![]()

Heading into the final trading session of the week, the US Dollar index is on track for its 11th consecutive weekly gain, extending its longest winning streak since the currency became free floating in 1973. While this is undoubtedly the strongest trend in the market right now, there are risks to the buck’s rally heading into next week. From a fundamental perspective, if next Friday’s high-impact Non-Farm Payroll report comes in below 200k again, it could cause USD bulls to tap the breaks. On the technical side, the bullish-dollar momentum appears to be slowing down in some key pairs including EURUSD, USDJPY, and the focus of today’s piece, AUDUSD.

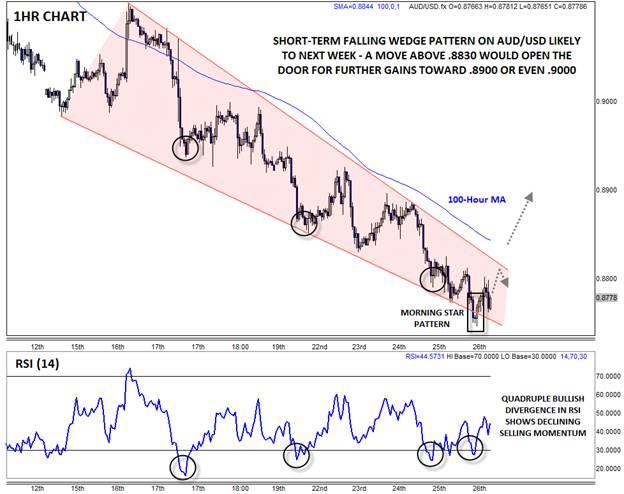

Looking at the 1hr chart, the AUDUSD has been in a falling wedge pattern for two full weeks now. While it is formed by a series of lower lows and lower highs, this classic price action pattern is typically seen as a bullish signal because it shows declining selling pressure on each additional thrust lower. That perspective is confirmed by the RSI indicator, which has now carved out a quadruple bullish divergence with price, showing waning bearish momentum.

On a very short-term basis, the unit put in a clear Morning Star* candlestick formation during today’s Asian session. This relatively rare 3-candle reversal pattern shows a shift from selling to buying pressure and is often seen at near-term lows in the market. Accompanied by the failed breakdown below the wedge pattern, this pattern hints at the potential for a more substantial rally if the pair can find a bullish catalyst early next week.

Despite some of the nascent signs of near-term bottom, bullish traders will want to exercise patience as long as the pair is below resistance from the upper trend line of the falling wedge pattern and the 100-hour MA around .8830. If rates manage to break above these short-term barriers, a quick move back toward .8900 or even .9000 may be seen given the deeply oversold conditions on the longer timeframes. Meanwhile, an extension of the recent USD uptrend could open the door for a move down to the AUDUSD’s 2014 low at .8660.

* A Morning Star candle formation is relatively rare candlestick formation created by a long bearish candle, followed a small-bodied candle near the low of the first candle, and completed by a long-bodied bullish candle. It represents a transition from selling to buying pressure and foreshadows more strength to come.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.