![]()

The roller coaster ride for the G10 FX market continues today with the unexpected announcement from the Swiss National Bank that it was disbanding its 3.5-year 1.20 floor in EURCHF. At its last meeting on 11th December the central bank kept its 1.20 peg and it seemed committed to using the currency as a policy tool.

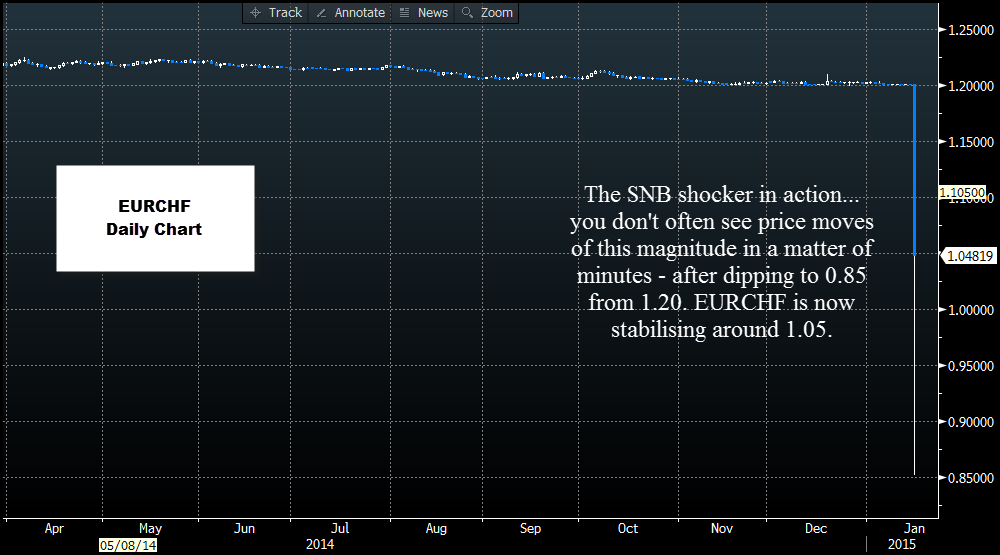

The immediate aftermath has been a more than 20% decline in EURCHF, this pair has fallen through parity for the first time, and the low so far this morning has been 0.8721. Right now this pair is falling like a stone as 3.5 years of the market trying to go against the SNB finally comes to fruition.

If the SNB though that it could make this adjustment in an orderly manner, then it has failed miserably. The EURCHF market has basically shut down so far this morning, while it waits for the dust to settle.

So why did the SNB do it?

The SNB has close ties with the ECB. This move could be a sign that the SNB thinks (or knows) that the ECB will embark on QE at next week’s meeting, and the size of its QE programme could be bigger than the market expects – perhaps $1 trillion, not the $500bn that was “leaked” last week.

If the SNB is so spooked it is disbanding with a policy that it has held dear since 2011, then the rest of the market may want to reconsider their expectations for next week’s ECB meeting. Hence the sharp fall in all EUR crosses.

On the other hand, maybe the SNB felt that maintaining the peg ahead of the ECB meeting was too costly, so they needed to act now. After all, the peg had to come to an end at some stage, why not at the start of the New Year.

This announcement signals a policy shift at the SNB – one that will hopefully preserve their FX reserves and reduce their exposure to EUR risks. The peg had proved costly for the SNB, and left the SNB with a sizeable EUR exposure, thus the market shouldn’t be that surprised that it wanted to end its peg, although the timing was unexpected.

At the same time as announcing it was disbanding with the peg, the SNB cut interest rates deep into negative territory. The deposit rate is now -0.75%, it was previously at 0%. The SNB may have thought that negative interest rates would limit unbridled Swissie buying in the market, but it didn’t. The market only focused on the end of the 1.20 peg. However in the long term the cut to interest rates may weaken the Swissie.

Where will Swissie go next?

After a huge surge higher on the announcement there are signs that the SNB may have had to come into the market this morning to stabilise the currency. EURCHF fell to a low of 0.8517 and is now trading back above parity around the 1.04-1.05 mark. We think there are two main risks going forward:

1, the ECB does not embark on a large QE programme next week, which triggers a dramatic reversal in EURCHF.

2, After such a sharp move higher the market may decide to sell the Swissie at this level, after all, the SNB has implemented negative interest rates, which should, in theory, flood the market with francs, causing CHF to weaken in the long term.

3, Right now the market is digesting the announcement from the SNB, and waiting for liquidity to come back on line. There remains intervention risk, so if you are planning on trading the Swissie at some stage in the near term expect some serious volatility.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.