end in Japan, which can have a positive impact on the yen.

Key support ahead

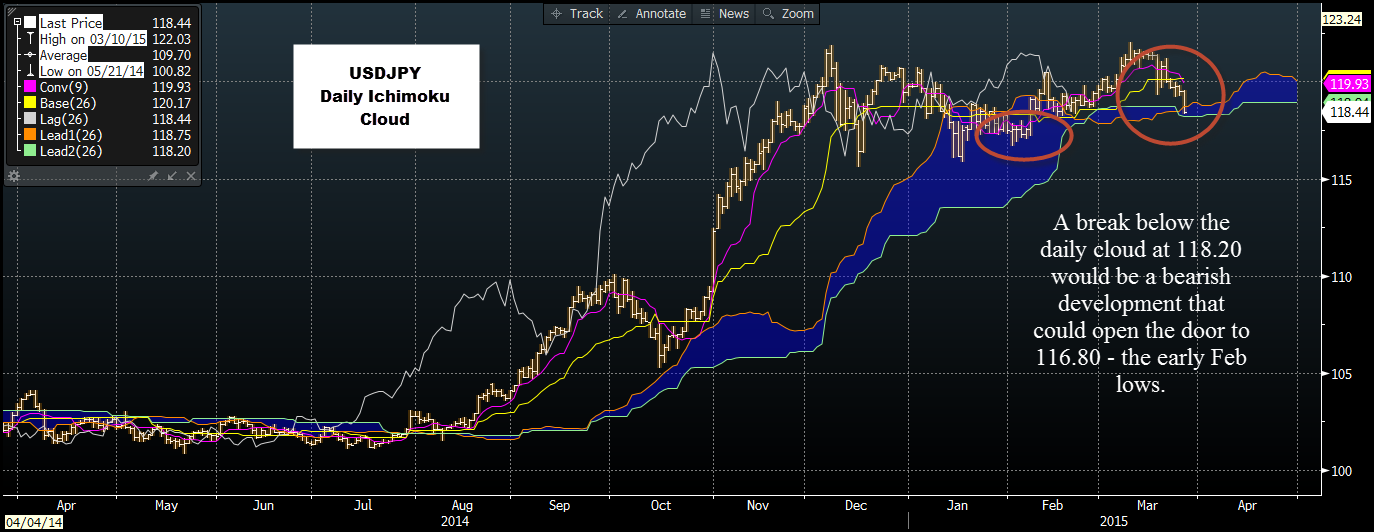

The biggest short –term risk to this pair from a technical perspective is a break below the daily Ichimoku cloud at 118.20 (see the chart below). When prices fall below the cloud this can signal the start of a technical downtrend, and it could signal another leg lower in the US dollar sell-off.

The USD is one of the weakest performers in the G10 FX space. Since the FOMC meeting last Wednesday, only the British pound has underperformed the dollar. Even the EM FX space has managed to pull back some recent losses versus the USD, with the ruble up more than 5%, the Polish zloty up 2.7% and the South African rand up 1.5%.

USD weakens as the Fed focuses on inflation

Economic data is fairly thin on the ground in the European session; however US jobless claims data is worth watching along with comments from the Fed’s Lockhart who speaks later this afternoon. Comments from the Fed’s Bullard this morning sounded a warning note on the drop in inflation expectations and also said that US monetary policy is to remain “exceptionally accommodative”, which helped to take the shine off the buck. Although he acknowledged that the Fed can’t keep interest rates at the zero bound forever, the focus on weak price pressures could keep a lid on the dollar for the time being and could weigh on USDJPY.

The technical view:

The break below the 100-day sma at 118.84 was a bearish development; if USDJPY falls below the bottom of the cloud at 118.20 then it reinforces the bearish trend for this pair. A move below that level could open the door to a further decline back to 116.80 – the early February lows.

If USDJPY can manage to stay above the cloud, then key resistance is the cloud top at 118.75, ahead of 120.00, which corresponds with the Kijun and Tanken lines.

Figure 1:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.