![]()

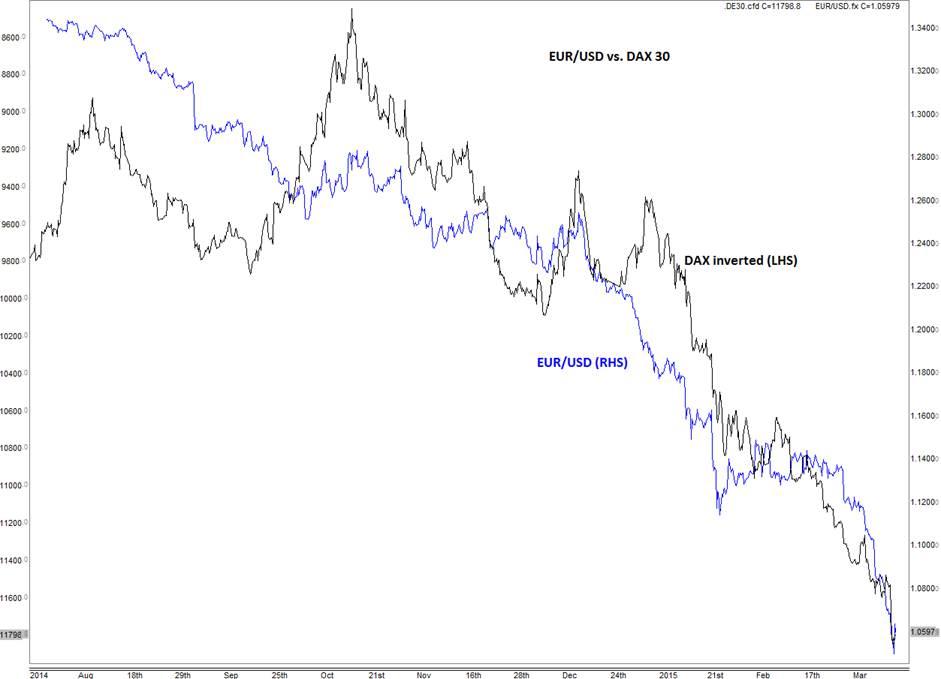

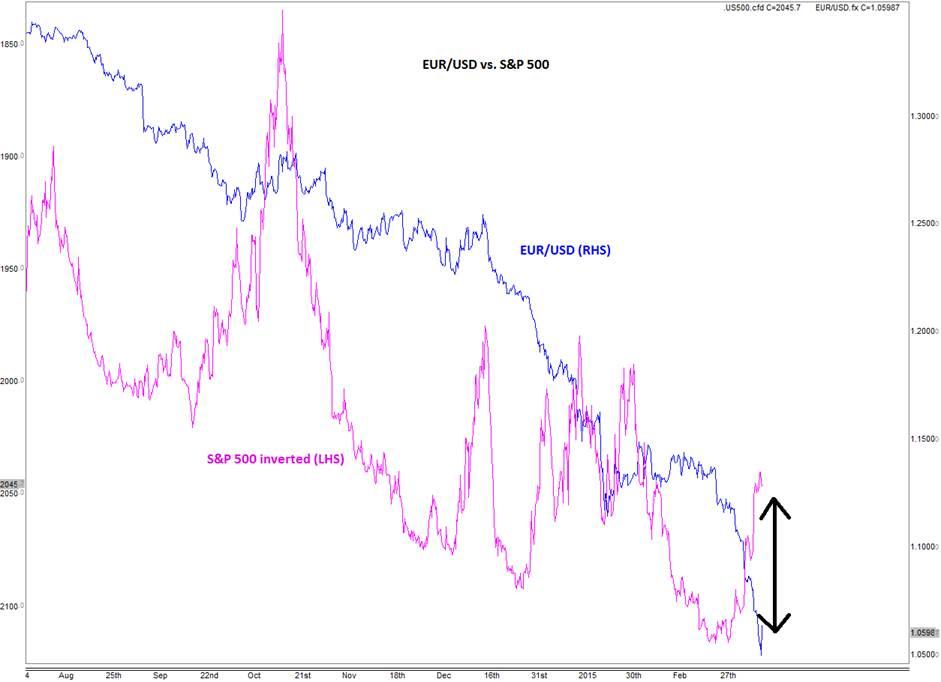

A clear pattern has emerged in the financial markets concerning stock indices and the EUR/USD currency pair. As can been seen from the comparison chart in figure 1, below, the major euro-based stock indices, such as Germany’s DAX, have rallied in the single currency’s slipstream. This makes sense as a weaker euro means more profits for German exporters. Although shares on Wall Street have managed to hold their own pretty well so far, the stronger dollar is finally weighing on US exporters. The chart in figure 2 shows how the S&P 500 has moved inversely to the dollar’s rally. The dollar’s strength has also weighed on the commodity-heavy FTSE, vis-à-vis the buck-denominated gold and oil prices.

