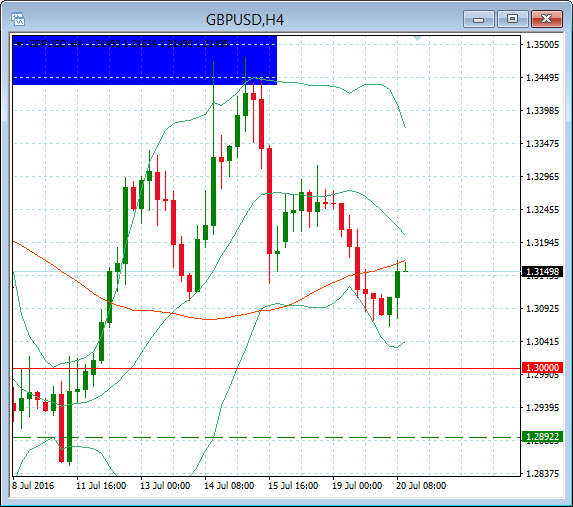

GBPUSD, H4

The UK headline unemployment rate fell unexpectedly to 4.9% from 5.0% and employment and inactivity rates registered record highs.

UK unemployment fell by 54,000 to 1.65 million between March and May. Average weekly earnings including bonuses increased from 2% to 2.3%, in line with expectations. The employment rate – the proportion of people aged 16 to 64 in work – was 74.4%, the highest since comparable records began in 1971 and the Office of national Statistics also reported that the inactivity rate rates those 16-64-year-olds not working and not seeking work – was 21.6%, the lowest since 1971. The new finance minister Philip Hammond “Today’s employment and wage figures are proof that the fundamentals of the British economy are strong”.

All this is a pre-Brexit snapshot. The median forecast had been for an unchanged 5.0% outcome. The more timely claimant count figures, for June, painted a slightly different picture, with jobless claimants rising fractionally, with May data revised to 12.2k from -0.4k reported originally. All this is what we’re seeing in the rear view mirror; a view that’s changing for the worst in the wake of the Brexit vote.

A survey of 1,000 heads of businesses by the Institute of Directors, conducted in the two days after the vote to leave the EU, found that 24% were planning to freeze recruitment, 5% were planning on making reductions, and 22% were considering moving some of their operations abroad (versus only 1% who said they were bringing their operations back).

Sterling spiked up on the release of the headlines with cable touching 1.3175, GBPJPY up to 140.30 and EURGBP down to 0.8350. Our Quarterly position on Cable remains and we are still in our SHORT GBPUSD trade from July 14th.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.