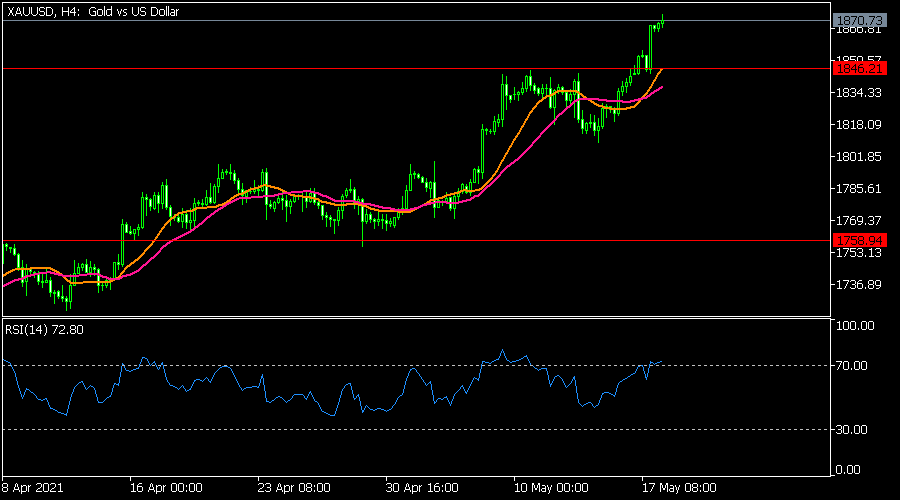

Gold surges to a 3-month high as inflation risks remain

Gold prices rose to a three-month high as investors focused on the rising number of coronavirus cases and inflation risks. Last week, data by the American statistics agency revealed that overall consumer inflation rose by 4.2% in April while the producer price index (PPI) rose by 6.2% in April. This was the fastest rate of growth in years. As such, investors are betting that the metal’s price will keep rising in the near term. Indeed, inflows in gold ETFs have been strong after declining in the early months of the year. Further, there has been rotation from Bitcoin to gold in the past few weeks, according to Bloomberg. BTC has dropped to $44,000 from its all-time high of $65,000.

The Japanese yen rose slightly against the US dollar even after relatively disappointing GDP data from Japan. According to the country’s statistics agency, the economy contracted by 1.3% in the first quarter after staging a 2.8% recovery in Q4. This decline was worse than the expected 1.2%. It led to a year-on-year decline of 5.1%, which was worse than the expected 4.6%. The bureau cited a 1.4% decline in capital expenditure and a 0.2% decline in external demand as the leading causes of the contraction. Private consumption also declined by 1.4%. In general, this contraction was because of the state of emergency imposed by the Japanese government and ongoing logistics issues.

The economic calendar will have some key events today. In the United Kingdom, the Office of National Statistics (ONS) will publish the latest employment numbers. Analysts expect that the economy added jobs in March as the government started to reopen the economy. They also expect that the unemployment rate remained unchanged at 4.9%. Going by the recent past, the rate may be better than analysts expect. Elsewhere, Eurostat will publish the second reading of EU GDP data. In the United States, we will receive the latest building permits and housing starts data.

EUR/USD

The EUR/USD pair rose to a high of 1.2167 ahead of the latest EU GDP data. On the four-hour chart, the pair moved above the lower line of the rising wedge pattern. It has also risen above the 23.6% Fibonacci retracement level and the 25-day moving average (MA). The strength of the moving average of the oscillator has started to weaken also. Therefore, the pair may keep rising as bulls target the upper side of the wedge at 1.2200.

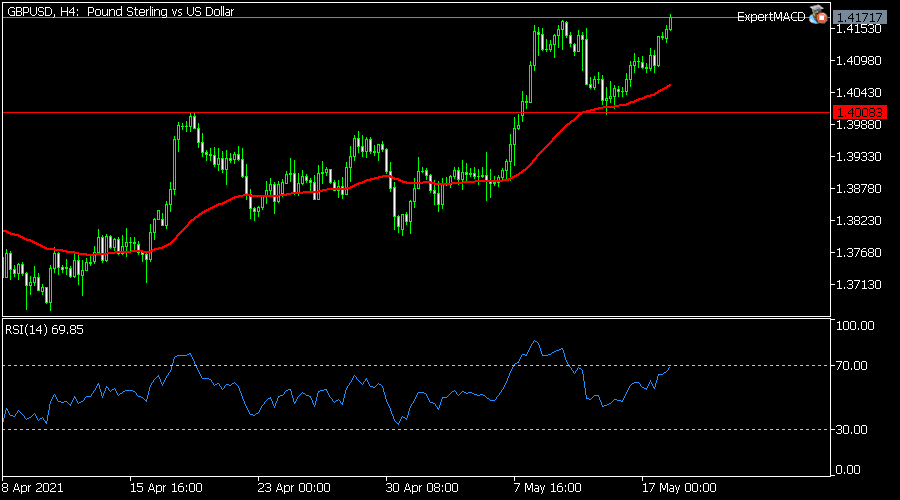

GBP/USD

The GBP/USD pair rose to a high of 1.4178 ahead of the UK jobs data. This was the highest level since February this year. On the four-hour chart, the pair has moved above the 25-day moving average. It has also managed to rise above the important resistance level at 1.4165, which was the highest level last week. The Relative Strength Index (RSI) has also moved slightly above the overbought level of 70. Therefore, the pair may keep rising, with the next level to watch being 1.4200.

XAU/USD

The XAU/USD pair rose to a high of 1,875, which was the highest level in three months. On the four-hour chart, the pair rose above the 25-day and 15-day moving average. It also managed to cross the vital support at 1,845, which was highest on May 10. The Relative Strength Index (RSI) has moved above the overbought level of 70. Therefore, the pair may keep rising, as inflation fears remain.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.