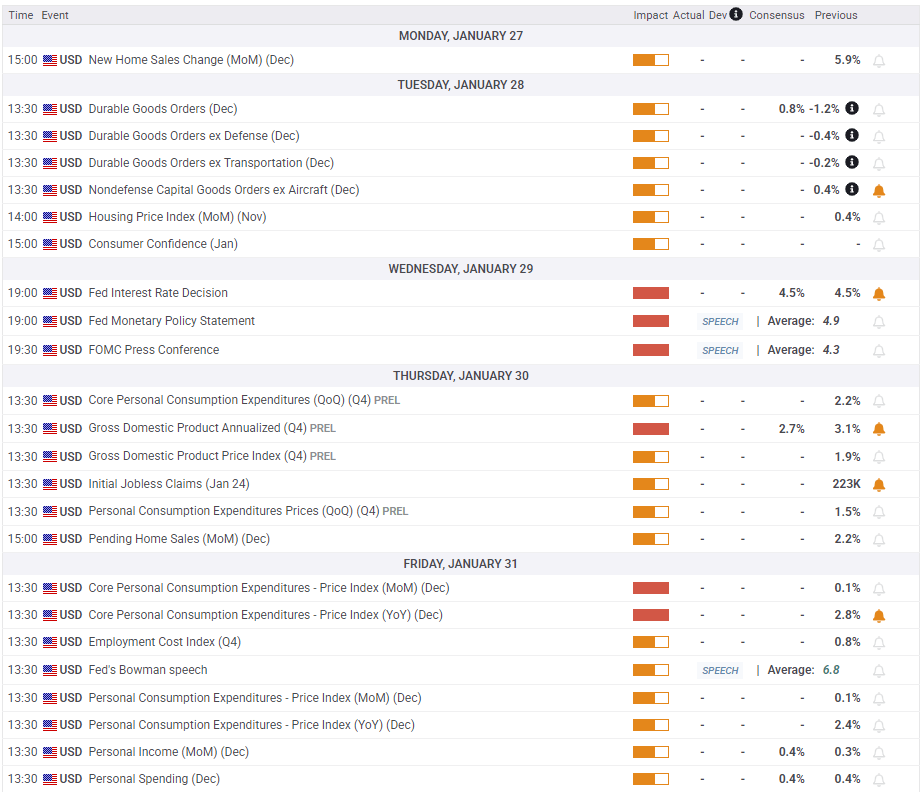

Gold Weekly Forecast: Fed policy announcements to test bullish potential

- Gold gathers bullish momentum and climbs to a fresh multi-month high above $2,780.

- The Fed will announce monetary policy decisions following the first meeting of 2025 next week.

- The near-term technical outlook suggests that Gold is about to turn overbought.

