Huge week for the markets

At the centre of things this week are rate announcements from major central banks, including updates from the US Federal Reserve (the Fed), the Bank of England (BoE), the Bank of Japan (BoJ), the Swiss National Bank (SNB) and the Reserve Bank of Australia (RBA). We also welcome inflation numbers from Canada and the UK, together with manufacturing and services PMIs for the euro area, the UK and the US.

FOMC: Dots in focus

Unquestionably, the Federal Open Market Committee (FOMC) policy-setting meeting will dominate the headlines this week, making the airwaves at 6:00 pm GMT on Wednesday.

As for a rate cut at this meeting, it is pretty much a sealed deal that the Fed will not budge. The OIS curve is pricing in a meagre 1.0% chance of a 25bp cut, largely powered by a dovish Powell and hot economic data. The hawkish repricing has also seen July now fully priced for the first 25bp cut (-26bps), though a June cut is still on the menu (-15bps of easing priced in). US growth and labour data remain strong, and inflation numbers are also heating up—both CPI and PPI inflation were higher than economists’ expectations at the headline level (YoY) for February (headline CPI inflation has been stabilising around the 3.0% mark since October 2023 [sticky inflation]), with MoM headline measures (Jan-Feb) showing a beat in PPI data and CPI coming in as expected.

With a rate adjustment highly unlikely, the limelight will be on the accompanying Rate Statement and, of course, the FOMC rate projections, particularly the dot plot (released every quarter). The last FOMC projections observed a dovish shift; Fed officials projected three 25bp rate cuts this year and four cuts in 2025. Given the latest data, evidence to support a change in the upcoming projections, nevertheless, is thin, but if a change is witnessed (or a meaningful language modification in the Rate Statement is seen), this will have a marked impact across major asset classes.

Ultimately, it is likely the Fed will maintain a similar message: three rate cuts for the year and requires more evidence inflation is sustainably moving towards the 2.0% target before pulling the trigger. Should this come to fruition, the US dollar could see some downside following the release. Also of relevance, ahead of the event, the US Dollar Index is seen nearing the underside of daily resistance at 103.62, a level complemented by the 200- and 50-day simple moving averages (SMA) at103.69 and 103.55, respectively.

BoE poised to stand pat

Similar to the Fed (and most other central banks this week, in fact), there is little to no chance that the MPC will cut rates this week; the event is scheduled to air on Thursday at 12:00 pm GMT. The Bank Rate is poised to remain at 5.25% for a fifth consecutive meeting, with some desks also projecting another three-way MPC vote. The OIS curve is still fully pricing in the first 25bp rate cut for August’s meeting and September’s meeting is also now a possibility, considering the recent hawkish repricing.

Heading into the event, the latest GDP growth data revealed that the UK economy rebounded by 0.2% in January (in line with market forecasts). This followed a month-over-month fall of 0.1% in December 2023 and two consecutive quarters of contraction in the second half of last year. The data sheds light on the possibility that the UK economy may have nudged out of recessionary territory, which will be welcomed by those at 10 Downing Street. January inflation remained unchanged at 4.0% (YoY) at the headline level and 5.1% (YoY) for the core reading but did marginally undershoot economists’ estimates on both prints. However, we will be getting February inflation numbers a day before the BoE rate announcement on Wednesday at 7:00 am GMT (median estimates show inflation is expected to slow to 3.6% [headline] and 4.6% [core]). In terms of the labour market, unemployment recently ticked higher, though wage growth slowed (albeit remained elevated).

Overall, the pound (GBP) will be watched closely around these events, and any notable miss in the inflation numbers this week will likely favour shorts (and be bought on any meaningful upside surprise). A significant out-of-consensus report will also possibly alter policy forecasts.

BoJ rate announcement: Rate hike?

Following stronger-than-anticipated wage increases and Rengo delivering a 5.0% wage increase in the first phase of wage negotiations, this has underpinned speculation that the BoJ will hike its Policy Rate this week.

The BoJ is poised to make an appearance on Tuesday at approximately 3:00 am GMT. According to market pricing, investors are divided heading into the event and it is essentially a 50/50 bet on whether the central bank exits its negative interest rate policy (NIRP). Should a 10bp rate hike come about, a move from -0.1% to 0.0%, the Policy Rate increase would mark Japan’s first hike since 2007.

