Gold Weekly Forecast: Shift in global interest rate environment supports XAU/USD

- Gold climbed to a new all-time high above $2,700.

- The technical outlook suggests that Gold is closing in on the overbought territory.

- Next week’s PMI data could provide important clues about the US economic outlook.

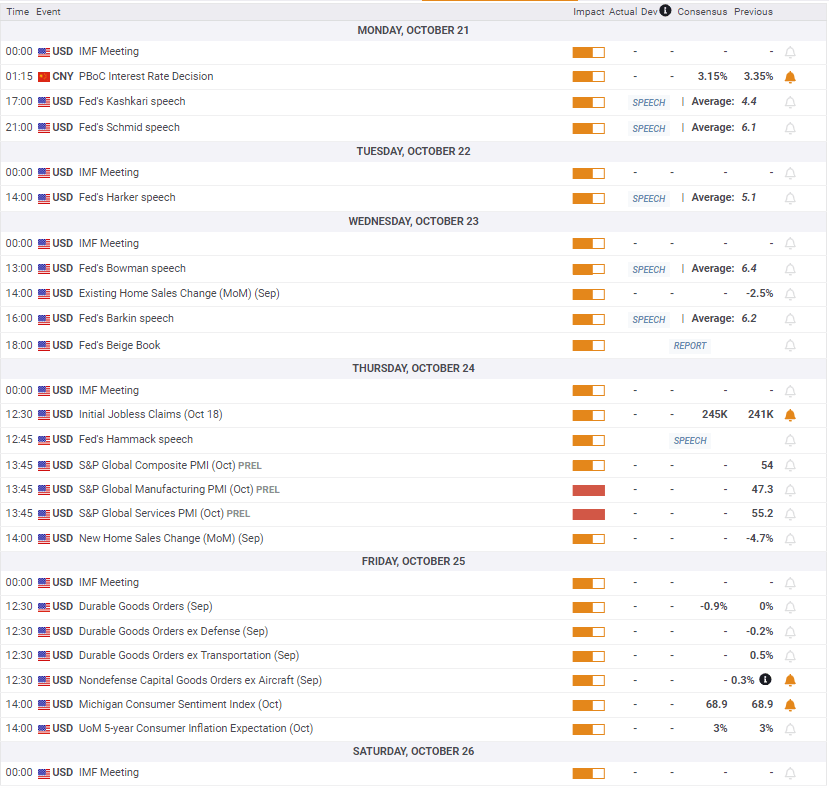

Gold (XAU/USD) ignored the broad-based US Dollar (USD) strength this week and advanced to a new all-time high above $2,700 as investors reacted to growing prospects of a globally lower interest rate environment. Next week’s calendar will feature S&P Global’s preliminary October Purchasing Managers Index (PMI) data, which will provide further insight into the health of the world’s main economies.

Gold gathers bullish momentum despite USD resilience

Gold moved sideways to start the week as trading conditions remained thin, with US financial markets remaining partially closed in observance of the Columbus Day holiday. After remaining choppy in the absence of high-tier data releases on Tuesday, XAU/USD started to edge higher midweek.

The UK's Office for National Statistics (ONS) reported on Wednesday that annual inflation in the UK, as measured by the change in the Consumer Price Index (CPI), softened to 1.7% in September from 2.2% in August. According to Reuters, the probability of the Bank of England opting for two consecutive 25 basis points (bps) rate cuts in November and December climbed to 70% from less than 50% with the immediate reaction. The XAU/GBP pair rose more than 1% on the day, suggesting that Gold captured capital outflows out of the Pound Sterling.

On Thursday, the European Central Bank (ECB) announced that it lowered key rates by 25 bps, as expected, following the October policy meeting. In its policy statement, the ECB repeated that it will continue to follow a data-dependent and meeting-by-meeting approach in determining the appropriate level and duration of policy restriction.

In the post-meeting press conference, however, ECB President Christine Lagarde acknowledged that the economic activity in the Eurozone has been weaker than expected. Commenting on inflation developments, she noted that “low confidence, geopolitical stress and low investment” were posing downside risks to inflation. XAU/EUR rose 1% on Thursday and continued to push higher on Friday, suggesting that Gold captured capital outflows out of the Euro as well.

The data from China showed on Friday that the Gross Domestic Product (GDP) expanded at an annual rate of 4.6% in the third quarter. Additionally, Industrial Production expanded by 5.4% on a yearly basis in September and Retail Sales rose by 3.2%. All these figures came in better than analysts' estimates. Moreover, People's Bank of China (PBoC) Governor Pan Gongsheng said that they expect, depending on the market liquidity situation, that the reserve requirement ratio (RRR) could be further reduced by the end of the year. Easing fears over an economic downturn in China further boosted Gold, lifting it to a new record peak above $2,700.

Gold investors assess global interest rate environment

In the early trading hours of the Asian session on Monday, the PBoC will announce the interest rate decision. In September, the PBoC left the one-year and five-year Loan Prime Rates unchanged at 3.35% and 3.85%, respectively. According to Xinhua news agency, the LPR will decrease by 20-25 bps on October 21. A bigger reduction in LPRs could further boost Gold prices at the beginning of the week.

On Wednesday, the Bank of Canada (BoC) will announce monetary policy decisions. The BoC is expected to lower the policy rate by 50 bps to 3.75% from 4.25%. Generally, the BoC’s rate decision is hardly a game changer when it comes to Gold prices. This past week’s action, however, suggests that Gold remains attractive as a go-to-asset, as major economies’ central banks remain on track to continue to unwind their restrictive policies at an aggressive pace. Hence, a big rate cut by the BoC, followed by a dovish outlook, could also help Gold stretch higher.

S&P Global will publish preliminary October Purchasing Managers Index (PMI) data on Thursday. The CME Group FedWatch Tool currently shows that markets are pricing in a 90% probability of the Fed lowering the policy rate by 25 bps next month. In case the composite PMI unexpectedly drops below 50 and shows a contraction in the private sector’s business activity, the immediate reaction could weigh on the USD. On the flip side, a positive surprise could be supportive for the USD. Nevertheless, the market reaction to PMI data is unlikely to be significant enough to have a long-lasting effect on Gold prices.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart stays near 70, suggesting that Gold is close to turning technically overbought. On the upside, the upper limit of the ascending regression channel coming from June aligns as the next resistance at $2,740 before the $2,800 round level.

In case Gold stages a technical correction, $2,670 (mid-point of the ascending channel) could be seen as the first support level before the 20-day Simple Moving Average (SMA) at $2,655 and $2,615, which aligns with the lower limit of the ascending channel.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.