Gold Weekly Forecast: Search for next fundamental catalyst continues

- Gold managed to hold above $2,300 despite broad US Dollar strength.

- The technical outlook highlights XAU/USD’s indecisiveness in the near term.

- Fed Chairman Powell’s speech and key macroeconomic data releases from the US could help Gold find direction next week.

Gold (XAU/USD) came under bearish pressure and declined below $2,300 on Wednesday after starting the week in a calm manner. The pair, however, managed to recover its losses on Thursday and stabilized above $2,320. Federal Reserve (Fed) Chairman Jerome Powell’s speech at the European Central Bank’s (ECB) Forum on Central Banking in Sintra on Tuesday and key macroeconomic data releases from the US, including the June jobs report, could help Gold break out of its range next week.

Gold has yet to decide on next direction

In the absence of high-tier macroeconomic data releases, the cautious market mood and hawkish comments from Fed officials allowed the US Dollar (USD) to stay resilient against its rivals and made it difficult for Gold to gain traction at the start of the week. Meanwhile, the data from the US showed on Tuesday that the Conference Board (CB) Consumer Confidence Index edged lower to 100.4 in June from 101.3 in May, while the Present Situation Index improved to 141.5 from 140.8 in the same period.

Fed Governor Michelle Bowman said on Tuesday that they are not yet at the point where it is appropriate to cut interest rates, adding that she is willing to raise rates at a future meeting if inflation progress were to stall or reverse.

The benchmark 10-year US Treasury bond yield gathered bullish momentum late Tuesday following Bowman’s comments and continued to push higher on Wednesday. In turn, XAU/USD dropped below $2,300 for the first time in two weeks.

Mixed data releases from the US opened the door for a rebound in XAU/USD on Thursday. The Bureau of Economic Analysis (BEA) announced that it revised the annualized Gross Domestic Product (GDP) growth for the first quarter to 1.4% from 1.3% in the previous estimate. On a negative note, Durable Goods Orders ex Defense declined 0.2% in May after staying unchanged in April, while Pending Home Sales contracted by 2.1% on a monthly basis in May, highlighting worsening conditions in the housing market.

The BEA reported on Friday that inflation in the US, as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, edged lower to 2.6% on a yearly basis in May from 2.7% in April, as expected. On a monthly basis, the PCE Price Index was unchanged in May, while the annual core PCE Price Index, which excludes volatile food and energy prices, rose 2.6% in the same period, down from the 2.8% increase recorded in April. Finally, the monthly core PCE Price Index rose 0.1%. The USD struggled to find demand following the PCE inflation data, allowing gold to cling to its daily gains in the American session on Friday.

Gold investors await Powell speech, key US data

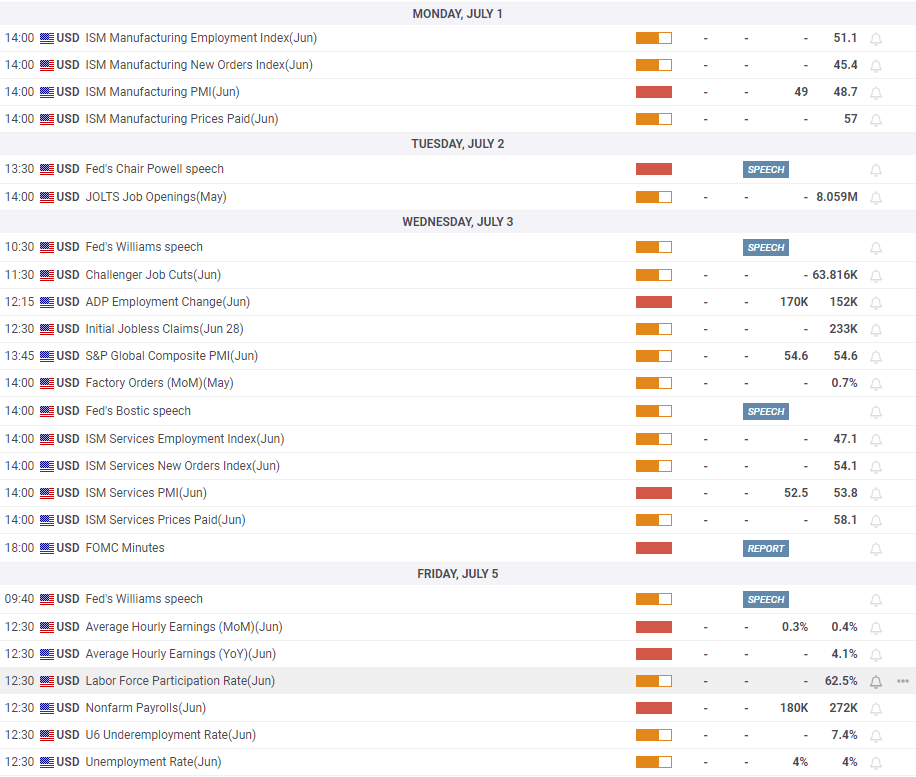

The ISM Manufacturing Purchasing Managers Index (PMI) data for June will be featured in the US economic docket on Monday. The headline PMI is forecast to improve to 49 from 48.7 in May. A reading above 50, which would point to a return to expansion in the sector’s business activity, could support the USD and limit Gold’s upside in the American trading hours.

On Tuesday, the Bureau of Labor Statistics (BLS) will release the JOLTS Job Openings data for May. Investors are likely to ignore this report and stay focused on Fed Chairman Jerome Powell’s speech at the ECB’s Forum on Central Banking. This will be Powell’s first public appearance since he spoke at the press conference following the June policy meeting.

