![]()

Highlights

- NFP Prep: Let the Good Times Roll!

- Another View: The Train Keeps Rolling

- View How Our NFP Forecasts Compare

NFP Prep: Let the Good Times Roll!

The August Non-Farm Payroll report will be released tomorrow at 8:30 ET (13:30 GMT), with expectations centered on a headline print of around 226k new jobs. My NFP proprietary model suggests that the NFP report will print roughly in line with expectations, with leading indicators suggesting an August headline NFP reading of 220k.

The model has been historically reliable, showing a correlation coefficient of .90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Source: Bureau of Labor Statistics, FOREX.com

Labor market indicators generally improved this month: The employment component of the Non-Manufacturing ISM PMI report ticked up one point to 57.1, while initial jobless claims also ticked down below 300k. Meanwhile, both the Manufacturing PMI employment component and ADP report effectively held steady in strong growth territory.

Trading Implications

With a series of dovish global central bank announcements earlier today, the US economy is rapidly becoming the proverbial “Belle of the Forex Ball.” The headline NFP report has now shown in excess of 200k new jobs were created in each of the past six months, and traders are finally starting to believe that the US economic recovery is accelerating. Based on recent comments, the Federal Reserve is growing incrementally more likely to raise interest rates in the first half of 2015, so as long as this month’s report comes in around 200k, the US dollar is likely to remain well bid.

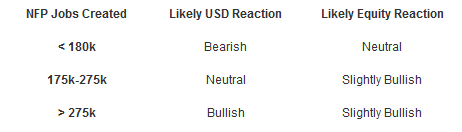

See three possible scenarios for this month’s NFP report, along with the likely market reaction below:

Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, readers should note that the U.S. labor market is notoriously difficult to foretell and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Finally, readers should note that stop loss orders will not necessarily limit losses in fast-moving markets.

Another View: The Train Keeps Rolling

By: Neal Gilbert, Senior Market Analyst

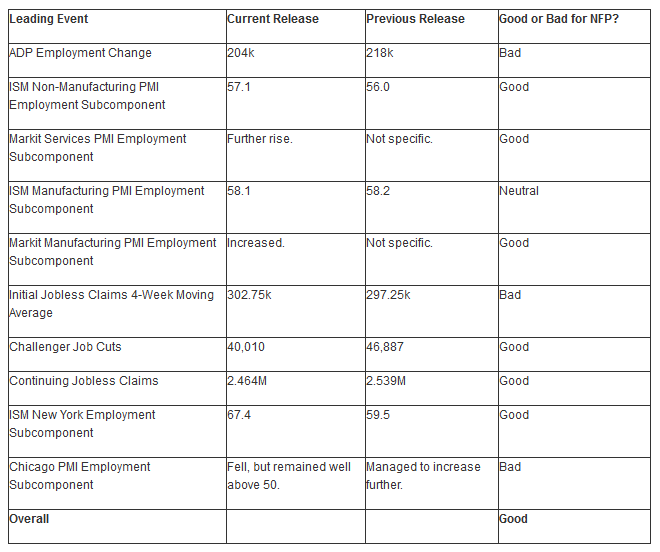

This month my Non-Farm Payroll model is forecasting a robust 277k increase in jobs in August 2014, which would continue the incredible run of impressive results emanating from the US employment sector. Unlike the last couple months, we actually have all ten of the leading events to hopefully give us a more accurate estimation of what the final NFP figure will be.

One personal bugaboo I have this month is that the Markit Manufacturing and Services PMIs are becoming much less specific in their representation of the Employment Subcomponent of their reports. Previously they would give an actual figure that was a concrete representation, but they have gone the way of the Chicago PMI in providing only anecdotal snippets. While the new methodology may be frustrating for people who like specifics such as myself, we are still able to read between the lines to see what they are trying to convey and are still able to utilize the reports regardless, frustrating as it may be.

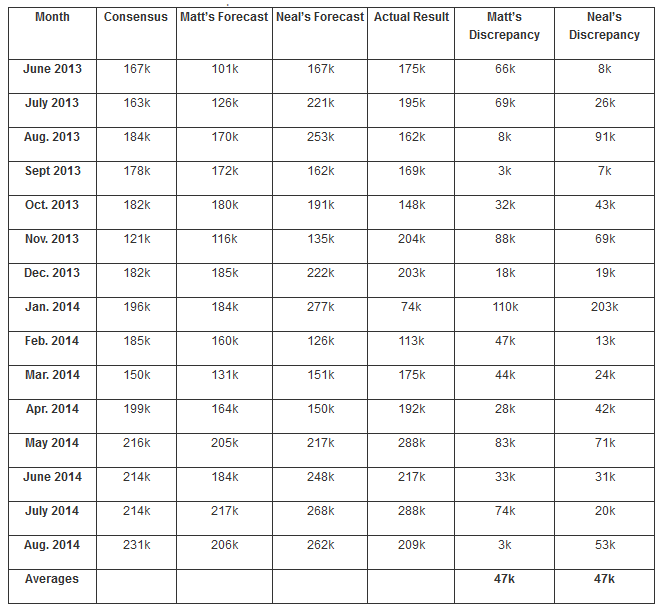

Using my forecast model had previously required me to take last month’s result and either add to or subtract from it based on ten employment reports released before NFP; however, all of the weather-related craziness in the first quarter of 2014 created a challenge to that doctrine in that previous results were anticipated to be revised substantially higher. While that anticipation turned out to be inherently incorrect, my forecast was actually fairly accurate utilizing the average calculation. Therefore, I will continue to repeat the method of using a three-month average which takes into consideration the possibility of a revision. So instead of using 209k as my base (last month’s result), it will now be 245k (an average of 229k May, 298k June, and 209k July).

Here is the breakdown of the leading employment reports:

As you can see from the table above, the majority of the employment indicators gave a positive score, despite the strongest indicator, ADP Employment Change, showing a decline from the previous month. Taking all these results together, I came up with my NFP estimation of 277k new jobs created in August 2014. This is better than the consensus estimate of around 225k, and could prompt the USD to continue its impressive strength as we see volatility increase in the post summer months.

Any figure above 200k would be encouraging for the growth of the US economy, but it also means that the Federal Reserve would likely continue moving closer to the end of Quantitative Easing and an eventual interest rate hike; maybe as soon as six months after QE’s demise. It would also mark the seventh straight month of 200k or more jobs gained; a feat that hasn’t been achieved since 1997. Therefore, if my forecasting model presumes correctly, I would expect to see an initial surge in a currency pair like the USD/JPY, which typically has the most logical reaction to NFP releases.

View How Our NFP Forecasts Compare

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.