Gold Weekly Forecast: Buyers commitment will be tested if Gold fails to hold above $2,500

- Gold pulled back after setting yet another record high but reclaimed $2,500.

- The technical outlook suggests that XAU/USD’s bullish bias stands in the near term.

- Investors will pay close attention to US inflation data next week.

Gold (XAU/USD) corrected lower after touching a new all-time-high this week but managed to climbs above the key $2,500 level on Friday. Next week’s economic calendar will feature key inflation data from the US.

Gold posts another record high

After ending the previous week on a bullish note, Gold entered a consolidation phase on Monday and closed the day virtually unchanged. Dovish comments from Federal Reserve (Fed) officials caused the US Treasury bond yields to stretch lower on Tuesday, paving the way for XAU/USD to set a new record-high of $2,531.

“Should incoming data show inflation is moving sustainably toward the target, it will become appropriate to gradually lower rates to prevent becoming overly restrictive,” Fed Governor Michelle Bowman said. Meanwhile, Minneapolis Fed President Neel Kashkari told The Wall Street Journal that it will be appropriate to debate about potentially cutting the policy rate in September.

On Wednesday, the US Bureau of Labor Statistics announced that the preliminary estimate of the benchmark revision indicates an adjustment to March 2024 total Nonfarm employment of -818,000 (-0.5%). Later in the day, the minutes of the Fed’s July 30-31 policy meeting showed that a "vast majority" of policymakers believed that if incoming data continued to meet expectations, it would likely be appropriate to ease policy at the next meeting. Although Gold struggled to preserve its bullish momentum midweek, it managed to stabilize above $2,500 as the US Dollar (USD) failed to shake off the selling pressure.

After the data published by S&P Global showed that the business activity continued to expand at a health pace in early August, with the flash estimate of the Composite PMI arriving at 54.1, the 10-year US T-bond yield gathered recovery momentum and helped the USD find a foothold. In turn, XAU/USD turned south and broke below $2,500 during the American trading hours.

The improving risk mood made it difficult for the USD to build on Thursday gains and allowed XAU/USD to recover back above $2,500 during the European trading hours on Friday. Ahead of the weekend, Fed Chairman Jerome Powell’s speech at the Jackson Hole Symposium put additional weight on the USD and paved the way for a leg higher in the pair. Powell acknowledged that the time has come for the monetary policy to adjust and said that they will do “everything they can” to support a strong labor market while making further progress toward price stability.

Gold investors await PCE inflation data

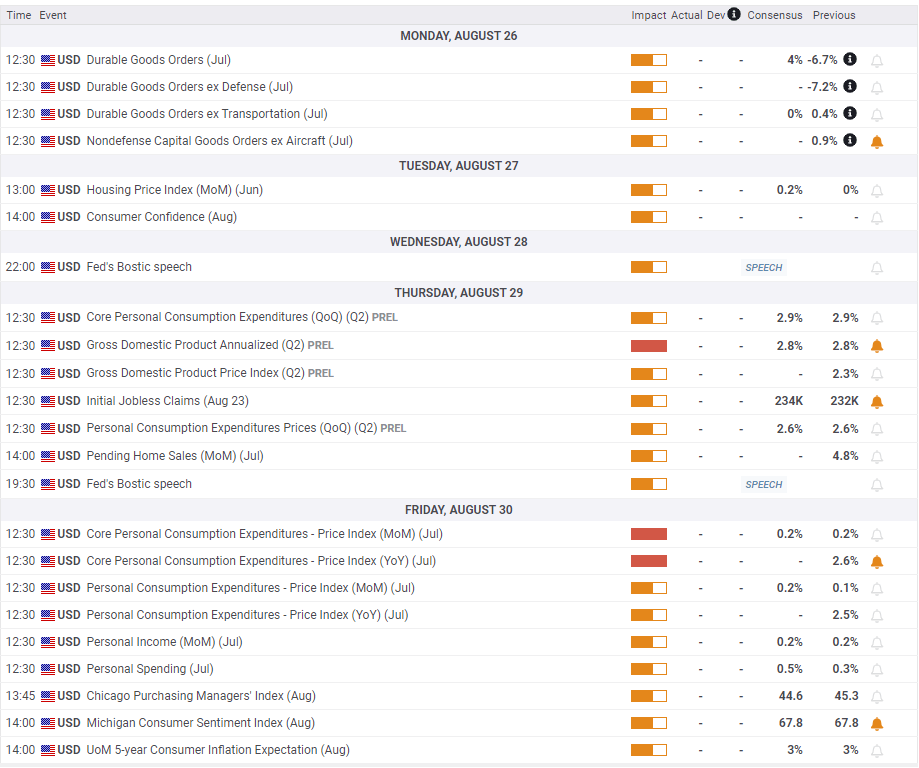

The US economic calendar will feature Durable Goods Orders data for July on Monday. Although this data is generally ignored by market participants, it could trigger a market reaction in case it diverges from the market expectation in a significant way. A positive surprise could ease fears over an economic downturn in the US and help the USD find demand.

