Holiday sales outlook

Believing in Things When Common Sense Tells You Not To

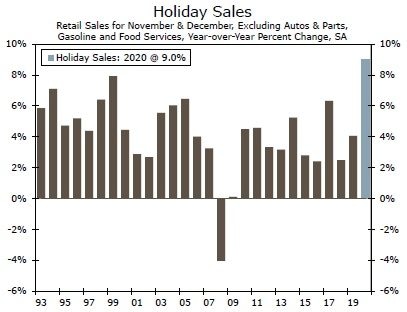

In what undoubtedly will be remembered as one of the most challenging and transformative years for most retailers, we are forecasting holiday sales will increase 9.0% in 2020, which would be the largest increase on record (Figure 1). That is not to say that things are fine for all retailers, (they are not), nor is it to say that consumers are in excellent financial shape (they are not, particularly not toward the lower end of the income spectrum). However, a forced thrift that has curtailed spending in the service sector and cancelled travel plans frees up income for more spending on gifts. After the anxiety and stress of a year defined by the virus, natural disasters and a divisive election, we suspect holiday sales will also benefit from a yearning for comfort and normalcy, which many consumers may associate with having a few more gifts under the tree.

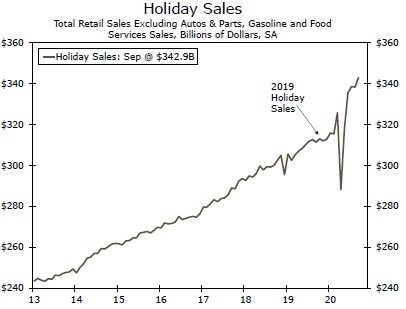

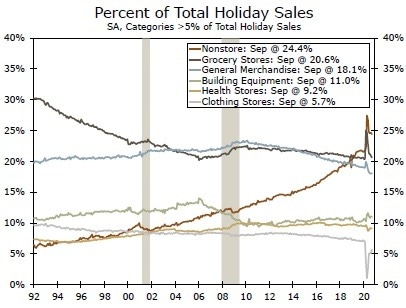

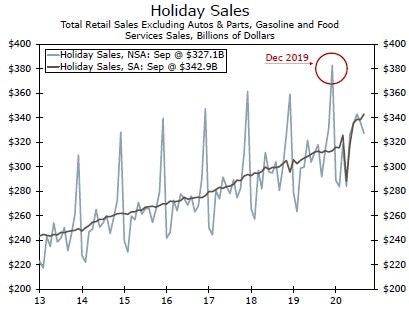

Traditions of the shopping season like the throngs of Black Friday shoppers the day after Thanksgiving, will be largely replaced this year with rolling special sales and "buy-online, pick-up in store" deals while online retailers pile on gains after last year's first-time finish as top overall category of holiday sales. In fact, since Amazon's ‘Prime Day' moved to October, many of its competitors began offering opposing special offers during the month. Some holiday shopping has already been pulled forward so we would not be surprised to see the pace of sales taper off in the traditional holiday spending months of November and December. Even if that is the case, our measure of holiday sales sits comfortably at an all-time high as of September after disruption from the virus earlier this year (Figure 2). The 2020 holiday sales season is on track to be a blowout. But keep this in perspective: this boom in goods spending is coming at the expense of spending on services, which remains depressed. In short, we do not look for overall consumer spending to return to its pre-crisis peak until Q2-2021.

Source: U.S. Department of Commerce and Wells Fargo Securities

After all the presents have been opened and all the cardboard shipping boxes have been broken down, we suspect consumers will slow their roll with respect to this goods spending spree. When that happens, retailers could be confronted with a larger-than-usual drop-off in sales in the first quarter. In fact, our forecast has growth in consumer spending slowing in each of the next six quarters as goods spending slows and as spending on services, which has been held back in recent months due to the virus, gradually resumes. With stimulus prospects still up in the air, household income is apt to remain under pressure amid a labor market rebound that has clearly lost momentum.

Every Time a Bell Rings

This has been a year that changed almost everything in the world of retail. The pandemic and the initial shutdowns in March and April shuttered retail operations except for those deemed essential. But, stimulus checks and generous unemployment benefits resulted in an unprecedented surge in income and months of savings that households were (and still are) able to draw upon to fund spending. With spending on many services cut back due to COVID, households had an additional source of funds from a reallocation of wallet share from services to goods.