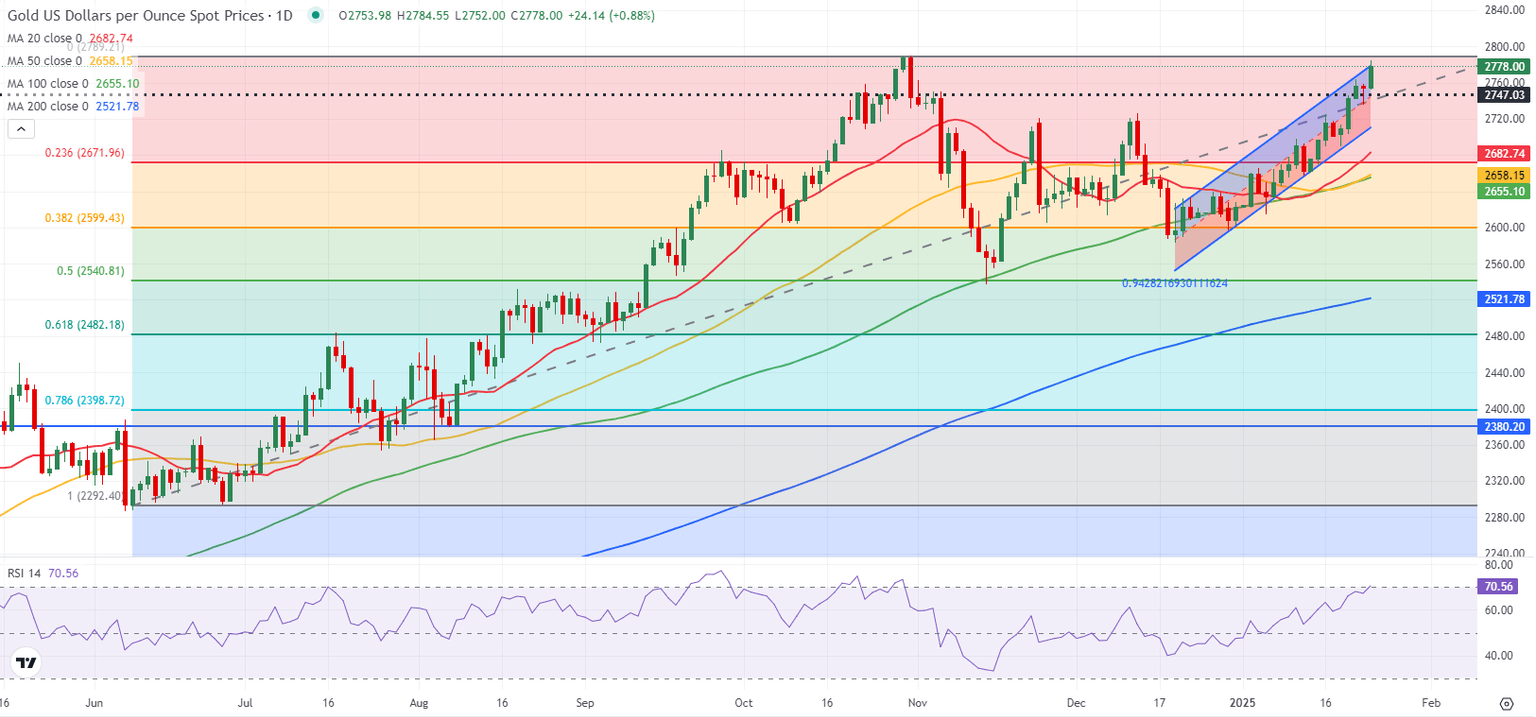

Following a cautious opening to the week, Gold (XAU/USD) reversed its direction and registered near 3% weekly gains, reaching its highest level since October 31 in the $2,780 region on Friday. As market attention turns to next week’s key central bank events, Gold’s technical outlook remains bullish, albeit showing signs of overbought conditions.

Gold gathers bullish momentum, closes in on all-time-high

Markets started the week in a calm manner as stock and bond markets in the US remained closed in observance of the Martin Luther King Jr. Day holiday on Monday. However, headlines surrounding US President Donald Trump’s trade policies on the day of his inauguration made it difficult for the US Dollar (USD) to find demand and helped Gold end the day marginally higher. The Wall Street Journal reported on Monday that President Trump will refrain from announcing day-one tariffs, and an official within the Trump administration confirmed that claim, explaining that agencies will be tasked with investigating and remedying persistent trade deficits while addressing unfair trade and currency policies by other nations.

In the early trading hours of the Asian session on Tuesday, Trump said on social media that he could impose tariffs on China if they make a TikTok deal and China doesn't approve it. Additionally, Trump noted they are considering imposing a 25% tariff on imports from Mexico and Canada. Safe-haven flows dominated the action in financial markets, and the 10-year US Treasury bond yield dropped below 4.6%, allowing Gold to gather bullish momentum.

After gaining more than 1% on Tuesday, Gold continued to push higher in the absence of high-tier macroeconomic data releases on Wednesday, touching its highest level since late October above $2,760.

On Thursday, the US Department of Labor reported that the number of first-time applications for unemployment benefits rose to 223,000 in the week ending January 18 from 217,000 in the previous week. This data failed to trigger a noticeable market reaction. In the Asian session on Friday, Trump said in an interview that he would rather not have to use tariffs on China but called tariffs a "tremendous power." Following this comment, the USD came under renewed selling pressure, and XAU/USD extended its weekly uptrend to beyond $2,780.

The data from the US showed on Friday that the business activity in the US private sector continued to expand in early January, albeit at a softer pace than in December, with the flash S&P Global Composite PMI declining to 52.4 from 55.4. This data failed to trigger a USD recovery and allowed Gold to stabilize near the top of its weekly trading range.

Gold investors await Fed policy announcements

The Federal Reserve (Fed) will conduct its first monetary policy meeting of 2025 next week. According to the CME Group FedWatch Tool, markets see virtually no chance of the Fed opting for a 25 basis points (bps) rate cut. Hence, investors will scrutinize the policy statement and Fed Chairman Jerome Powell’s remarks at the press conference.

In December, the revised Summary of Economic Projections (SEP) showed that the US central bank is projected to lower rates twice this year. During the presser, Powell explained that the slower pace of rate reductions reflected the expectation of higher inflation. Additionally, he noted that stronger economic growth and the resilience of the labor market were also contributing to a cautious outlook on policy-easing.

In case Powell adopts a more optimistic tone on the inflation outlook, citing Trump’s not-so-aggressive approach to trade policy, the immediate reaction could weigh on the USD and open the door for another leg higher in XAU/USD. Additionally, the USD could come under further pressure if Powell suggests that immigration policy could hurt the labor market.

On the other hand, the USD could gather strength and make it difficult for Gold to hold its ground if Powell reiterates the cautious approach to rate cuts, while trying to assess the potential impact of changing policies on the economy.

On Thursday, the US Bureau of Economic Analysis (BEA) will release its first estimate of the fourth-quarter Gross Domestic Product (GDP) growth. A significant surprise in either direction could impact the USD’s valuation and drive XAU/USD’s action in the near term. A stronger-than-forecast GDP growth could support the USD and weigh on XAU/USD and vice versa.

Investors will also continue to pay close attention to President Trump’s comments on trade policies, geopolitics and possibly the Fed’s policy decisions. Trump made it clear that he wants Russia and Ukraine to reach an agreement to end the war. Any progress on this front could limit Gold’s upside.

Gold technical analysis

The near-term technical outlook shows that Gold is about to turn technically overbought, suggesting that there could be a downward correction before continuing the uptrend. The Relative Strength Index (RSI) indicator on the daily chart is slightly above 70, and Gold trades near the upper limit of a five-week-old ascending regression channel.

On the upside, the first resistance area could be spotted at $2,790-$2,800 (all-time high, round level). In case Gold manages to rise above this area and starts using it as support, it could target $2,900 (round level) next. Looking south, the first support level could be seen at $2,750 (static level, mid-point of the ascending channel) before $2,710-$2,700 (lower limit of the ascending channel, round level) and $2,680 (20-day Simple Moving Average).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.