![]()

The GBP/USD is coming off a very interesting week to kick off April. Helped along by decent Manufacturing Production data and a stationary BOE, the pair surged up to test its 4.5-year high at 1.6820 on Thursday before losing steam and turning back lower on Friday. Though the longer-term trend remains to the topside, there are some technical signs that Friday’s selling pressure may carry over into this week’s trade.

Looking to the daily chart first, last week’s reversal has created an Evening Star* formation off the highs. This relatively rare 3-candle reversal pattern shows a gradual shift from buying to selling pressure and is often seen at major tops in the market. In fact, the pair has already formed two significant tops after similar patterns already this year! Meanwhile, the Slow Stochastics indicator is forming a possible bearish divergence with price after ticking into overbought territory ahead of the top.

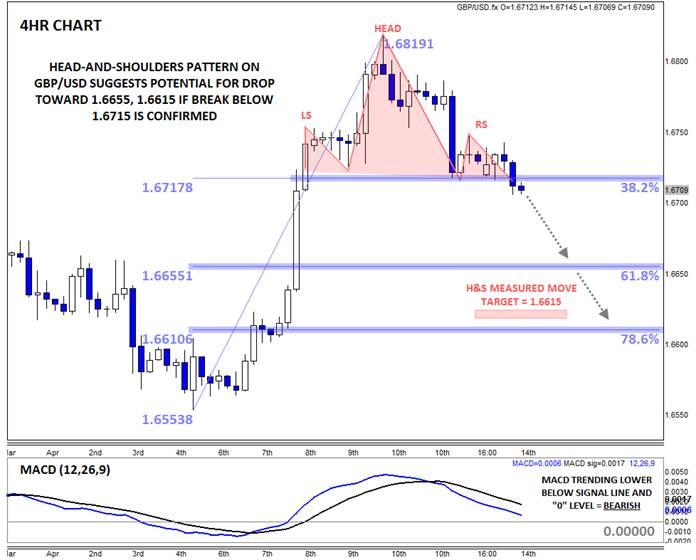

Zooming into the 4hr chart (below) reveals a potentially actionable pattern for readers to monitor. Within the daily Evening Star formation, the GBP/USD has actually carved out clear Head-and-Shoulders pattern. With a confirmed break of the neckline near 1.6715 (more aggressive traders may even consider the current dip toward 1.6710 as significant enough), the bearish pattern would be confirmed, pointing to a deeper pullback in the early part of this week. In addition to the price pattern, the downward trending MACD suggests that the momentum has shifted to the bears as well.

The measured move target of the Head-and-Shoulders pattern projects a move down to around 1.6615, but the unit may also find support at the near-term 61.8% Fibonacci retracement at 1.6655. On the other hand, a break back above the right shoulder near 1.6750 may invalidate, or at least delay, the pattern and shift the bias back to neutral in the short term.

- An Evening Star candle formation is relatively rare candlestick formation created by a long green candle, followed a small-bodied candle near the top of the first candle, and completed by a long-bodied red candle. It represents a transition from bullish to bearish momentum and foreshadows more weakness to come.

Key Economic Data/Events that May Impact GBP/USD This Week (all times GMT):

Ø Monday: US Business Inventories (14:00), UK BRC Retail Sales Monitor (23:01)

Ø Tuesday: UK CPI, PPI, & HPI (8:30), US CPI & Empire State Manufacturing Survey (12:30), Speech by Fed Chair Yellen (12:45), US TIC Purchases (13:00), NAHB Housing Market Index (14:00), Speech by Fed Member Plosser (19:00)

Ø Wednesday: Speech by Fed Member Kocherlakota (00:00), UK Claimant Count & Unemployment Rate (8:30), Fed Member Stein Speaks (12:00), US Building Permits & Housing Starts (12:30), US Industrial Production and Capacity Utilization (13:15), Speech by Fed Chair Yellen (16:15), Speech by Fed Member Fisher (17:25), Fed Beige Book (18:00)

Ø Thursday: US Unemployment Claims (12:30), US Philly Fed Manufacturing Index (14:00)

Ø Friday: Good Friday – US and UK stock markets closed (All Day)

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold snaps two-day losing streak above $2,280 ahead of Fed rate decision

Gold price posts modest gains around $2,288 on Wednesday during the Asian session. The precious metal edges higher as markets turn to a cautious mood ahead of the Federal Reserve's monetary policy meeting on Wednesday.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.