Gold Weekly Forecast: XAU/USD looks for direction as $2,030 resistance caps gains

- Gold is having a tough time gathering directional momentum.

- US PCE inflation data from the US next week could help XAU/USD break out of its range.

- Key near-term resistance for the pair seems to have formed at $2,030.

Gold (XAU/USD) fluctuated in a relatively narrow channel as it failed to benefit from the broad-based selling pressure surrounding the US Dollar (USD) this week. Nevertheless, XAU/USD ended up posting small weekly gains. Inflation data from the US will be watched closely by investors, but buyers could remain hesitant to bet on a steady uptrend until the pair stabilizes above $2,030.

Gold price struggles to gather bullish momentum

Gold edged higher on Monday but the yellow metal’s gains were limited, with trading conditions remaining thin due to the Presidents’ Day holiday in the US. Improving risk mood on Tuesday made it difficult for the USD to find demand and XAU/USD managed to post small daily gains.

The Federal Reserve (Fed) said in the minutes of the January policy meeting on Wednesday that most policymakers noted the risks associated with moving too quickly to ease the policy. Furthermore, the publication showed that officials highlighted uncertainty around how long the restrictive policy stance would be needed. The benchmark 10-year US Treasury bond yield rose nearly 1% on the day and didn’t allow Gold to build on its weekly gains.

During the Asian trading hours on Thursday, risk flows started to dominate the action in financial markets, triggering a USD sell-off. Wall Street’s main indexes opened decisively higher and the S&P 500 rose more than 1% to reach a new all-time high, while the Nasdaq Composite added 3% on the back of surging technology stocks. Later in the American session, upbeat US data releases allowed US yields to stretch higher and made it difficult for Gold to gather bullish momentum despite the broad-based USD weakness. The number of first-time applications for unemployment benefits declined by 12,000 to 201,000 in the week ending February 17, and S&P Global PMI surveys showed that business activity in the private sector continued to expand at a healthy pace in early February. In turn, the 10-year US yield reached its highest level since late November above 4.35%.

In the meantime, Federal Reserve (Fed) Governor Christopher Waller said on Thursday that they are not in a rush to begin a reduction in interest rates, citing the need to see further evidence of inflation cooling. “Cutting too soon could squander inflation progress and risk considerable harm to the economy,” Waller argued.

The market reaction remained subdued ahead of the weekend and Gold remained within its weekly range on Friday.

Gold price could react to US PCE inflation data next week

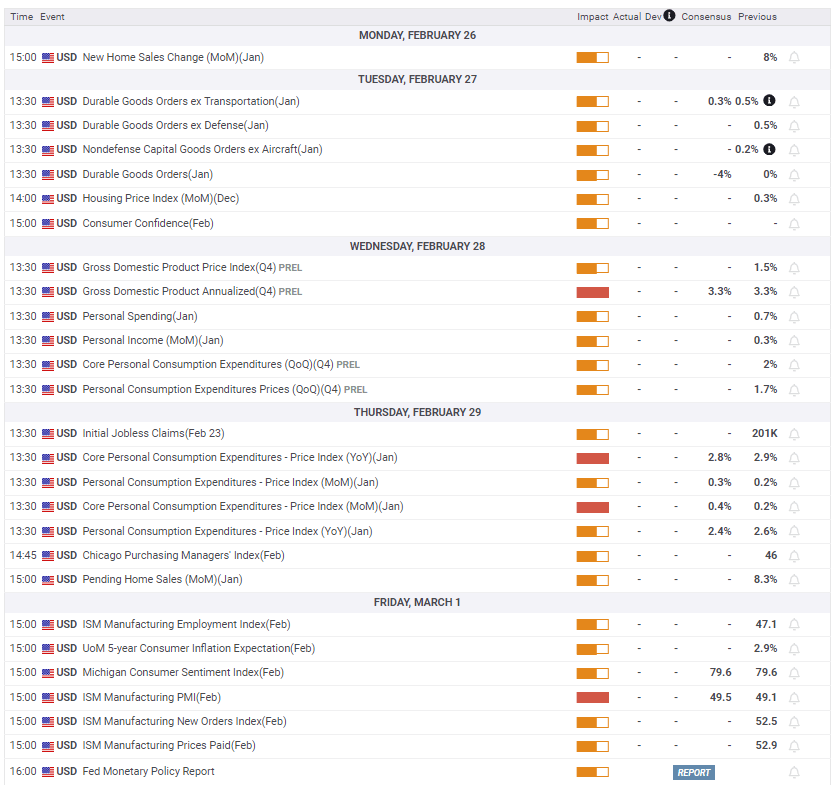

The US economic docket will feature Durable Goods Orders data for January on Tuesday. On a monthly basis, Durable Goods Orders are forecast to decline 4.5% after staying unchanged in December. Although this data is unlikely to trigger a significant market reaction, an unexpected positive print could support the USD.

The US Bureau of Economic Analysis (BEA) will release the second estimate of the Gross Domestic Product (GDP) growth for the fourth quarter of 2023 on Wednesday. Markets don’t forecast a revision to the annualized 3.3% expansion announced in the initial estimate.