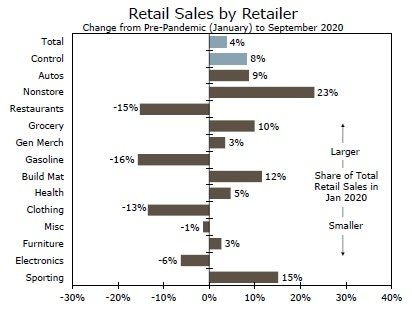

For some retailers, the result was much better than expected. Despite a global pandemic and record numbers of people filing jobless claims, sporting goods stores were back up above their prerecession peak by May and went on to have one of the best summers on record as camp was cancelled and parents picked the shelves clean of bikes, basketball hoops and trampolines. After a 6% monthly increase at sporting goods stores just during the month of September, the category is now up 15% relative to its pre-pandemic level (Figure 3).

Source: U.S. Department of Commerce and Wells Fargo Securities

The strong showing of sporting goods stores is only second to e-commerce. Sales for nonstore retailers (online merchants) is 23% above its pre-pandemic peak and now commands a record share of overall retail spending. In our Holiday Sales outlook piece last year we correctly predicted that ecommerce would take the top category for overall holiday sales for the first time. This year we expect it should retain the title belt by a comfortable margin (Figure 4), as consumers increasingly rely on online shopping this holiday season amid the pandemic.

This theme of goods outperforming services helps explain why we have such a strong number for our holiday sales forecast. When looking at our definition of the categories we have long used to define our measure of holiday sales, it is all goods. We define holiday sales as total retail sales, excluding autos & parts, gasoline and food services (restaurant) sales. So while total retail sales are already 3.7% above their pre-virus January level as of September, total holiday sales are a whopping 8.6% above where they stood prior to the virus. We are not cherry picking here as we have long excluded these categories. But as it turns out, these exclusions eliminate some of the worst performing retailers.

People are spending less on gas with the elimination of commuting for many office workers. This is a key explanatory factor for why gasoline station sales are still down 16%, as is lower prices at the pump with average gasoline prices about 16% below where they stood at the start of the year. Restaurant sales have been clawing back lost business for months. But even after five consecutive monthly increases, restaurant sales are still 15% lower than where they were before the pandemic as capacity constraints continue to limit the rebound. On the other hand, we also exclude autos & parts, which has done rather well this year, up 9% ahead of its pre-virus level as of September. Even if our overall measure of holiday sales remains flat on a seasonally adjusted basis from October to December, it would still be up 9.8% relative to last year (reference back to Figure 2 on page 1).

If I Woke Up with My Head Sewn to the Carpet, I Wouldn't Be More Surprised

Like a lot of things in 2020, dialing in a precise estimate for holiday sales this year is more difficult than usual. COVID has caused large swings in retail sales in recent months and it is unclear if the typical November and December surge will materialize in a year when some demand may have been pulled forward. The National Retail Federation described it perfectly comparing the task of forecasting holiday sales this year to completing a jigsaw puzzle without all the pieces.1

After approaching our forecast a few different ways, we are looking for holiday sales, or sales in November and December, to rise about 9% over last year, the highest on record. A record increase in the midst of a pandemic is hardly the most intuitive outcome, but consider that our measure of holiday sales already sits comfortably above the level of sales reached last year. In order to get anything short of a well-above-average increase you would need to assume massive declines in the remaining months of the year; declines in the ballpark of what we saw during April lockdowns. In fact, even if you take the worst monthly declines on record going back to 1992 for October (-1.6%), November (-1.4%) and December (-3.1%), and use those as placeholders for the next three months, holiday sales would still come in a strong +4.9% this year.

After framing out thinking by looking at the worst monthly declines as a first pass, we arrived at our 9% figure by conducting a bottoms-up approach looking at the 10 types of retailers included in our holiday sales measure.2 Based on buying patterns we have seen throughout the pandemic and what we are expecting regarding certain types of stores, we plugged in our expected forecast per retailer category to arrive at our final figure of 9%.

