Yesterday, we examined the longer-term charts of the USD/CAD, concluding that the bias remains generally to the topside above 1.0850 support (see “USD/CAD: The Long View Remains Bullish” for more). Today’s Canadian Retail Sales figure helped validate that view; though the headline number came in as expected at 0.5%, the previous month’s report was revised sharply lower – from 1.3% to 0.9% - leading traders to view the release as negative for the loonie. The USD/CAD has seen only a limited reaction to this morning’s data, but the EUR/CAD is forming a much more actionable near-term technical pattern.

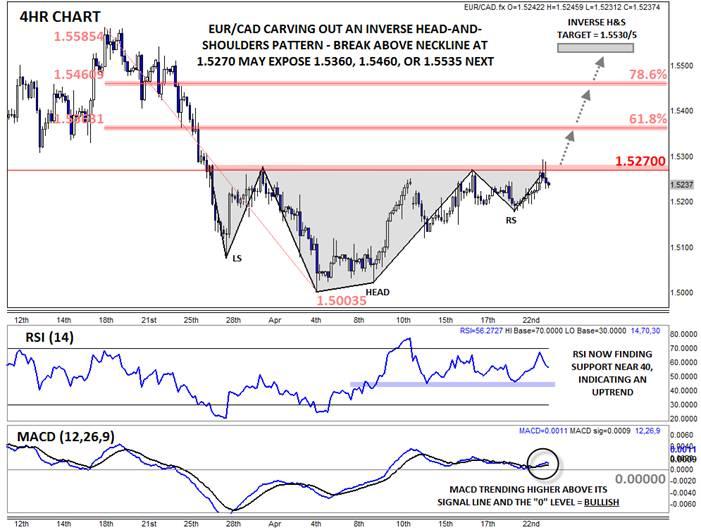

After peaking near 1.5600 last month, the EUR/CAD collapsed down to trade near the 1.5000 handle early this month. Now, the pair has recovered back to test key previous resistance at 1.5270. A cursory look at the 4hr chart reveals that 1.5270 is the neckline of a clear inverted Head-and-Shoulders pattern. For the uninitiated, this classic technical pattern shows a shift from a downtrend (lower lows and lower highs) to an uptrend (higher highs and higher lows) and is confirmed by a conclusive break above the neckline.

The secondary indicators are also suggesting a possible shift to a more bullish environment. The Relative Strength Index (RSI) indicator is now finding support at the key 40 level, indicating that the recent uptrend remains intact. Meanwhile, the MACD is trading above its signal line and the “0” level, showing that the momentum remains generally with the bulls, despite the stall in price over the last week.

Of course, more conservative traders may want to wait for a daily close above the 1.5270 level, or even 1.5300, before turning outright bullish. If we do see a confirmed breakout, bulls may look to target the Fibonacci retracements of the March-April drop at 1.5363 (61.8%) and 1.5460 (78.6%) next, followed by the measured move target projection of the inverse H&S pattern near 1.5530-5. Meanwhile, a drop below the 1.5200 area would postpone any breakout and turn the near-term bias back lower.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.