![]()

The North American trading session has once again been trumped by news out of Europe as Greece continues to try and work out a deal with their Eurozone partners. Today’s sound bite came courtesy of Germany, who rejected the Greek proposal for a six month extension on their bailout. While this doesn’t spell outright doom for the negotiations, it surely increases the skepticism observers are feeling toward this slow motion car crash. Considering Europe has come to 11th hour deals with Greece various times in the past, it may be prudent to expect a few more headlines announcing impasses, but not closing the door completely; therefore, be cautious of continued whipsaw price action in anything EUR related.

Moving away from the European continent, US data was a bit of a mixed bag this morning. While Initial Jobless Claims worked their way back below the 300k level and beat consensus, the Philly Fed Manufacturing Index, Leading Index, and Continuing Jobless Claims failed to achieve expectations creating a bit of malaise toward US stocks which are reacting more to the European drama anyway. Oil has also gone on a bit of a roller coaster ride in concert with equities.

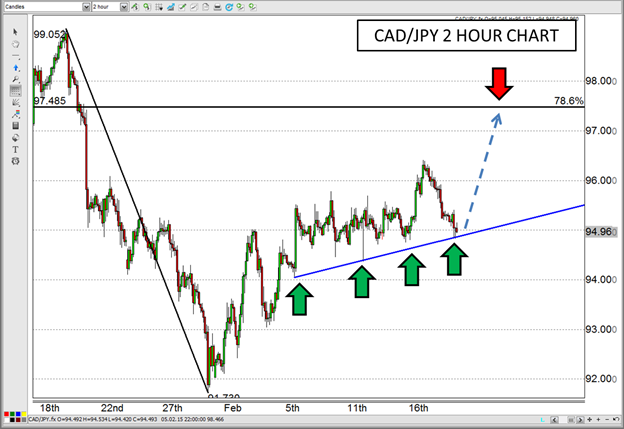

The moves in crude have influenced the CAD as well, and have brought the CAD/JPY down to previously established support. WTI specifically has remained in the range I highlighted a couple of days ago, but is near the bottom of that range this morning. However, considering oil has been a little Jekyll-and-Hyde-ish over the last few days, it may be prudent to look toward a proxy for the commodity in lieu of trading it. Since the CAD/JPY is of that ilk, and has found some support of its own, perhaps it is the better option. In addition, yesterday’s break above resistance of 95.50 may have signaled that the pair is ready for another run higher with today’s pullback an attempt to “clear the deck†for a run to the 78.6% Fibonacci retracement of the recent significant high to low.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.