But now that the dollar index has reached the psychologically-important 100 level, will the US and UK stocks begin to outperform their European peers? As much as I am tempted to say yes, there is no reason for the dollar rally or the euro slump not to continue, for after all today’s bounce back in the EUR/USD and other major FX pairs looks to be technically driven. For example, the EUR/USD has bounced off a psychologically-important level of 1.0500; the GBP/USD has found some support at its 61.8% Fibonacci retracement level (1.4910) of the upswing from the 2009 low, and as mentioned the dollar index itself has hit the 100 hurdle. Thus, once this profit-taking phase in the FX markets ends, the flow of funds from US stocks to European markets may resume. But even without the weaker euro, most of the European stock markets may still have a lot of catching up to do with their US peers as economic activity picks up momentum in the euro area and as the ECB’s bond purchases program continues to push yields further lower, driving investors into European equities. So, regardless of the impact of the FX rates, we remain fundamentally bullish on European stocks.

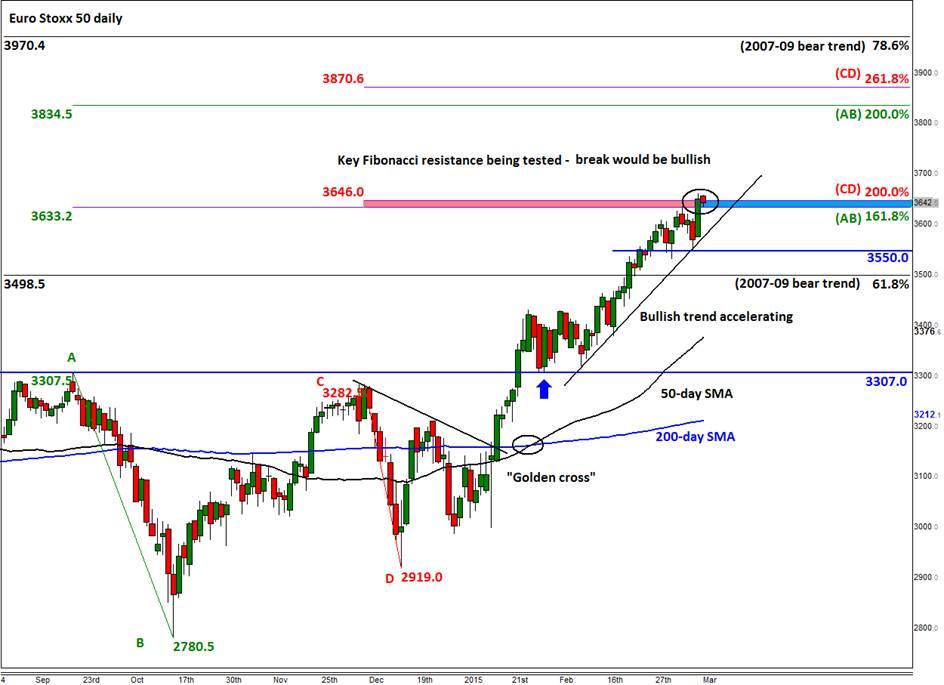

Indeed, the Euro Stoxx 50 index (see figure 3) looks to be on the verge of another bullish breakout after forming a Marubozu-like candle on its daily chart on Wednesday. At the time of this writing, the index was testing support at 3630/45. The lower end of this range was the recent high that was taken out following yesterday’s rally, while the upper end is the 200% extension of the last notable downswing that took place in December (from point C to D on the chart). Should support hold here then a move towards the next set of Fibonacci levels may begin. These are:

3835: 200% extension of AB swing

3870: 261.8% Fibonacci extension of CD swing

3970: 78.6% Fibonacci retracement level of the upswing from

Our short-term view on the Euro Stoxx 50 remains bullish for as long as it can hold above the bullish trend line. If however it breaks through it and also take out support at 3550, then a pullback towards the 50-day moving average, currently at 3376, or horizontal support at 3305/10 may get underway.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.