![]()

Consumer prices for March fell back to 1.6% from 1.7%, as the market expected, which is the lowest level of price growth since 2009. The key driver of weaker prices was motor fuel. If you felt that you left the forecourt with a slightly heavier wallet than you expected, you weren’t imaging things – petrol prices remained unchanged between February and March this year, which compares with a 2.2p per litre increase a year ago. Diesel prices actually fell 0.4 p per litre this year, compared with a rise last year.

Some smaller downward effects on prices came from clothing and furniture and household goods, while the upward effects came from restaurants and hotels along with an increase in the price of spirits. The Office for National Statistics (ONS) reminded us that while petrol is having a downward contribution on the inflation rate, utility bills continue to rise, which could dampen the impact of falling prices on consumer confidence going forward.

Will we get a raise?

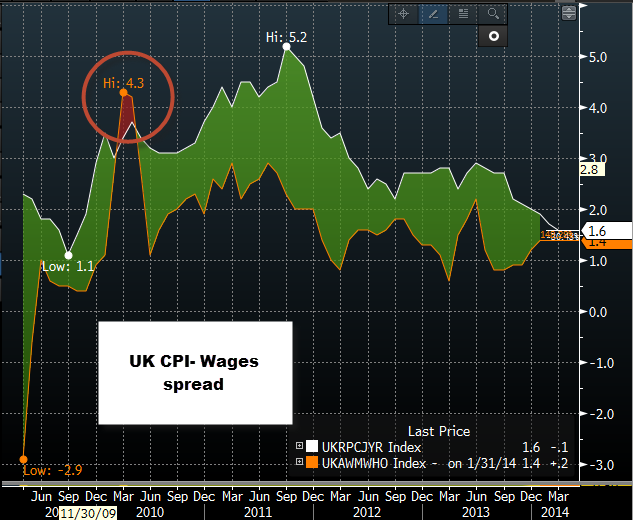

On Wednesday we get the ultimate piece of the jigsaw – will wages (including bonus) have outpaced price increases for the first time since 2010? There has been a lot hype about this in the media, which could be one reason why the pound has shrugged off the drop in price pressures. If wage growth fails to meet expectations of 1.8% then we could see the pound come under some downward pressure. This may also account for the rise in Gilt yields this morning, with bond investors happy to push 2-year yields to their highest level in 10 days, possibly on the back of expected wage inflation on Wednesday.

So where does this leave the BOE? Probably in a sweet spot. While the inflation rate continues to linger below the BOE’s target rate of 2% then the BOE may be able to take things easy. While sterling and the FTSE are moved by global as well as domestic factors, it’s the bond market that can be the more accurate predictor of market expectations for BOE policy. Right now, the market is still predicting a Q2 2015 rate hike. With wages rising (albeit from a very modest base) and prices falling, we think that rate hike expectations for the UK could remain stable. If they are to be pushed forward then we may need to see 1, a turnaround in inflation, potentially on the back of Easter and summer spending, and 2, a sustained pick-up in wages. We think that both of these events are some way off, thus the BOE can rest easy for now…

The impact on the pound:

After the initial whipsaw action, the pound is actually higher as the market waits for labour market data, and wage data, in particular, due on Wednesday. GBPUSD is back above 1.6700, and is close to the highs of the day at 1.6729. The biggest risks to the pound in the short term could be weaker than expected wage inflation; if wages don’t reach the 1.8% target then we could see a sharp selloff in the pound, especially if wages don’t pick up at least to the 1.6% inflation rate.

From a technical perspective, this pair is moving in a range between 1.6823 – the February high – and key support, which lies at 1.6688, the mid-point of the latest advance. If we get a strong labour market report on Wednesday then we could see back to 1.6823, above here opens the way to 1.70. On the downside, 1.6614 – the top of the daily Ichimoku cloud, and then 1.6556, the April 4th low, are key support levels worth noting.

Figure 1: Will wages rise above the rate of inflation for the first time in nearly 4 years?

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.