![]()

Markets have been a bit slow getting out of the blocks this morning as Europe’s daylight savings time shift and a lack of top-tier economic data has prompted many traders to punch the snooze button. Probably the biggest development over the weekend was the long-anticipated release of the European bank stress tests , which showed that most of Europe’s largest banks are on generally stable footing. However, the subsequent release of yet another disappointing German IFO report (103.2 vs. 104.6 expected) has kept EURUSD below the 1.2700 handle heading into today’s US session.

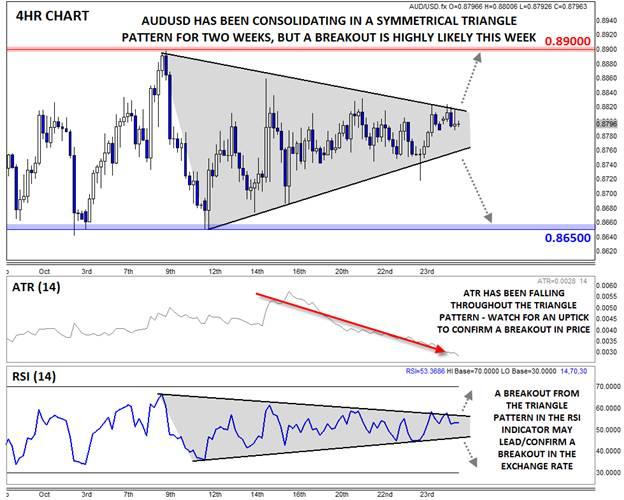

Though markets are off to a slow start, volatility should start to pick up as the week progresses. In that vein, one pair primed for a breakout is AUDUSD. For the last two weeks, the Aussie has been putting in lower highs and higher lows against the greenback, creating a clear symmetrical triangle pattern. For the uninitiated, this pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction. Similarly, if and when AUDUSD breaks out from its triangle, a strong continuation in the same direction is likely.

The textbook symmetrical triangle pattern will see declining volume as the pattern develops and then a surge in volume once the instrument breaks out. Of course, it’s difficult to find a reliable measure of volume in the forex market, but a good proxy for trading interest in a currency pair is the Average True Range (ATR). As the chart below shows, the ATR(14) indicator has been dropping consistently, falling from nearly 60 pips per 4hr candle two weeks ago to under 30 pips per candle today. This confirms that traders are growing increasingly disinterested in the pair, a common precursor to a big breakout; readers should keep their eyes out for an uptick in the ATR indicator to confirm any breakout in price.

Finally, the RSI pattern is forming its own corresponding symmetrical triangle pattern. As many experienced traders know, a breakout in a corresponding indicator pattern can serve as a leading or confirming indicator for a breakout in the exchange rate itself.

Bringing it all together, AUDUSD is displaying a picture-perfect symmetrical triangle pattern. With the triangle pattern nearing its apex, a breakout and continuation is highly likely this week. A confirmed break to the topside could quickly expose the October high at .8900, while a drop through the bottom of the pattern would favor a move toward the 4-year low at .8650 next. Keep an eye on tomorrow’s US Durable Goods and Consumer Confidence reports, Wednesday’s Fed Meeting, or Thursday’s US GDP report as possible catalysts for a breakout in AUDUSD.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD recovers toward 1.0850 as risk mood improves

EUR/USD gains traction and rises toward 1.0850 on Friday. The improvement seen in risk mood makes it difficult for the US Dollar (USD) to preserve its strength and helps the pair erase a portion of its weekly losses.

GBP/USD stabilizes above 1.2700 after downbeat UK Retail Sales-led dip

GBP/USD staged a rebound and stabilized above 1.2700 after dropping to a weekly low below 1.2680 in the early European session in response to the disappointing UK Retail Sales data. The USD struggles to find demand on upbeat risk mood and allows the pair to hold its ground.

Gold rebounds to $2,340 area, stays deep in red for the week

Gold fell nearly 4% in the previous two trading days and touched its weakest level in two weeks below $2,330 on Thursday. As US Treasury bond yields stabilize on Friday, XAU/USD stages a correction toward $2,340 but remains on track to post large weekly losses.

Dogecoin inspiration Kabosu dies, leaving legacy of $22.86 billion market cap meme coin behind

Kabosu, the popular Shiba Inu dog that inspired the logo of the largest meme coin by market capitalization, Dogecoin (DOGE), died early on Friday after losing her fight to leukemia and liver disease.

Week ahead – US PCE inflation and Eurozone CPI data enter the spotlight

Dollar traders lock gaze on core PCE index. Eurozone CPIs in focus as June cut looms. Tokyo CPIs may complicate BoJ’s policy plans. Aussie awaits Australian CPIs and Chinese PMIs.