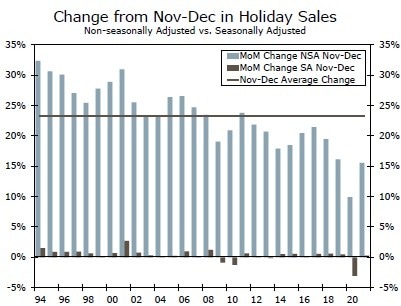

Remarkably, we are not even penciling in a banner year in terms of month-over-month growth rates. Our 9% forecast looks for monthly changes over the next three months that are below what we typically see historically. Perhaps the best way to put it is that our forecast of a 9% year-over-year increase requires a 2% decline in seasonally adjusted sales through the end of the year from where we are as of September.

A record increase in holiday sales is a lot to process. We have also considered a more pessimistic forecast, which has holiday sales still up at a solid 6.9% versus last year. In this forecast, we again utilized our bottoms up approach, but assumed that sales are pulled extensively into October and November and then fall off a cliff in December. This forecast requires a nearly 5% decline in sales through the end of the year from where we are as of September. Although, this is not our base case scenario, it presents a reasonable outcome, in our view. We will update the numbers as the data come in over the next few months. Even if we get a blowout October, however, we would not revise our forecast higher because of this concern about demand being pulled forward.

Seasonals' Greetings!

The biggest factor giving us pause with respect to our forecast is the seasonal adjustment process. To fully understand what it actually means to be unchanged on a seasonally adjusted (SA) basis, it is useful to offer a very high-level recap of this adjustment process itself. Seasonal adjustment is used in economics whenever you have a data series that is subject to regular and predictable (often annual) disruption or volatility that you are trying to mute statistically so that the underlying cyclical trend becomes more visible. Classic examples include summer shutdowns to retool plants which disrupt auto production figures, or farm output and crop yields which vary by month and season, and of course retail sales figures, which get a big bump in November and particularly in December due to the holidays.

In a typical December, non-seasonally adjusted (NSA) holiday sales rise about 23% relative to the previous month. A gain of something smaller than that would likely come out as a decline in the seasonally adjusted (SA) figures. In each of the past two years, we have gotten bit by this dynamic. In 2019, holiday sales increased 5.8% (NSA) in November, but because that was smaller than a typical November increase of 6.7%, the SA change was a small monthly decline (-0.3%). December 2018 was an even worse example—NSA holiday sales rose 9.9% in December, but because a typical December increase would be well into the double digits, the SA number was a 3.1% monthly decline (Figure 5).

Source: U.S. Department of Commerce and Wells Fargo Securities

This is where that dynamic of sales being pulled forward into earlier months becomes very important to the outlook for the final months of the year. Consider, for example, if the combination of Prime Day and adjacent competing sales at other major retailers results in October bringing forward sales that might otherwise have been recorded in the traditional holiday shopping season (November and December). Then, we might reasonably expect smaller gains in November or December, which could even result in outright declines on a SA basis. Figure 6 demonstrates the key difference in the SA and NSA measure of holiday sales this season. Although NSA sales remain significantly below their December 2019 level, which is typical if you observe the variation leading to the typical pop in November and December, the SA measure is already considerably above where it stood last holiday season through September (+9.6%).

Outlook: Giddy-Up Jingle

Horse Once the holidays are over, retailers might be due for a patch of softer spending from consumers. We do not expect the absence of stimulus to result in sales cratering thanks to the shored up savings that households have squirreled away. But, that savings might be parsed out slowly if the job market does not pick-up soon.

At the bottom end of the income and wealth spectrum, spending could decline sharply. These are the households that disproportionately were impacted by layoffs earlier this year and thus were the greatest beneficiaries of generous unemployment benefits. The absence of those top-up checks are keenly felt by these households. We recently wrote about the degree to which households can tap rising wealth, but according to Census data median income for the bottom 40% of households is below $35K/year and most of that is tied up in the value of automobiles and other durable goods which are not easily converted into cash. For now though, the consumer sector that has been the primary driver for the economy in 2020 has one more trick up its sleeve with a record increase in holiday sales.

Download The Full Special Commentary

Author

Wells Fargo Research Team

Wells Fargo