![]()

The big news of the morning is that the Eurozone recovery continues, Eurozone composite PMI rose to a multi-year high, while UK CPI fell to 0% last month, the lowest ever reading for UK annualised prices. Core prices, when you strip out food and energy costs, also saw a larger than expected decline in February to 1.2%, the lowest level since November last year.

The key contributors to the slowdown in prices were recreational goods, including data processing equipment (computers), books and games, and toys and hobbies. Food along with furniture and furnishings also saw downward pressure in prices for Feb. The Office for National Statistics said that there were no large upward effects to offset this change.

A glimmer of hope for UK inflation?

Once you dig deeper into the data it looks increasingly likely that the UK will fall into deflation, potentially as early as this month, after more declines in the price of oil for March. However, there are some glimmers that the pace of the decline in prices could start to slow, which could limit the UK falling deep into deflation territory in the coming months. Input prices and factory gate prices (included in the producer price category) both rose in February, after registering steep falls in January. However, progress could be slow going, as materials and fuel costs paid by manufacturers fell by a whopping 13.5% in the year to February.

So, while there may be a glimmer of hope that is all it is at this stage, a glimmer. The pound is still at risk as low price pressures reduce the need for BOE rate hikes this year, which is eroding the pound’s yield potential. Along with rising political uncertainty ahead of the May 7th election, the pound is looking vulnerable, and is the weakest performer in the G10 vs. the USD so far this month.

Will the Eurozone outperform the UK?

In contrast to the UK, the Eurozone had some good economic news. The composite PMI rose to a fresh multi-year high in March, with strong gains for Germany, and even French services sector PMI beat expectations. Eurozone data continues to surprise on the upside, and the Citigroup economic surprise index for the currency bloc remains close to its highest level in 2 years.

EURGBP – a technical turnaround

This is significant for EURGBP, which looks like it made a medium-term bottom at 0.7014 – reinforcing 0.7000 as a major level of support, the lowest level since 2007. EURGBP continues to strengthen on Tuesday, and the break of hourly resistance at 0.7301, was a short-term bullish development.

EUR enjoys some yield effect

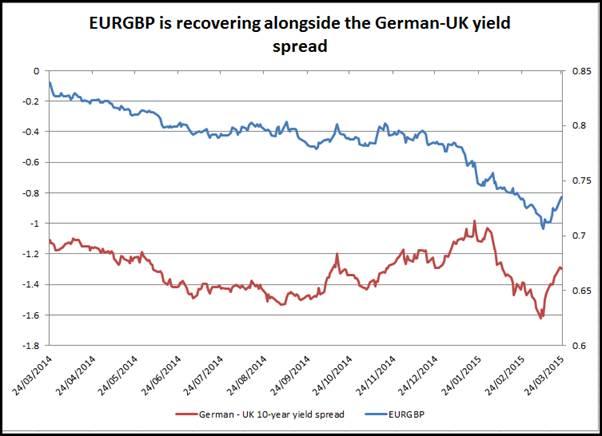

As you can see in the chart below, the yield differential between German and UK 10-year yields has narrowed by 30 basis points in the past week. Although this yield spread is still negative, it is starting to improve, which could be enough to spur the EUR bulls after such a long downtrend.

The general oversold conditions in EURGBP, and a deterioration in sentiment towards the pound suggests that we could see back to 0.7382 – the 50-day sma, then 0.7459, with a longer term target of 0.7630 – the 100-day sma. It looks like the pound may have taken the mantle from the EUR as the most despised currency in the G10.

Takeaway:

UK price pressures remain weak, which has weighed on the pound.

In contrast, the Eurozone economic data surprised on the upside.

This has boosted EURGBP, which may have made a medium-term low ahead of critical 0.70 support.

The yield spread is also starting to move in EUR’s favour; if this continues then we could see a medium-term recovery for EURGBP as the market loses interest in the pound.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.