If Powell voices a preference for a single rate hike this year, the initial reaction could provide a boost to the USD. On the other hand, investors could remain hopeful about an interest rate cut in September if Powell reiterates the data-dependent approach and refrains from dismissing the possibility of a policy pivot before the end of the year. According to the CME FedWatch Tool, markets are currently pricing in a 36% probability of the Fed leaving the policy rate unchanged in September.

Weekly Initial Jobless Claims, ADP Employment Change and the ISM Services PMI data will be released on Wednesday. Investors might remain reluctant to take positions based on these data because stock and bond markets will remain closed in observance of the July 4 holiday on Thursday. More importantly, the BLS will publish the June jobs report on Friday, which will include Nonfarm Payrolls (NFP), Unemployment Rate and wage inflation figures.

Late Wednesday, the FOMC will release the Minutes of the June policy meeting. The publication is unlikely to offer any fresh clues regarding the Fed’s interest rate outlook.

Following the stronger-than-forecast increase of 272,000 in May, NFP is expected to rise 180,000 in June. The Unemployment Rate is seen holding steady at 4% and the wage inflation, as measured by the change in the Average Hourly Earnings, is anticipated to grow 0.3%, down slightly from 0.4% growth in May. Unless there is a significant downward revision to the May NFP print, an increase of 200,000 or more in June could help the USD outperform its rivals ahead of the weekend. On the flip side, an increase of less than 150,000 could be seen as a sign of loosening conditions in the labor market and cause the USD to lose interest. In this scenario, XAU/USD is likely to end the week on a bullish note.

Gold technical outlook

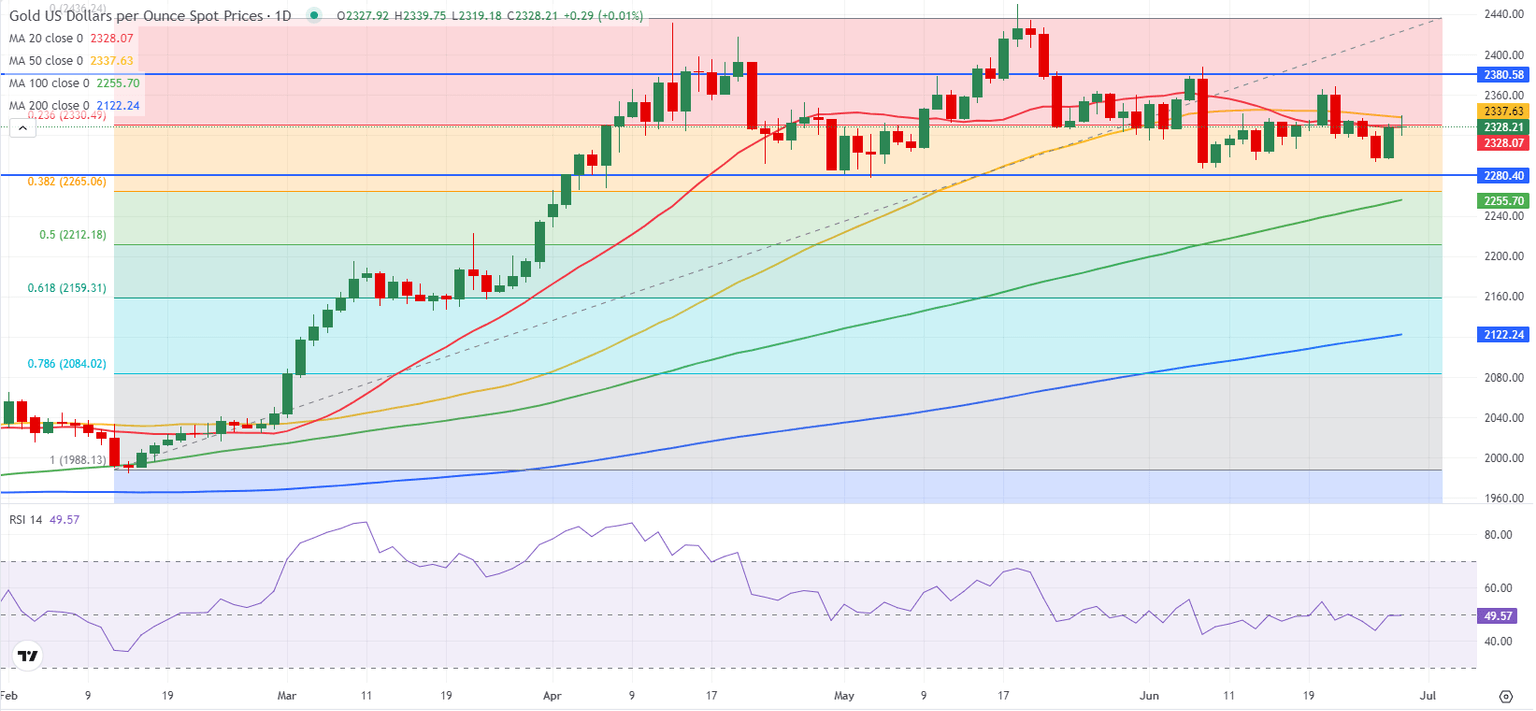

The Relative Strength Index (RSI) indicator on the daily chart moves sideways near 50, highlighting a lack of directional momentum. Although Gold held above $2,300 (psychological level), it has yet to clear the 50-day Simple Moving Average (SMA), currently located near $2,340. If XAU/USD rises above this level and confirms it as support, technical buyers could take action. In this scenario, $2,380 (static level) could be seen as the next resistance before $2,400 (psychological level, static level).

On the downside, additional losses toward $2,280 (static level) and $2,265-$2,255 (Fibonacci 38.2% retracement of the mid-February-June uptrend, 100-day SMA) could be seen if $2,300 support fails.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.