A rate hike this week would likely fuel an upside move in JGB yields and the Japanese yen (JPY). Should a rate hike not come to fruition, traders will be closely watching for any hawkish language to suggest a pivot in April, a move that would also perhaps increase demand for the JPY.

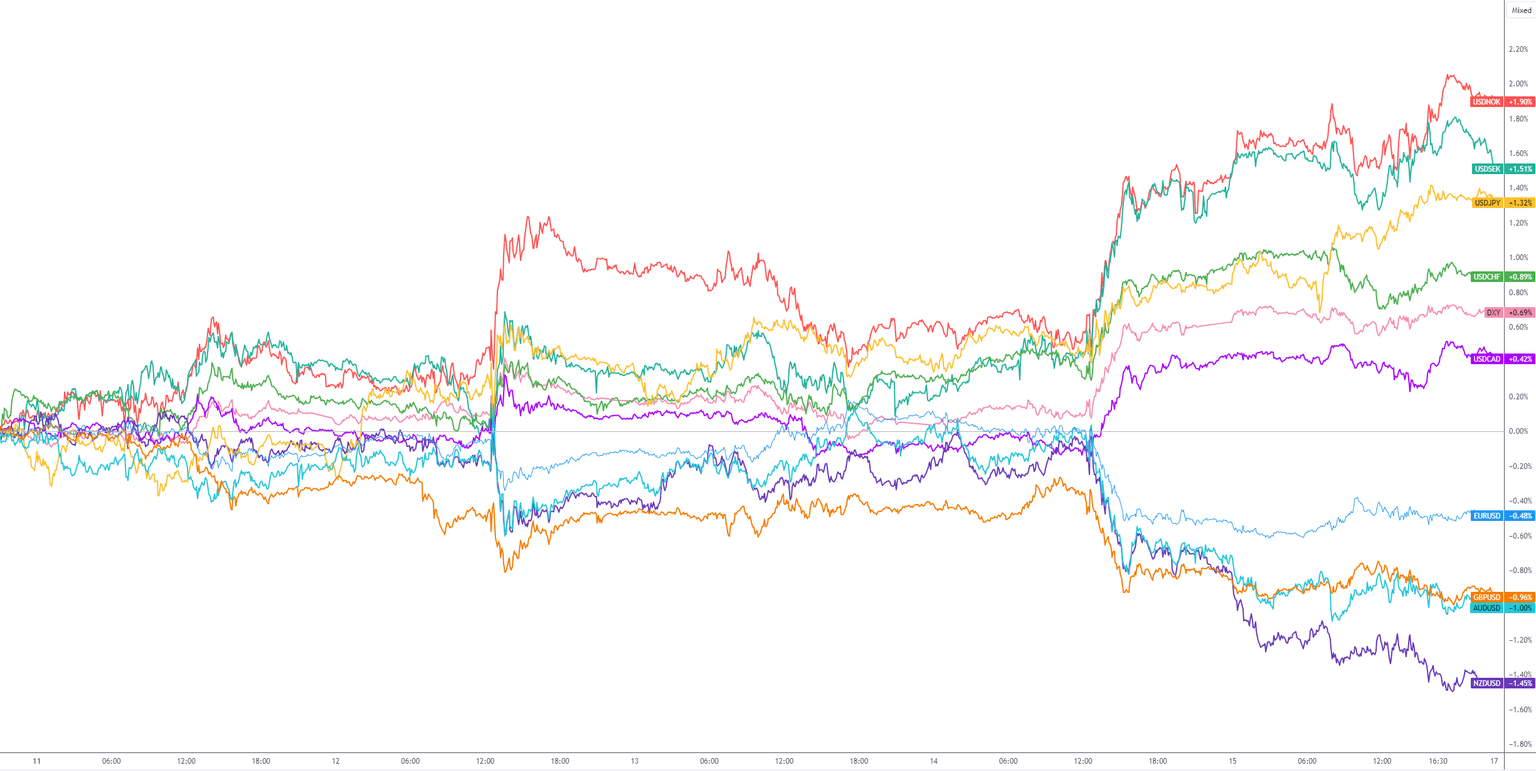

G10 FX (five-day change):

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,