On Thursday, January Personal Consumption Expenditures (PCE) Price Index data will be scrutinized by market participants. The Core PCE Price Index, the Federal Reserve’s (Fed) preferred gauge of inflation, is seen rising 0.4% on a monthly basis following the 0.2% increase recorded in December.

Markets are fairly certain that the Fed will leave the policy rate unchanged at 5.25%-5.5% range at the March policy meeting. The probability of a rate cut in May currently stands at 20%, according to CME FedWatch Tool. The market positioning suggests that the USD doesn’t have a lot of room on the upside even if the PCE inflation data confirms that there won’t be a Fed policy pivot until June. On the other hand, a soft monthly Core PCE inflation reading of 0.2% or lower could revive expectations for a rate cut in May. In this scenario, US yields could push lower and allow Gold to gather bullish momentum.

During the Asian trading hours on Friday, investors will pay close attention to NBS Manufacturing PMI and NBS Non-Manufacturing PMI data from China. In case both of these PMIs come in the expansion territory above 50, Gold could benefit from heightened optimism for an improving demand outlook.

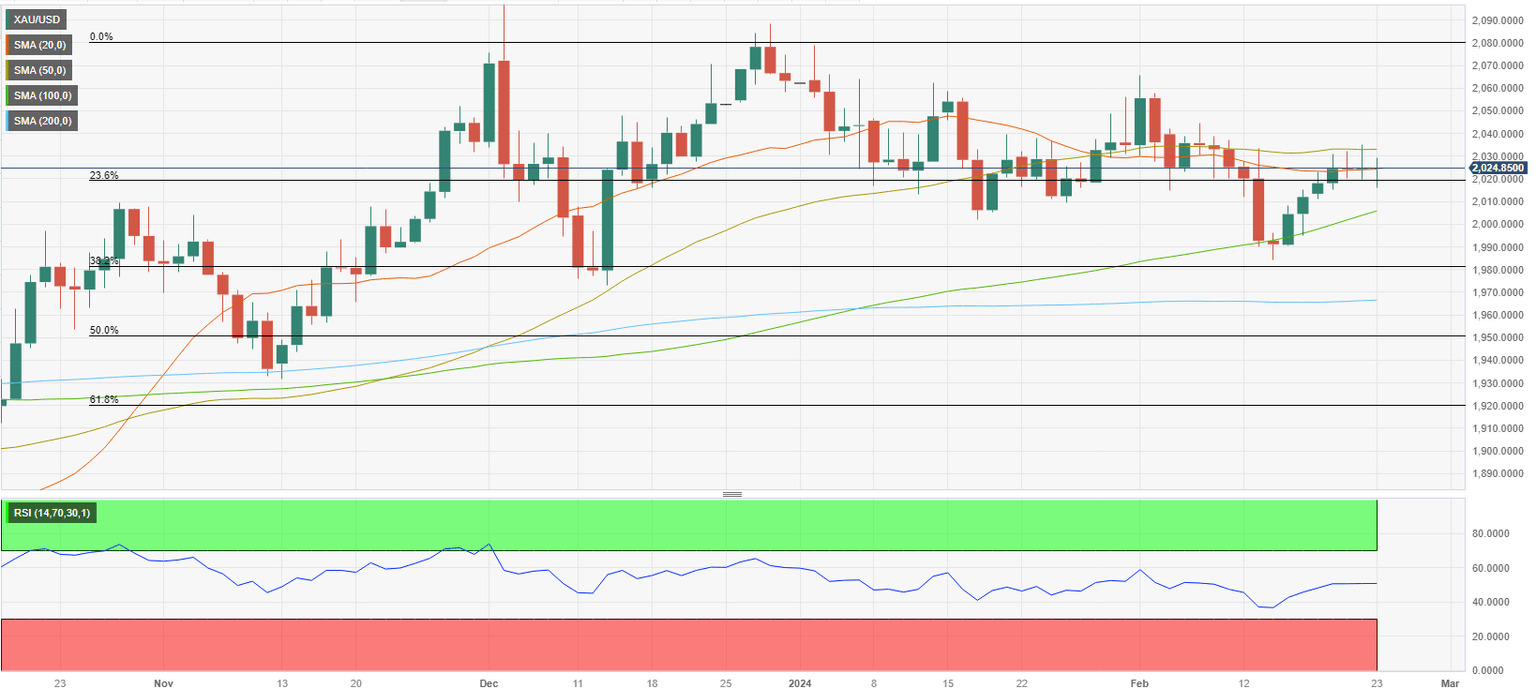

Gold technical outlook

The Relative Strength Index (RSI) on the daily chart retreated to 50, reflecting a lack of bullish momentum. The Fibonacci 23.6% retracement of the latest uptrend forms a pivot level at $2,020. In case XAU/USD falls below this level and confirms it as resistance, it could encounter strong support at $2,005-$2,000 (100-day Simple Moving Average (SMA), psychological level) before targeting $1,980 (Fibonacci 38.2% retracement).

On the upside, $2,030 (50-day SMA, static level) aligns as immediate resistance. A daily close above this hurdle could attract technical buyers and open the door for a leg higher toward $2,050 (static level) and $2,065 (static level).

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.