On Thursday, the US Bureau of Economic Analysis (BEA) will release the second estimate of the annualized Gross Domestic Product (GDP) growth for the second quarter. Markets expect no changes to the initial estimate of 2.8%. An unexpected downward revision could weigh on the USD and open the door for a leg higher in Gold with the immediate reaction.

The BEA will publish July’s Personal Consumption Expenditures (PCE) Price Index data, the Fed’s preferred gauge of inflation, on Friday. Investors are likely to react to the monthly core PCE Price Index, which excludes prices of volatile items and not distorted by base effects. The core PCE Price Index is forecast to rise 0.2% on a monthly basis. Since Powell’s latest comments suggested that policymakers’ are now more focused on the labor market than inflation, it might take a reading of 0.4%, or higher, for the USD to rise decisively. On the flip side, a print at or below the market expectation could support Gold heading into the weekend.

Gold technical outlook

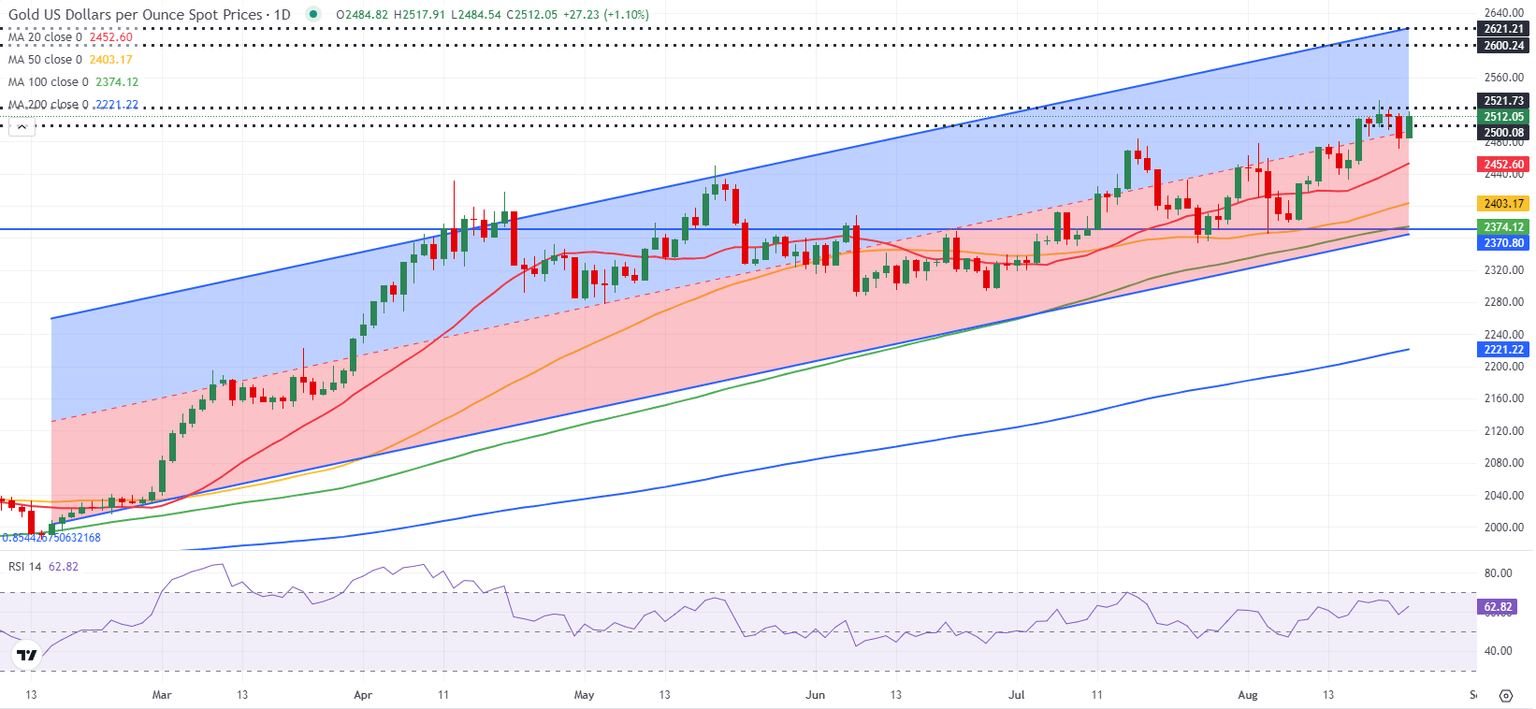

The Relative Strength Index (RSI) indicator on the daily chart stays above 60, suggesting that the bullish bias remains intact.

The round $2,500 figure (psychological level, mid-point of the ascending regression channel coming from mid-February) aligns as a pivot level for Gold. In case Gold continues to use this level as support, $2,600 (psychological level) could be seen as the next resistance before the upper limit of the ascending channel at $2,620.

Technical sellers could show interest if Gold fails to stabilize above $2,500. In this scenario, the 20-day Simple Moving Average (SMA) could be seen as next support at $2,455 before $2,400 (psychological level, static level, 50-day SMA) and $2,370 (lower limit of the ascending channel, 100-day SMA).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.