![]()

US stocks are up for a fourth day, extending their run after the Federal Reserve last night decided to keep the “considerable time” pledge until the first rate hike in the FOMC statement. This boosted stocks, sending the Dow and today the S&P to fresh record highs. Today’s mostly weaker data shows us why the Fed is still not as hawkish as some had thought they might have been. Although jobless claims were down by a good 36,000 applications last week to 280,000, easily beating the consensus forecasts, housing starts and building permits both plunged in August by 14.4 and 5.6 per cent respectively. And on a regional level, manufacturing expansion slowed down in the Philadelphia area somewhat more sharply than had been expected. Nevertheless, the market once again took the bad economic news in its stride. Meanwhile investors are also looking forward to Alibaba’s IPO tomorrow, which, if goes smoothly, could lend additional buoyancy to stocks, especially in the technology sector. We have prepared a full review for Alibaba’s IPO – click HERE if interested. Meanwhile in Europe, all eyes are on the outcome of the Scottish independence vote. If they choose to stay in the union, the UK’s FTSE could stage a relief rally which may provide some impetus for global stocks, including the US markets.

Technical outlook

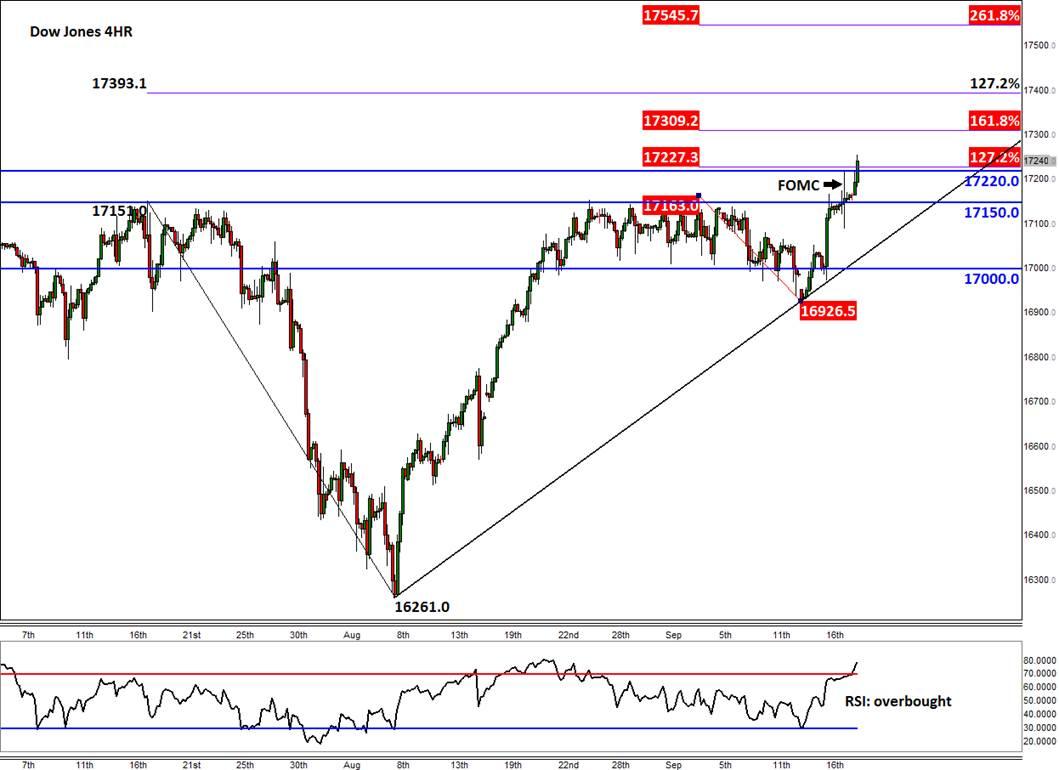

As mentioned, the Dow is trading at a fresh multi-year high. And judging by the chart, below, it looks like more gains could be on the way. As can be seen, the FOMC’s initial reaction left behind a doji candle on the 4-hour time frame, which is often the case following such a big fundamental event. The doji candle indicates that the market was initially unsure how to react but the fact that Dow has since pushed higher, taking out yesterday’s high in the process, suggests that the bulls have remained in full control of things. So, unless the index unexpectedly turns back around and finishes the day below the key 17150 support level, I think that we could see continued push higher into uncharted territories. My next three bullish targets are around 17310, 17395 and 17545. These levels correspond with the Fibonacci extension levels that can be seen on the chart. Meanwhile the 4-hour RSI has again drifted into the overbought territory which shows how strong a move we have seen over the last several days. It also indicates that a possible pullback is due soon. We may therefore see some hesitation around those Fibonacci-based levels, should the index get there.

Figure 1:

Source: FOREX.com. Please note this product is not available to US clients.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.