![]()

Yesterday saw the global stock markets make a reversal as better-than-expected US retail sales and Citigroup’s first quarter earnings results offset concerns over Ukraine where the crisis continues to escalate. The prospects of further stimulus from the ECB have also soothed the nerves after Mario Draghi stepped up his verbal intervention over the weekend by suggesting some sort of non-standard policy measures such as quantitative easing could be unleashed if the euro continued to appreciate further. However the rally faded somewhat overnight and European markets started today’s session on the back foot. Miners were leading the way down on the FTSE although the losses were limited by some good corporate updates from the likes of GKN and Aggreko.

On the data front, we had some mixed-bag ZEW numbers out of the eurozone while the UK’s Consumer Price Index (CPI) fell back to 1.6% in March from 1.7 percent the month before. This was the CPI’s lowest reading since October 2009, helped in part by weaker fuel prices. The ONS’s jobs data on Wednesday will likely show wage growth rose 1.8% in the three months to February compared to the same period a year ago. As such, wages may have at long last outpaced inflation for the first time since early 2012. For details, see my colleague Kathleen Brooks’ article here. Meanwhile UK’s jobless claims are expected to have fall by around 30.2 thousand applications in March compared to the 34.6 thousand the month prior while the unemployment rate is expected to have remained unchanged at 7.2%. With the inflation remaining comfortably below the Bank of England’s 2% target, the MPC can easily justify maintaining their ultra-loose policy for some time yet even if the unemployment rate falls below the Bank’s previous threshold of 7% that would have triggered the first rate hike. The improving domestic data and the Bank of England’s on-going support could fuel another rally for the FTSE.

Meanwhile Wednesday’s release of Chinese economic data, which includes the first quarter GDP estimate and the latest industrial production number, are particularly significant for the London-listed mining stocks. The world’s second largest economy is expected to have grown by around 7.3% year-on-year during the quarter, slightly below the government full-year target of 7.5%. Therefore we cannot rule out the possibility for an intervention by the PBOC in order to stimulate demand. But with the US earnings season about to kick into a higher gear this week, most of the focus will be on the individual companies. JP Morgan’s disappointing results is a chilling reminder of what to expect following that the severe cold winter in the US. Analysts have already trimmed their earnings forecasts, with Bank of America, for example, expecting flat earnings, rather than 5% growth as they had previously estimated, for the S&P 500 companies compared to last year. Today we will hear from the likes of Coca-Cola, Yahoo and Intel.

Technical outlook

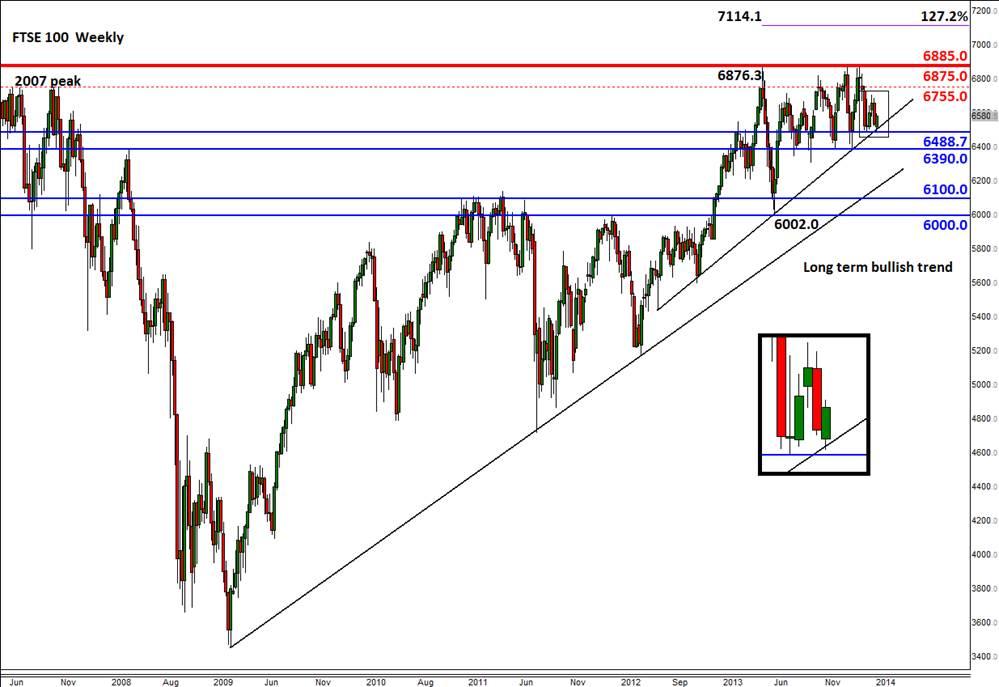

From a technical point of view, the FTSE continues to trade sideways but it does feel a bit heavy with recent sell-offs being more intense than the rallying periods. The key level is 6500 and if this gives way then I would expect to see some more downside action towards the 2014 lows of 6390 at the very least. There’s a clear bearish trend established and this comes in somewhere between the next two resistance levels of 6620 and 6680. The FTSE could be in the process of forming a descending triangle pattern which is bearish.

Having said that, the index has now rallied off the 6500 level on three separate occasions now. This suggests that a potential triple bottom pattern could develop here which is obviously a bullish outcome. A potential break above the trend line could confirm this. Meanwhile as the weekly chart shows, the FTSE has also managed to once again defend a medium term bullish trend line and it may be in the process of making an ascending triangle pattern on the higher time frame.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.