Gold targets $1,830 regions

After a strong risk-aversion on Monday, broader market risk appetite remained uneven and unclear in US session hours. US equity index futures are presently trading higher in the pre-market, accompanied by a recovery in their European counterparts, as bond rates on both sides of the Atlantic continue to fall from multi-month highs. Energy and industrial metal prices have fallen, while currency market conditions are largely mixed and muted, with the USD flat but strongly held around recent highs. The gold price is currently hovering around $1,860, with minor daily gains. The balance of Tuesday’s trading day will be dominated by Fed officials’ remarks. So far, Fed officials appear to be on board with the policy signal delivered by Fed Chair Jerome Powell following last week’s policy meeting, and Tuesday’s speakers are expected to stick to the script. The Fed plans to bring interest rates to neutral (approximately 2.5%) by the end of the year, after which it will assess the amount to which it has to continue raising rates, which will be determined by how serious the inflation situation stays.

Recent falls in equities, cryptocurrencies, and certain economically sensitive commodities like copper, and precious metals have been largely attributed to fears that interest rates may reach “restrictive” territory. Gold demand tends to fall when the “opportunity cost” of owning non-yielding assets rises. Longer-term US bond rates are a proxy for this “opportunity cost,” explaining gold’s negative relationship with them. Traders are already anticipating the release of US Inflation data for April on Wednesday, as well as a slew of forthcoming Fed speakers. If this happens, the markets may be relieved. This might provide gold a short-term boost.

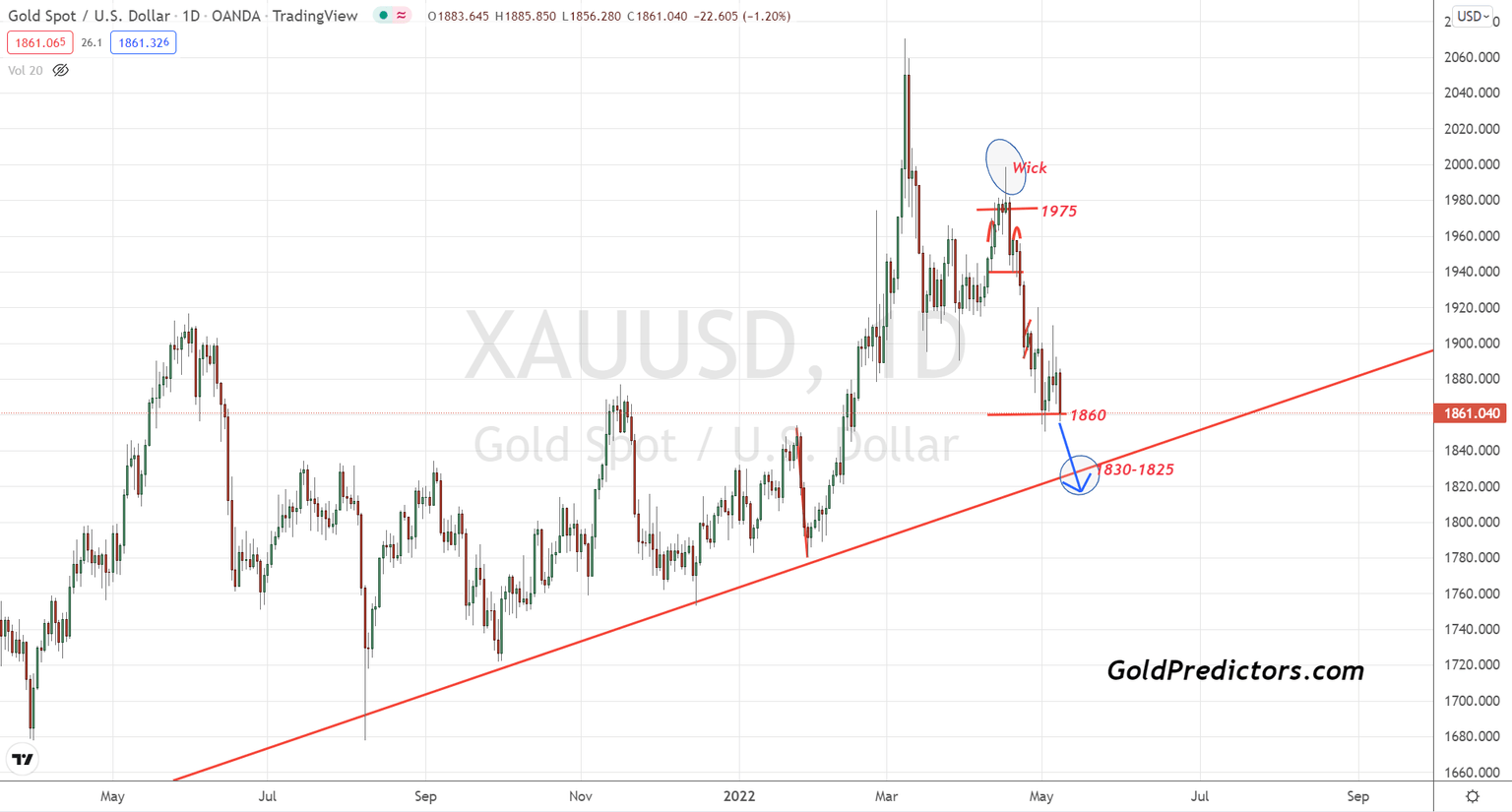

For the past 18 months, we have been watching the gold market’s ascending broadening patterns. This pattern was discovered in 2020, and prices have been trading within it ever since. $1,680 was identified as the inflection point for gold on the diverged cycle of March 10th, 2021. Within the same time frame, the bottom was formed, and both numbers and prices have risen to higher levels. Currently, $2,075 has been identified as the yearly pivot point where the long-term continuation of gold bull phase was about to begin. Gold prices precisely reached $2,075 and then reversed below $1,875, indicating a medium-term top. $1,860 was recently expected to be the support with a rebound. Price has recovered and is now trading below $1,850. The immediate target for this gold move is lower, with $1,830 acting as immediate support.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.