Gold

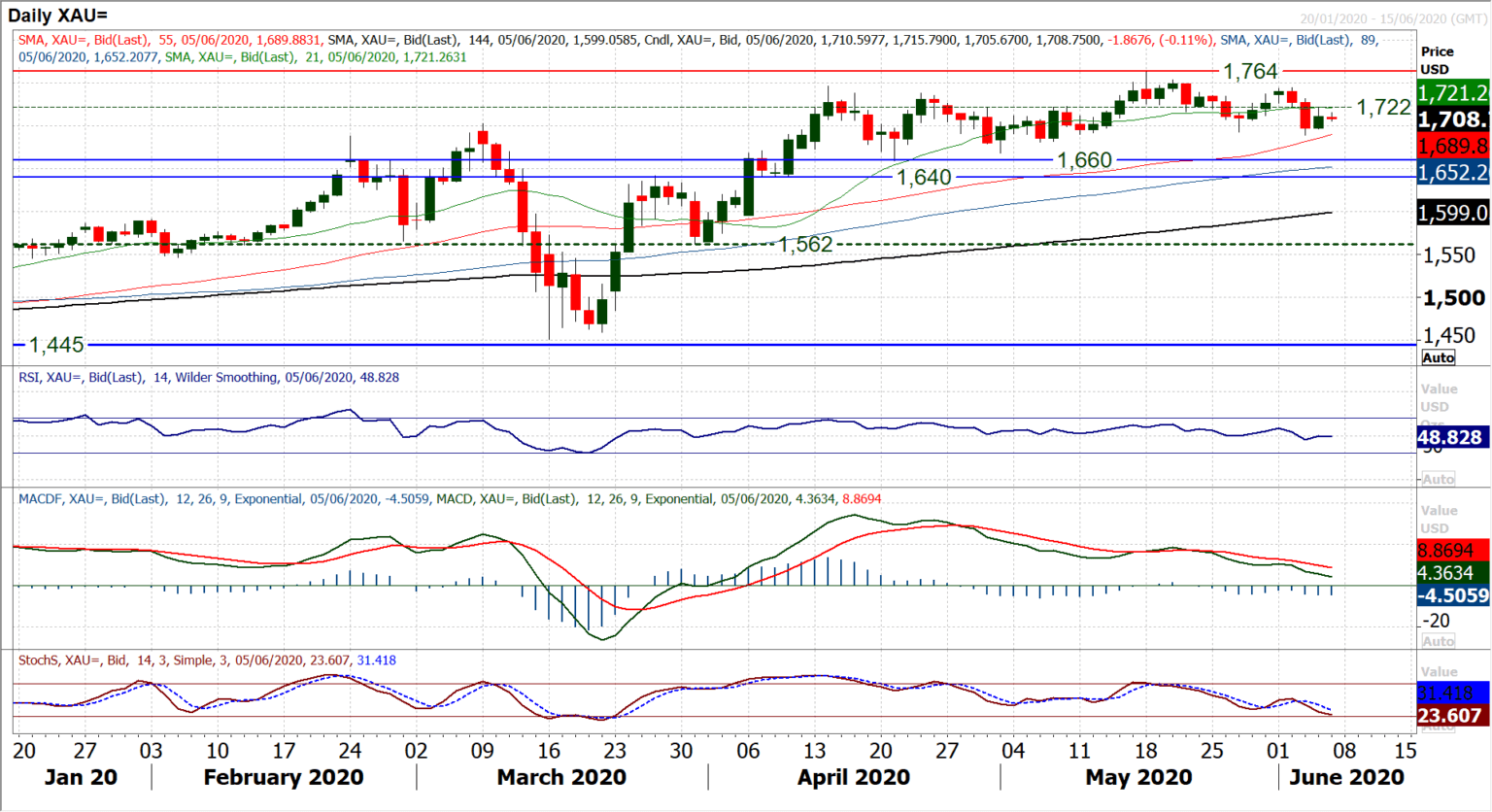

Following the breakdown of the 8 week uptrend and the support at $1693 we turned neutral on gold. Noting that the bulls are no longer in control, we see that upside traction is difficult to sustain and in the past couple of weeks the negative candles are more of a dominant force on the daily chart. Momentum indicators sliding back are a reflection of this. The RSI went below 50 for the first time since March this week, whilst MACD lines continue to fall and Stochastics are also their lowest since March. We have recently been talking about the $1722 old May pivot being a gauge for the market, and it was interesting to see yesterday’s rebound faltering at $1721 (the hourly chart shows a band of resistance now $1720/$1725). We believe that the price action of the last two weeks suggests that gold has developed into a trading range now, of around $100 between $1660/$1764. Effectively then, at current levels, the market is trading around the mid-point of this range. On the hourly chart we continue to note the slightly corrective bias that is in place, with eh hourly RSI stuck under 60, whilst MACD lines have crossed lower around neutral in the wake of the rebound failure at $1721. The market is in more of a choppy mid-range phase now. A negative candle posted today will continue the near term negative bias and increase pressure on $1689 (Wednesday’s low). If breached then it would suggest a negative drift back towards the $1660/$1668 range support band. Closing back above $1722 begins to edge more of an improving bias once more, but the market needs a pull above $1744 to end a corrective run of lower highs.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.