![]()

What a difference 2 months’ make. Back in June, Mark Carney went out of his way to say that rates could rise sooner than expected, today, during his third Inflation Report of the year, he said that “now is not the time for a rate increase”, and when it is the time rate hikes will be slow and steady.

Carney was called an unreliable boyfriend for his switch in tone towards rate hikes, but, in fairness, I would say he is more like a fearful fiancé, he has popped the question (i.e., put the prospect of a rate hike out there), but is yet to commit to a date for the big day.

The bank based its assumptions for growth and inflation on the prospect of a rate hike in February 2015, which is roughly what the market had already been expecting. This comes even though the BOE revised up its growth forecast for this year to 3.5%, and revised down its unemployment forecast. It now expects the unemployment rate to drop below 6% by the end of the year and to fall to 5.5% in the next 2 years. This is a large reduction compared to its May forecast, so why is the BOE still reluctant to hike rates?

It’s all about the money…

Wages, that’s why. If you have noticed that your wallet is a bit lighter than it used to be then you are completely right, it is. And, by the looks of things, it is only going to get lighter from here. Average weekly earnings including bonuses fell 0.2% in the three months to June, the first time that wages have contracted since 2009, when we were in the eye of the financial storm.

In previous reports the BOE had wondered if wage growth would play catch up with developments in the labour market, however in this report it suggested that the Committee now sees some of this weakness as structural. Carney’s opening statement said that this may “partly stem from the recent reforms to retirement and benefit rules, as well as concerns about households about the need to service debts and provide for pensions” which is making them reluctant to demand higher wages.

This structural shift in wage growth supports a cautious approach to the BOE’s rate hiking cycle, since the UK economy may be able to sustain a higher level of employment and lower rate of unemployment without “generating additional inflationary pressures.”

Looking forward, wages have trumped the unemployment rate as the most important economic metric to monitor. Even though the BOE stated that it does not have a threshold for wage growth, the development of wages will be important to gauge the timing of the first increase in the bank rate.

The market reaction:

This is a bank of England happy to be on hold for 2014 even though the economy is stronger than the BOE initially thought earlier this year. Leading up to today’s risk events we thought that the inflation report would be the hottest ticket in town, but it turns out the humble labour market report is the key driver of the GBP and UK assets these days.

Carney’s near-confirmation that there will not be a rate hike this year triggered a mixed reaction in UK assets, with the pound falling and the FTSE 100 reversing recent losses.

GBP outlook:

The latest Inflation Report is bearish for the pound. It has fallen against most of the G10 currencies, although it has scraped a gain versus the CAD. It had the hardest fall against the CHF and EUR, and EURGBP broke above key resistance at 0.7969 – the 50-day sma. The next key level of resistance is 0.8150 – the high from June.

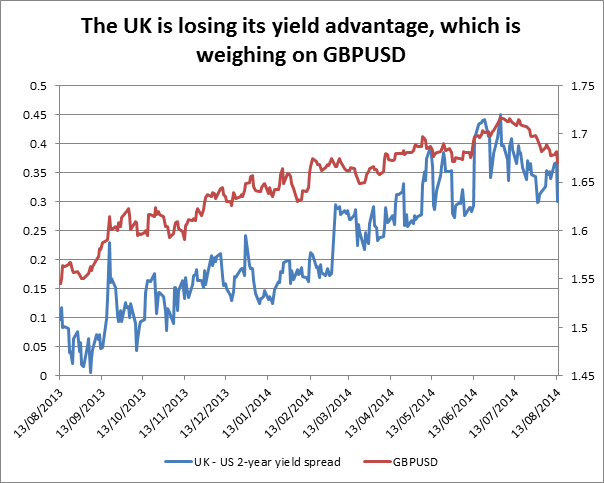

The decline in UK 2-year bond yields, which are sensitive to changes in monetary policy, has also weighed on the pound on Wednesday. The 2-year yield has fallen 10 basis points, which may not sound like much, but for bond yields this is huge. The 2-year yield is at its lowest level since mid-June, before Mark Carney made his comments about the prospect of sooner than expected rate hikes, which earned him the title of unreliable boyfriend. As you can see in figure 1, the decline in 2-year UK yields, has pushed the spread between UK-US yields lower, which could lead to further losses in GBPUSD. The break below 1.6740 - the 61.8% retracement of the March – July advance - was a bearish development that could trigger further losses back to 1.6556 – the April 4th low.

FTSE 100 outlook:

The UK stock index has taken Carney’s dovish comments and run with them, the FTSE continues to extend gains that it has made throughout the UK session and is reversing some recent losses. From a fundamental perspective, the outlook is good. Carney has said that rates won’t rise immediately; when they do rise rates will only increase gradually, and low wage growth is helping firms to expand their margins despite the sharp increase in employment. The next key resistance level to watch is 6,700.

Takeaway:

The growth rate was revised up for 2015, and unemployment was revised down.

However, weak wage growth should keep rates on hold for the rest of this year.

When the Bank does raise rates, increases will only be gradual.

Wage data is now of particular importance to the BOE, and if pay growth does not pick up then the BOE could be on hold for some time.

This is bad news for the pound, but good news for the FTSE 100.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.